May real retail sales positive, but industrial production remains in a shallow recession Retail sales are one of my favorite indicators, because in real terms they can tell us so much about the present, near term forecast, and longer term forecast for the economy. This morning retail sales for May were reported up +0.5%, and April was revised upward by a net +0.5% as well. Since consumer inflation increased by +0.4% over that two month period, real retail sales have risen +0.6% in the past two months. For the past two months I have noted that sales were still slightly below their peak last November, and YoY real sales remained in a downshift. This morning’s report helps those comparisons substantially, as YoY real retail sales are now up +1.4%. Here is

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

May real retail sales positive, but industrial production remains in a shallow recession

This morning retail sales for May were reported up +0.5%, and April was revised upward by a net +0.5% as well. Since consumer inflation increased by +0.4% over that two month period, real retail sales have risen +0.6% in the past two months. For the past two months I have noted that sales were still slightly below their peak last November, and YoY real sales remained in a downshift. This morning’s report helps those comparisons substantially, as YoY real retail sales are now up +1.4%.

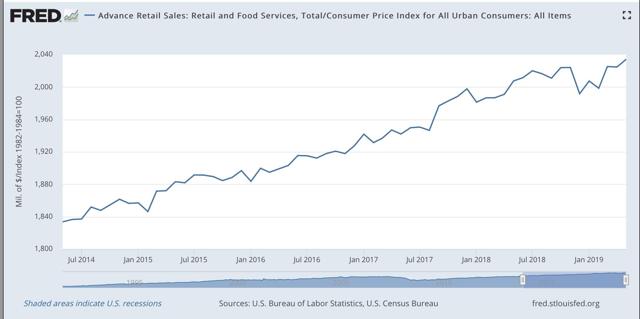

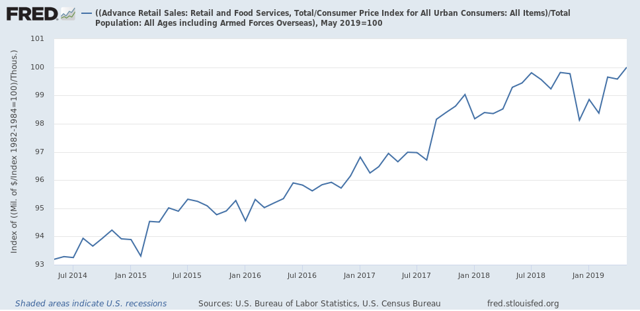

Here is what the last five years look like:

Real retail sales turned flat for about a year before both of the last two recessions. Even with this morning’s positive revisions, since late last year we’ve hit the biggest soft patch since 2013.

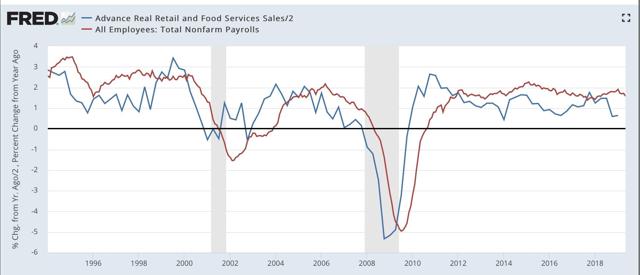

Next, although the relationship is noisy, because real retail sales measured YoY tend to lead employment (red in the graph below) by a number of months, here is that relationship for the past 25 years, measured quarterly to cut down on noise:

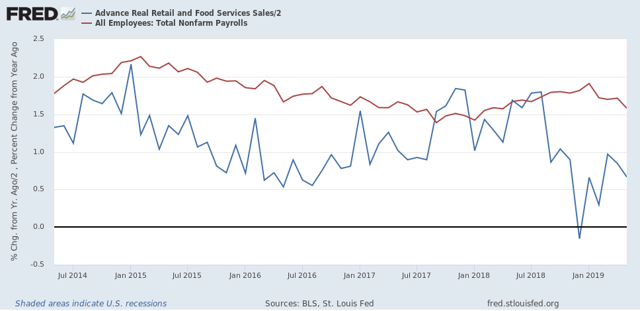

Now here is the monthly close-up of the last five years. You can see that it is much noisier, but helps us pick out the turning points:

The lead times are somewhat variable, although usually within 6 to 9 months. We have had 9 months of a big downshift in YoY sales. Even with this morning’s improvements, the YoY metric is still low, and so I still expect the slowdown in employment as measured in the monthly jobs report that showed up last Friday to continue.

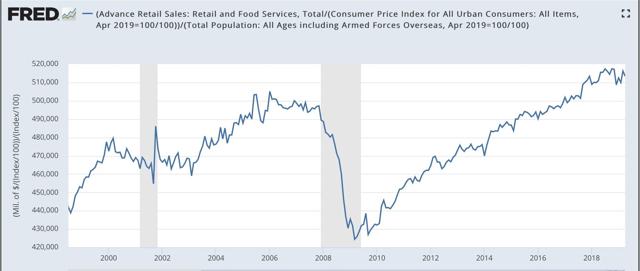

Finally, real retail sales per capita is a long leading indicator. In particular it has turned down a full year before either of the past two recessions:

Here is the close-up of the past five years:

The good news is, as of this morning’s report this measure made a new high, which if not revised away is evidence against a recession this year. Further, in the last 70 years, this measure has always turned negative YoY at least shortly before a recession has begun. Although there have been some false positives, there are no false negatives. But this is still up a little over +0.6% YoY, which is very much consistent with a slowdown.

To sum up, real retail sales Have resumed a weakly positive trend, that nevertheless points to a slowdown in employment gains in the months ahead.

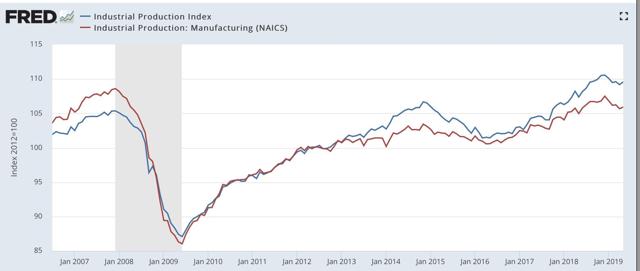

Turning to industrial production, this also improved, up +0.4% in May. The difference is, this merely took back the -0.4% decline in April. Industrial production, both in total and limited to manufacturing, is lower than it was last December:

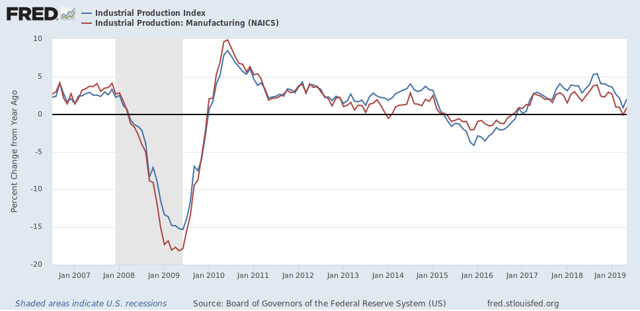

YoY industrial production is only up +2.0%, a mediocre result compared with most of this expansion:

Bottom line: the consumer part of the economy is picking up after the government shoutdown caused “mini-recession”. But the producer side is still *in* a shallow recession now. If the economic slowdown we are in is going to metastasize into a recession, it is probably going to come from the producer side and be due mainly to the effects of chaotic trade and tariff decisions from the Administration.