If there is one thing that Presidential candidates, pundits, and bloggers agree on, it’s that Americans suffer under a heavy burden of debt. We have passed from alarm over predatory credit card lending, to underwater and deliquent mortgages to student debt, but in any case, we agree that debt is a huge problem. There are those who aim to save us from ruthless bankers and those who scold us for living beyond our means and eating avocado toast (personally I eat my avocados straight which is, I guess to avocado toast as crack is to cocaine) but all agree that the burden of debt has become intolerable. Few mention that household debt service payments as a fraction of disposable personal income are near an all time low. I think the reason is that we tend to

Topics:

Robert Waldmann considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

If there is one thing that Presidential candidates, pundits, and bloggers agree on, it’s that Americans suffer under a heavy burden of debt. We have passed from alarm over predatory credit card lending, to underwater and deliquent mortgages to student debt, but in any case, we agree that debt is a huge problem. There are those who aim to save us from ruthless bankers and those who scold us for living beyond our means and eating avocado toast (personally I eat my avocados straight which is, I guess to avocado toast as crack is to cocaine) but all agree that the burden of debt has become intolerable.

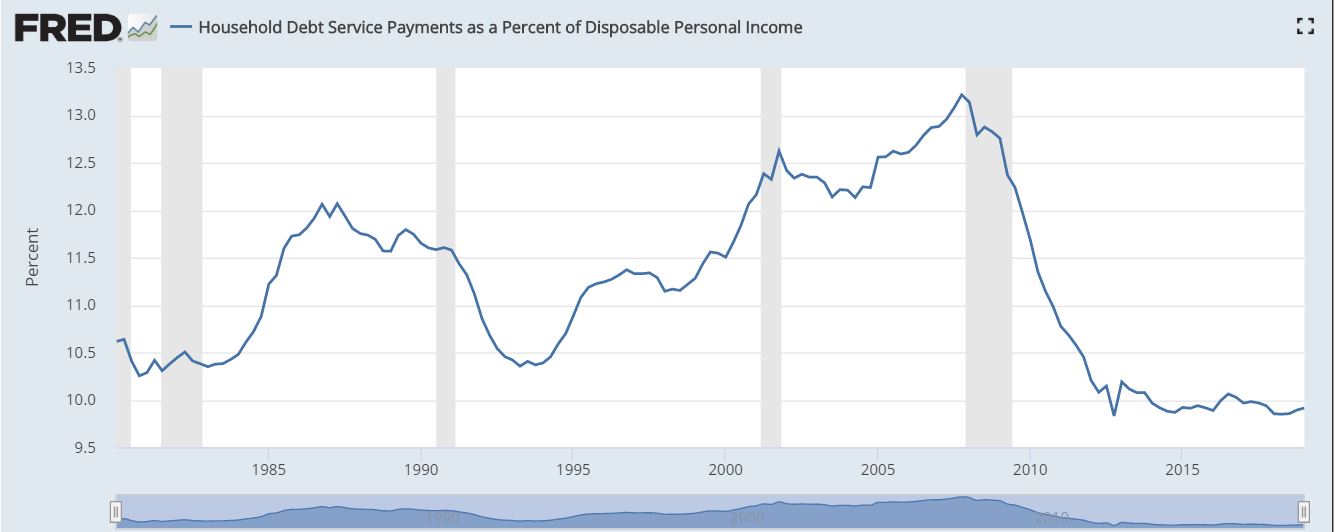

Few mention that household debt service payments as a fraction of disposable personal income are near an all time low.

I think the reason is that we tend to assume that this is a brief temporary reprieve due to unsustainably low interest rates.

I think that people got used to thinking that interest rates are tiny to zero, because of desperate and temporary efforts by the Fed to fight the great recession. But the Fed shifted to worrying about inflation (as central bankers do) in late 2016. The US is currently believed to be near a business cycle peak and one reason for worry is that spending is depressed by the crushing burden of debt, which will become even less crushing if interest rates fall as they do in recessions.

I think that while economists have begun to ask if extremely low interest rates are the new normal and about what this means for fiscal policy (pdf ) I haven’t read any argument that persistently low interest rates imply that households will be able to manage student debt plus mortgage debt.

I stress I am not advising people with student debt to buy a house anyway, so it’s ok (never ever ever buy a house when I decide it is time to buy a house — I have a perfect record of buying at the peak).

My point is that the twin problems of persistently slack demand (that is high desired saving) and high household debt do tend to cancel out. It almost looks as if we aren’t headed for a macroeconomic catastrophe (in any case before Antarctica melts and we all drown, but that’s another problem).