Negative Nov. and Dec. revisions overwhelm positive January retail sales The initial spin on this morning’s delayed retail sales report for January has been positive, with for example the Wall Street Journal calling it a “rebound” and “a sign of solid economic momentum in the first quarter. Ummmmm, No. Both nominally and in real terms, retails sales did improve by +0.2% in January over December. The problem is, both November and December were revised downward. In particular, December’s initially reported poor -1.2% showing got even worse, to -1.6% nominally. In other words, for the two months combined, retail sales even measured nominally declined by -0.2%. Here’s what they look like in real terms through January: Because real retail sales tend to

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Negative Nov. and Dec. revisions overwhelm positive January retail sales

The initial spin on this morning’s delayed retail sales report for January has been positive, with for example the Wall Street Journal calling it a “rebound” and “a sign of solid economic momentum in the first quarter.

Ummmmm, No.

Both nominally and in real terms, retails sales did improve by +0.2% in January over December.

The problem is, both November and December were revised downward. In particular, December’s initially reported poor -1.2% showing got even worse, to -1.6% nominally. In other words, for the two months combined, retail sales even measured nominally declined by -0.2%.

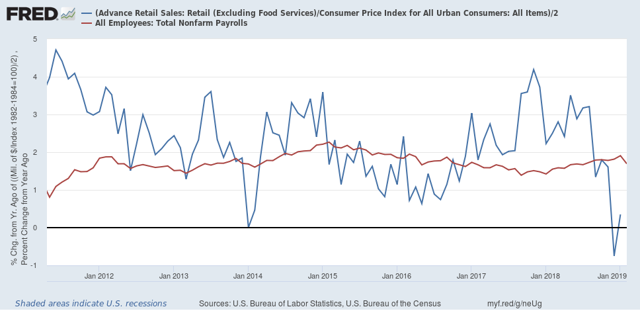

Here’s what they look like in real terms through January:

Because real retail sales tend to lead employment (red in the graph below) with a variable lag on the order of 6-9 months, this downturn in retail sales is more evidence that February’s poor employment report should not simply be dismissed as an outlier:

On a YoY basis, real retail sales peaked over a year ago. They have sharply decelerated since then all the way to roughly zero. We should expect employment gains to also decelerate, and February’s poor report is consistent with such a deceleration having started.

I expect to put up a more detailed look at Seeking Alpha, probably tomorrow. Once it is up, I will link to it here.