Q1 corporate profits and real gross domestic income Yesterday the second estimate of Q1 GDP came out, which means that corporate profits for Q1 were finally reported. In my post earlier this week at Seeking Alpha, I wrote that corporate profits are of higher forecasting importance because of the contradiction in the signals being sent by the bond market vs. the housing market. So what light do they shed on the forecast for the next 12 months? I wrote a follow-up post, and it is up on Seeking Alpha. As usual, clicking over and reading should be informative for you, and helps to the tune of a couple of pennies for me. P.S.: As a bonus, another important Q1 metric, gross domestic income, was also reported in yesterday’s revision. There is some evidence

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Q1 corporate profits and real gross domestic income

Yesterday the second estimate of Q1 GDP came out, which means that corporate profits for Q1 were finally reported.

In my post earlier this week at Seeking Alpha, I wrote that corporate profits are of higher forecasting importance because of the contradiction in the signals being sent by the bond market vs. the housing market. So what light do they shed on the forecast for the next 12 months?

I wrote a follow-up post, and it is up on Seeking Alpha. As usual, clicking over and reading should be informative for you, and helps to the tune of a couple of pennies for me.

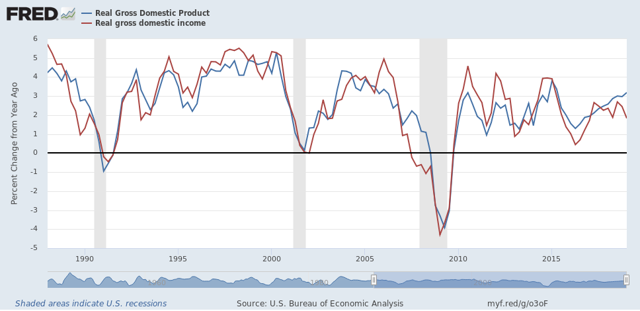

P.S.: As a bonus, another important Q1 metric, gross domestic income, was also reported in yesterday’s revision. There is some evidence that, when they diverge, GDI leads GDP. Here’s what that relationship looks like for the past 30 years:

Note 1989-90 and 2006-07. And finally, note that YoY real GDI growth has once again diverged sharply from real GDP, and is only up 1.8% through Q1.