Leading scenes from the employment report not so positive I seem to have been the only person to pick up on the weakness in the underlying leading aspects of last Friday’s jobs report. While the number of job gains was great, and that average wages for non-managerial workers had their second best showing, at 3.4%, of the entire expansion, just behind last month’s 3.5%, the leading aspects of the report, with one exception, were not so positive. Let’s start with temporary and manufacturing jobs. Here are two graphs showing their month over month percentage gains over the last 20 years (manufacturing is multiplied *2 for scale purposes): Both of these advance less than 0.2% m/m and ultimately decline m/m before a recession begins. Now here is a close-up on

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Leading scenes from the employment report not so positive

I seem to have been the only person to pick up on the weakness in the underlying leading aspects of last Friday’s jobs report.

While the number of job gains was great, and that average wages for non-managerial workers had their second best showing, at 3.4%, of the entire expansion, just behind last month’s 3.5%, the leading aspects of the report, with one exception, were not so positive.

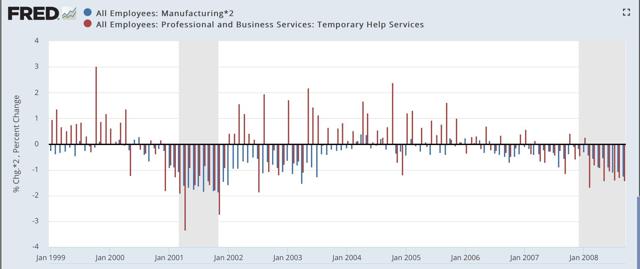

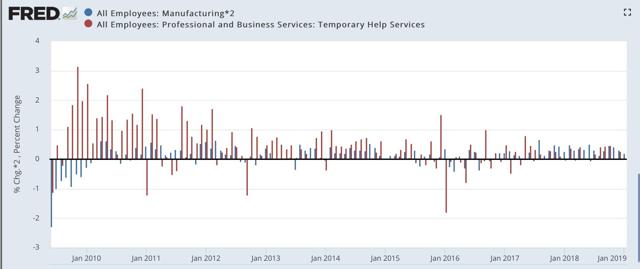

Let’s start with temporary and manufacturing jobs. Here are two graphs showing their month over month percentage gains over the last 20 years (manufacturing is multiplied *2 for scale purposes):

Both of these advance less than 0.2% m/m and ultimately decline m/m before a recession begins.

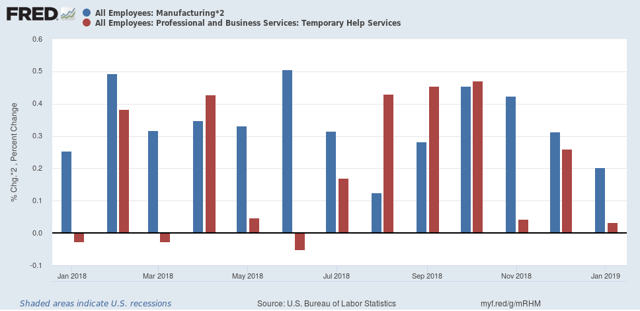

Now here is a close-up on the last year:

Manufacturing jobs increased just shy of +0.2% as scaled, and temporary jobs less than +0.1% for the second time in three months. Even the three month average for temporary jobs is only +0.1%.

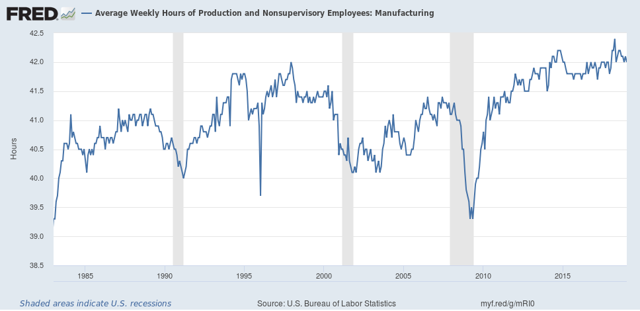

Next, let’s look at the manufacturing work week. This is one of the 10 components of the Index of Leading Indicators, and generally turns before manufacturing jobs do. At 42.0 hours in January, they are 0.4 hours below their recent peak:

While a turndown of at least -0.5 hours has generally been necessary prior to a recession, the recent decline isn’t just noise and in the last 20 years has usually coincided with a slowdown, such as in 1984, 1994, and 2002.

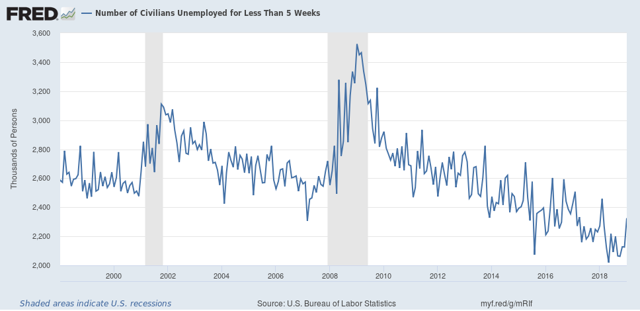

Next, here is short time unemployment (less than 5 weeks). This is one of the short leading indicators identified by Prof. Geoffrey Moore, and while they are obviously noisy, his research indicated they usually made a bottom before initial jobless claims:

These are clearly within the range of noise, but they have not made a new low for close to a year.

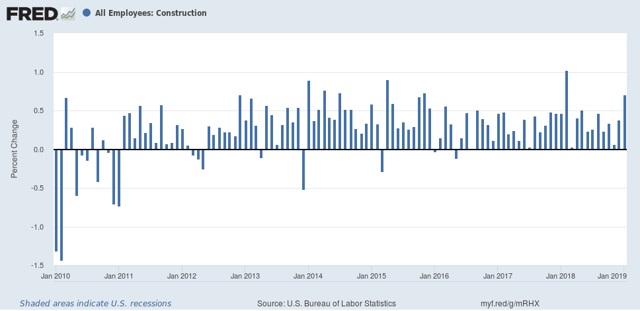

Finally, here are construction jobs for the duration of this expansion. These had one of the 10 best months of the entire 10 year expansion in January:

In fact, they stand out in sharp contrast to the weakness in the housing market, so much so that I suspect there will be a substantial downward revision in a month’s time.

In summary, of the five leading indicators in the jobs report, only one — construction jobs — was clearly positive. Two — temporary jobs and manufacturing jobs — while positive, have decelerated significantly and are consistent with a slowdown in the near future. Two — the manufacturing work week and short term unemployment — outright declined. The latter is within the range of noise, but the former is also consistent with a slowdown.