Industrial production and retail sales both improve strongly in July, suggest further gains in employment This Friday morning two important indicators for July, with implications for future employment, were released: retail sales and industrial production. Retail sales for July increased 0.8% on an unadjusted basis. After adjusting for inflation, they rose 0.7%. In the past two months they have completely recovered to higher than their pre-pandemic levels: Since consumption is about 70% of the entire US economy, this constitutes good news. Meanwhile, industrial production, the King of Coincident Indicators, also rose sharply, by 3.0%. Manufacturing production rose by 3.4%. As a result, total production has recovered 50% of its lost ground to the

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Industrial production and retail sales both improve strongly in July, suggest further gains in employment

This Friday morning two important indicators for July, with implications for future employment, were released: retail sales and industrial production.

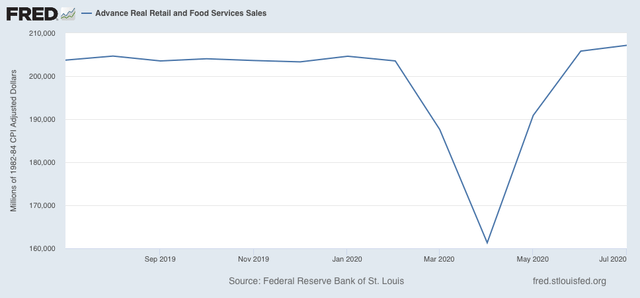

Retail sales for July increased 0.8% on an unadjusted basis. After adjusting for inflation, they rose 0.7%. In the past two months they have completely recovered to higher than their pre-pandemic levels:

Since consumption is about 70% of the entire US economy, this constitutes good news.

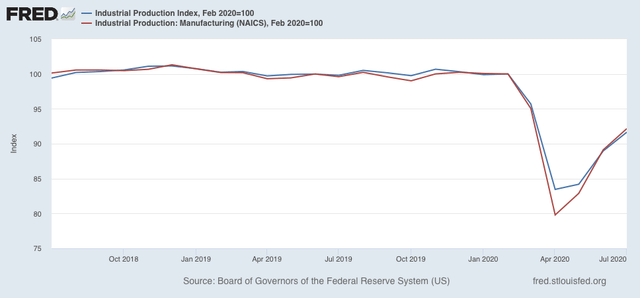

Meanwhile, industrial production, the King of Coincident Indicators, also rose sharply, by 3.0%. Manufacturing production rose by 3.4%. As a result, total production has recovered 50% of its lost ground to the pandemic, while manufacturing production has recovered 60%:

Note that production actually peaked in summer 2018, and was already on a slightly fading trajectory thereafter before the pandemic hit.

Thus, three of the four monthly coincident indicators (including employment) used by the NBER to determine if the US is in recession or not, all indicate that July marked the 3rd month of a recovery. Note they do *not* forecast whether the recovery will last – they are nowcasting tools only.

As noted above, both retail sales and industrial production do have implications for future employment.

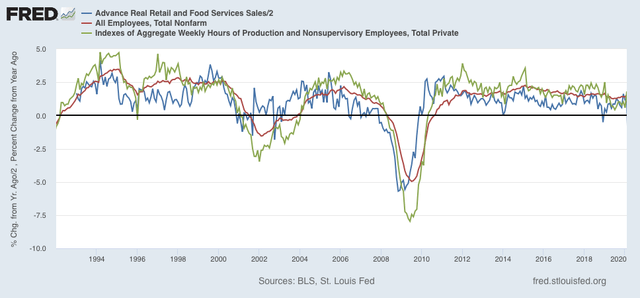

Going back over half a century, consumption leads employment. More specifically, real retail sales (blue in the graphs below) tend to lead employment (red) by 3 to 6 months. They are an even better fit for aggregate hours worked (green) 3 to 6 months in the future.

Here is the past 25+ years through February:

And here is this year through July:

The recovery in sales suggests that total hours of employment and the number of jobs will both continue to increase in the next few months.

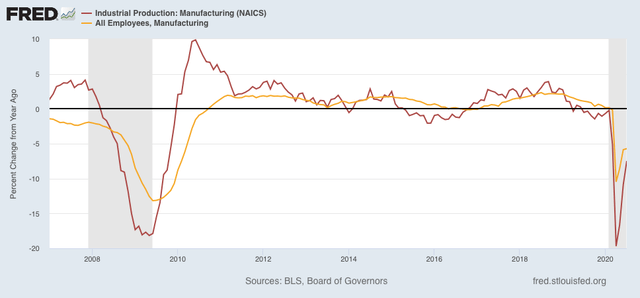

Meanwhile, since the early 1980s manufacturing production (red in the graph below) has generally led employment in manufacturing (gold).

Here’s the last 13 years:

The increase in manufacturing suggests that manufacturing employment, itself a leading indicator for total employment, will pick up steam in the next few months.