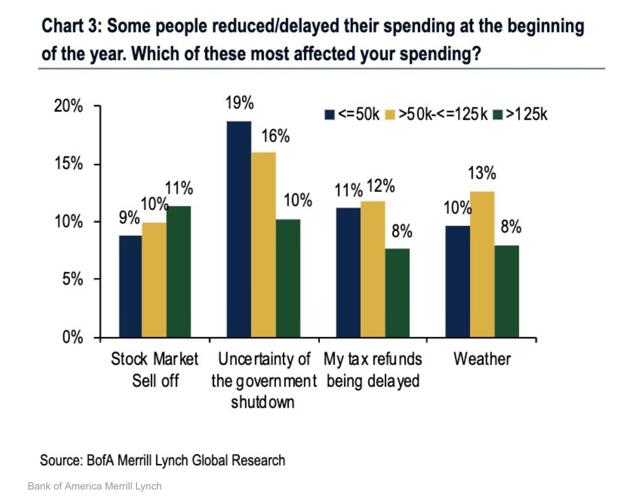

Yes, Virginia, the government shutdown really did cause a mini-recession For the past several months, I have been pounding on the idea that the government shutdown, during which 800,000 jobholders were temporarily laid off without pay, had a much bigger impact on the economy than was originally thought. This morning we get the following graph from Bank of America Merrill Lynch, which speaks for itself: One of the most important insights from behavioral economics is that losses have an outsized effect on behavior compared to gains, usually on the order of 2 to 1. In the case of the government shutdown, about 0.5% of the workforce went without pay for about 45 days. Using the 2:1 ratio, that would translate into a -1% deadweight loss to the economy

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Yes, Virginia, the government shutdown really did cause a mini-recession

For the past several months, I have been pounding on the idea that the government shutdown, during which 800,000 jobholders were temporarily laid off without pay, had a much bigger impact on the economy than was originally thought.

This morning we get the following graph from Bank of America Merrill Lynch, which speaks for itself:

Of course, the workers got back pay when the government reopened – but if the 2:1 ratio holds, there wouldn’t be an equivalent “kick” from renewed spending. Which seems to have been the case, since the March +1.3% rebound in real retail sales didn’t make up for the -1.6% decline in December.