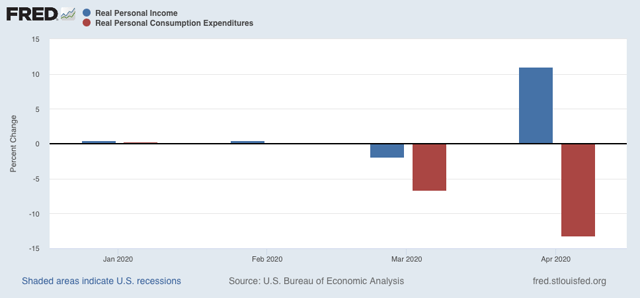

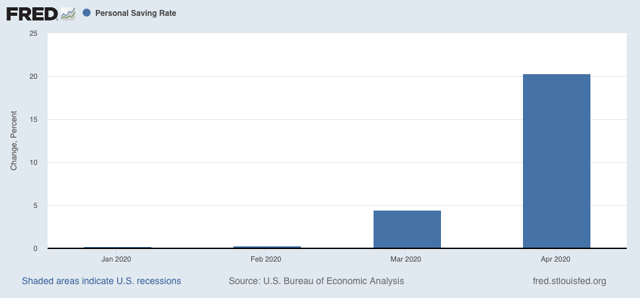

April personal income and spending: considering the extreme circumstances, a good report April personal income and spending, reported this morning, showed the impact of both the lock downs and the stimulus that was passed by the Congress. To cut to the chase, spending in real inflation-adjusted terms declined -13% (red), while real income rose 11%(blue): Unlike the recent jobs report, this is not a byproduct of the layoffs that were concentrated in the lower wage sector, which changed the composition of the labor force. Rather, this is an aggregate number, meaning that total income for everybody, adjusted for inflation, rose 11% As a result of the combination, the personal savings rate rose by 20%: Depending on what happens with the intensity

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

April personal income and spending: considering the extreme circumstances, a good report

April personal income and spending, reported this morning, showed the impact of both the lock downs and the stimulus that was passed by the Congress.

To cut to the chase, spending in real inflation-adjusted terms declined -13% (red), while real income rose 11%(blue):

Unlike the recent jobs report, this is not a byproduct of the layoffs that were concentrated in the lower wage sector, which changed the composition of the labor force. Rather, this is an aggregate number, meaning that total income for everybody, adjusted for inflation, rose 11%

As a result of the combination, the personal savings rate rose by 20%:

Depending on what happens with the intensity (or not) of “safer-at-home” orders in the future, and whether or not there is any further stimulus enacted by Congress (looking increasingly unlikely), this will either have to tide over the 20%+ of the labor force that has filed for unemployment in the last two months, or will serve as fuel for robust consumer spending once people feel it is safe to resume relatively normal activities.

Given the extreme circumstances, this was a good report.