Real average and aggregate wage growth for July 2019: yellow flag for aggregate wages Now that we have the July inflation reading, let’s take a look at real wages. First of all, nominal average hourly wages in June increased +0.2%, while consumer prices increased +0.3%, meaning real average hourly wages for non-managerial personnel decreased -0.1%. This results in a slight decline of real wages to 97.0% of their all time high in January 1973: On a YoY basis, real average wages were up +1.5%, a decline from their recent peak growth of 1.9% YoY in February: Updated through July, real aggregate wages – the total amount of real pay taken home by the middle and working classes – are up 28.7% from their October 2009 low: For total wage

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Real average and aggregate wage growth for July 2019: yellow flag for aggregate wages

Now that we have the July inflation reading, let’s take a look at real wages.

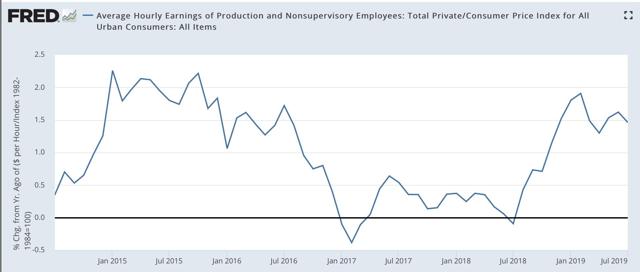

First of all, nominal average hourly wages in June increased +0.2%, while consumer prices increased +0.3%, meaning real average hourly wages for non-managerial personnel decreased -0.1%. This results in a slight decline of real wages to 97.0% of their all time high in January 1973:

On a YoY basis, real average wages were up +1.5%, a decline from their recent peak growth of 1.9% YoY in February:

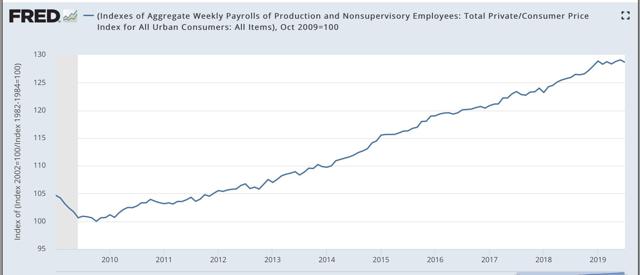

Updated through July, real aggregate wages – the total amount of real pay taken home by the middle and working classes – are up 28.7% from their October 2009 low:

For total wage growth, this expansion remains in third place, behind the 1960s and 1990s, among all post-World War 2 expansions; while the *pace* of wage growth has been the slowest except for the 2000s expansion.

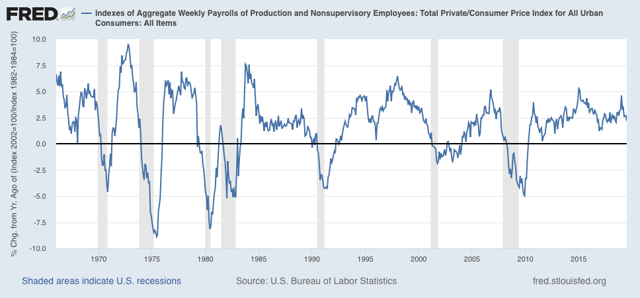

Finally, two months ago I raised a concern that real aggregate wages had decelerated sharply this year, writing that “real aggregate wage growth has typically decelerated by 1/2 or more from its 12 month peak just at the onset of recessions, although there have been 3 false positives coincident with slowdowns.” Last month that concern disappeared. As of this month it re-appeared, as YoY growth has declined to 2.2% vs. 4.9% at the beginning of this year, and is actually -0.2% below its level in January:

Still, we have had two similar declines already during this expansion, so I would characterize th is metric as a yellow flag vs. a red flag at this point.