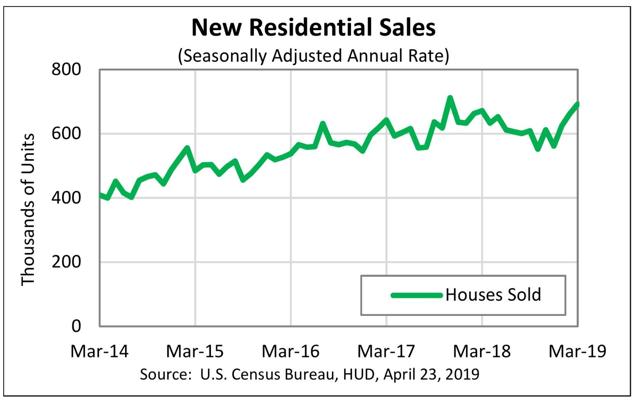

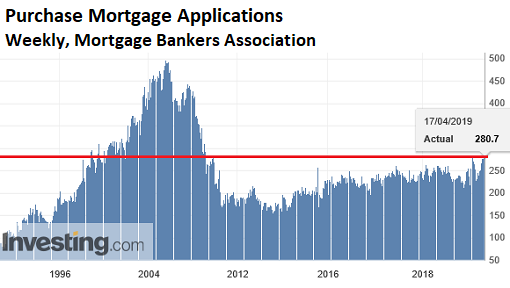

New home sales suggest housing bottom is in New home sales are extremely volatile, and extremely revised, but they do have the advantage of probably being the single most leading housing statistic, ahead of permits and starts. So it is noteworthy that new home sales for March rose to 692,000, below only one month in late 2017 when they hit their expansion high of 712,000: I have been looking for the bottom in housing, as mortgage interest rates have fallen in the past 5 months, and purchase mortgage applications have risen to new expansion highs: Subject to revisions(!) —this morning’s data indicates we’ve already made the bottom in new home sales, and adds to my confidence that we either have just made or will shortly make the bottom in housing

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

New home sales suggest housing bottom is in

So it is noteworthy that new home sales for March rose to 692,000, below only one month in late 2017 when they hit their expansion high of 712,000:

I have been looking for the bottom in housing, as mortgage interest rates have fallen in the past 5 months, and purchase mortgage applications have risen to new expansion highs:

Subject to revisions(!) —this morning’s data indicates we’ve already made the bottom in new home sales, and adds to my confidence that we either have just made or will shortly make the bottom in housing permits and starts.

My guess is that interest rates have now stayed lower long enough for new expansion highs to be set in all of the metrics, although because of continuing increases in the price of houses, there is not much room for advances beyond that.