A few thoughts while you are digesting Thanksgiving dinner There was a bunch of data released Wednesday, while yours truly was on the road along with everybody else. So here are a couple of thoughts for you as you sit there with your loosened belt figuring out what leftovers you’re going to be eating for the next few days . . . Initial jobless claims declined back to their recent baseline last week, so the four week average declined slightly, further back into its normal range. The YoY% change averaged monthly also is lower: And the four week average of continuing claims, while slightly higher YoY, is also well below the point where it would be a serious concern: Bottom line: the economy is simply not going to be in recession this quarter.

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

A few thoughts while you are digesting Thanksgiving dinner

There was a bunch of data released Wednesday, while yours truly was on the road along with everybody else. So here are a couple of thoughts for you as you sit there with your loosened belt figuring out what leftovers you’re going to be eating for the next few days . . .

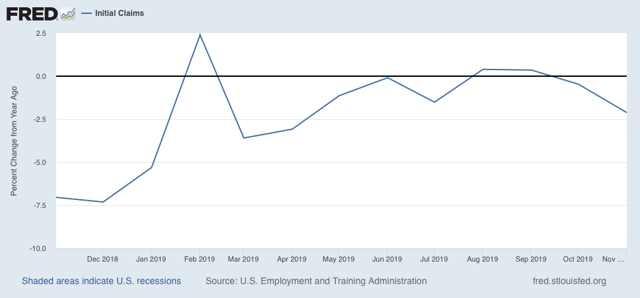

Initial jobless claims declined back to their recent baseline last week, so the four week average declined slightly, further back into its normal range. The YoY% change averaged monthly also is lower:

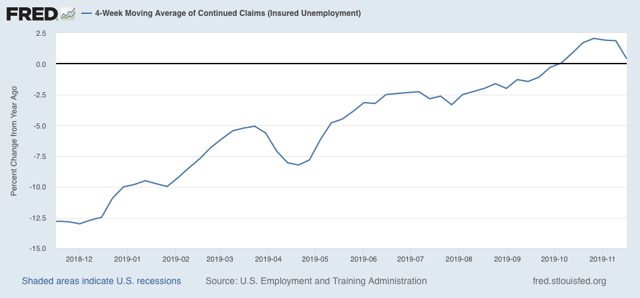

And the four week average of continuing claims, while slightly higher YoY, is also well below the point where it would be a serious concern:

Bottom line: the economy is simply not going to be in recession this quarter.

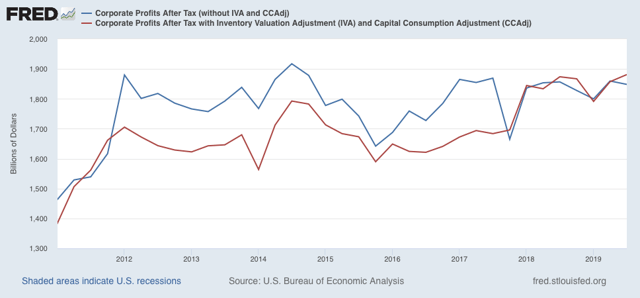

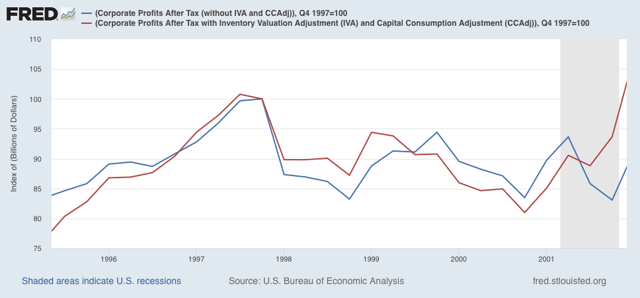

Corporate profits for the third quarter were also released as part of the second estimate of Q3 GDP. Depending on whether you include inventories and capital consumption or not, they either slightly increased or decreased:

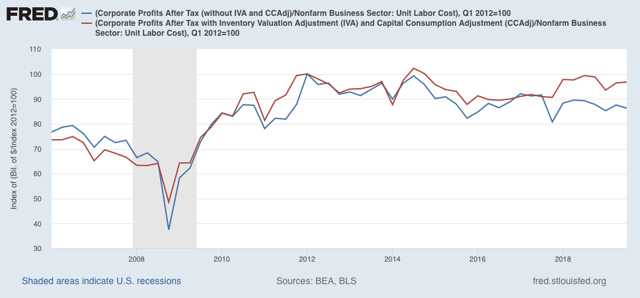

Adjusted by unit labor costs, they are either slightly (-3.3%) or significantly (-13.8%) below their peak for this expansion:

Before the last producer-led recession in 2001, both were off more than -15%:

This is a mixed signal for the economy in the second half of next year.