Economy still expanding, but with retail consumption outpacing production This morning saw two important releases of October data: industrial production and retail sales. Both showed continued strength. Industrial production is the King of Coincident Indicators, and more than any other metric typically shows whether the overall economy is expanding or contracting. In October it increased by 1.1%, while manufacturing production increased by 1.0%. The overall number more than reversed last month’s decline, while past manufacturing numbers were revised higher. In the below graph I’ve normed both to 100 as of February to show the pandemic impact: Note that their actual peaks were in November and December 2018, respectively. After declining about 20% at

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Economy still expanding, but with retail consumption outpacing production

This morning saw two important releases of October data: industrial production and retail sales. Both showed continued strength.

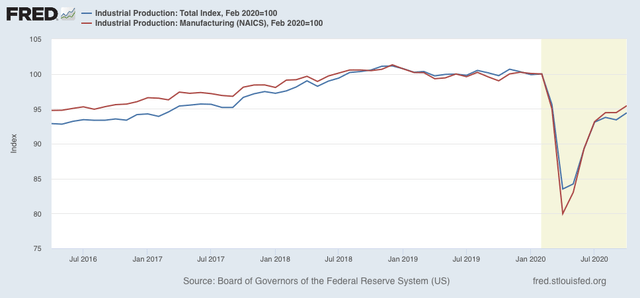

Industrial production is the King of Coincident Indicators, and more than any other metric typically shows whether the overall economy is expanding or contracting. In October it increased by 1.1%, while manufacturing production increased by 1.0%. The overall number more than reversed last month’s decline, while past manufacturing numbers were revised higher. In the below graph I’ve normed both to 100 as of February to show the pandemic impact:

Note that their actual peaks were in November and December 2018, respectively. After declining about 20% at their April troughs, both are now only about 5% below their February peaks. Still, the pace over the last 3 months has averaged less than a 1% increase per month, so it would take about 6 more months at this rate simply to equal the series’ pre-pandemic levels.

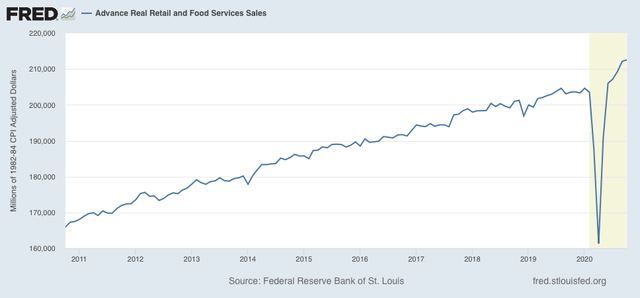

Retail sales were reported up +0.3%. After adjusting for inflation, which was just slightly above 0, real retail sales were up +0.2%. Despite the pandemic, sales have continued to set new all time records:

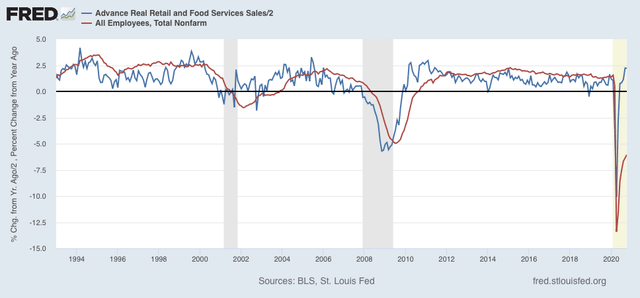

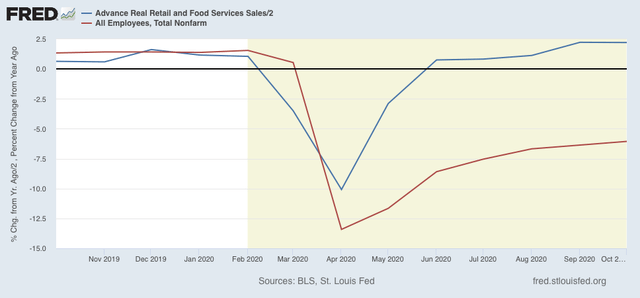

As I have said many times in the past, historically consumption has slightly led employment by several months, albeit with a lot of noise. It has almost universally done so for the entire 70+ year history that both measures have been kept. Basically, the demand for goods and services drives hiring to fulfill that demand (or at least to an increase in hours employed) typically within a few months later. Here’s the latest update (YoY retail sales /2 for scale):

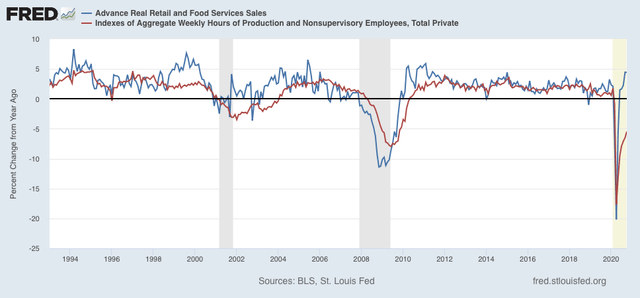

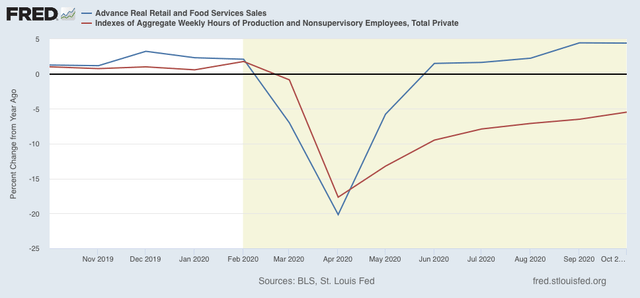

And consumption as measured by retail sales has had an even closer relationship with aggregate hours:

Here is a close-up on the past year for each:

Because sales have not just recovered, but on a YoY basis have continued to accelerate, I expect employment and hours worked to continue to show gains for the next several months, despite the pandemic, unless partial or total closures are ordered by State governments.

These two important measures show an economy still in expansion, but with retail consumption outpacing manufacturing production.