May inflation steadies: meanwhile, an artificial all time high in “real” wages – by New Deal democrat In May, overall consumer prices declined by -0.1% (blue in the graph below), while consumer prices excluding energy (gas) rose +0.1% (red): Note that in 2015 when gas prices collapsed, prices otherwise continued to increase, showing the underlying strength of the economy. But in March and April of this year, even prices outside of gas declined, showing underlying weakness. This is a typical recessionary scenario. May’s increase in prices ex-energy may be a good sign. YoY inflation is now only +0.2%, while YoY inflation ex-energy is up +1.6%: Last month I didn’t look at “real” inflation-adjusted wages. As it turns out, an important milestone was

Topics:

NewDealdemocrat considers the following as important: Taxes/regulation, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

May inflation steadies: meanwhile, an artificial all time high in “real” wages

–

by New Deal democrat

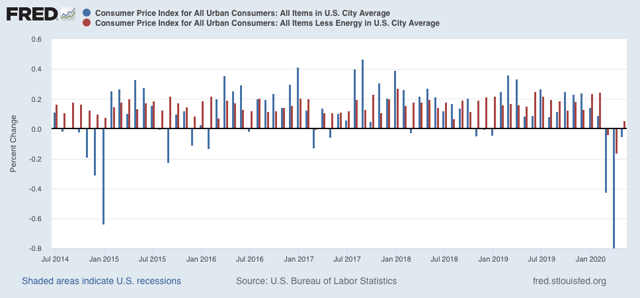

In May, overall consumer prices declined by -0.1% (blue in the graph below), while consumer prices excluding energy (gas) rose +0.1% (red):

Note that in 2015 when gas prices collapsed, prices otherwise continued to increase, showing the underlying strength of the economy. But in March and April of this year, even prices outside of gas declined, showing underlying weakness. This is a typical recessionary scenario. May’s increase in prices ex-energy may be a good sign.

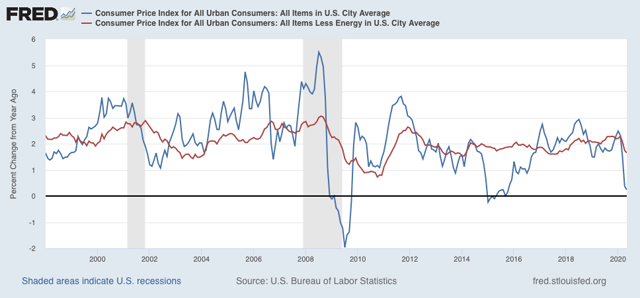

YoY inflation is now only +0.2%, while YoY inflation ex-energy is up +1.6%:

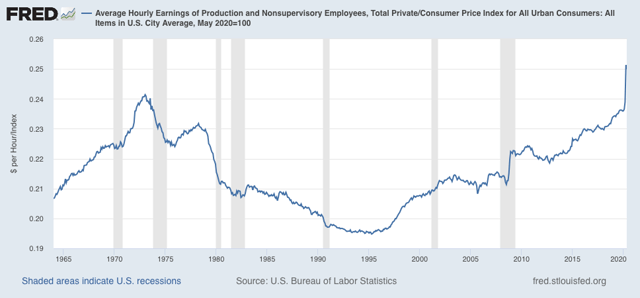

Last month I didn’t look at “real” inflation-adjusted wages. As it turns out, an important milestone was made – but was totally an artifact of the relative decimation of lower wage jobs.

“Real” inflation-adjusted wages for non-managerial employees rose to an all time high in April, finally surpassing the previous peak of January 1973:

May declined -0.5% from the April peak. I suspect as more people are recalled to work, April will prove to have been a short-lived spike

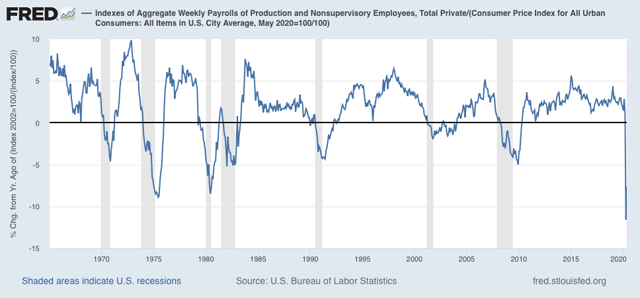

More importantly, here are “real” aggregate payrolls for all non-managerial employees YoY:

This is the worst drop in the entire history of this series.

That consumer prices steadied in May is a good sign. We will probably have to wait for the quarterly Employment Cost Index, which normalizes for the mix of jobs in the economy and won’t be released till the end of July, to find out what “really” has happened with wages during the pandemic.