January real personal income consistent with either slowdown or incipient recession Real personal income (less government transfers) is one of the four coincident indicators the NBER looks at in determining recessions. Since January’s numbers were reported this morning, let’s take an updated look. Truth be told, real personal income is actually a short lagging indicator. It frequently continues to improve a few months into a recession – and occasionally never turns down, as shown in the graph below which is rendered in log scale so that data from a few decades ago doesn’t just show up as microscopic squiggles. What historically *has* happened as a recession approaches is that the rate of increase decelerates sharply, by 40% or more from the recent

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

January real personal income consistent with either slowdown or incipient recession

Real personal income (less government transfers) is one of the four coincident indicators the NBER looks at in determining recessions. Since January’s numbers were reported this morning, let’s take an updated look.

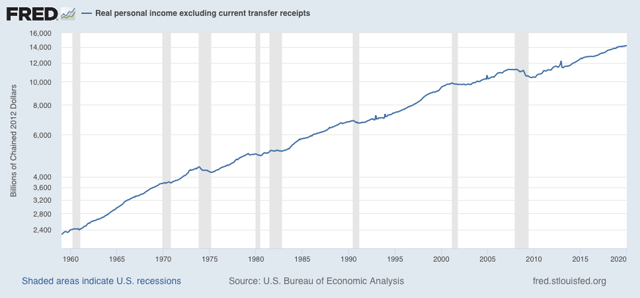

Truth be told, real personal income is actually a short lagging indicator. It frequently continues to improve a few months into a recession – and occasionally never turns down, as shown in the graph below which is rendered in log scale so that data from a few decades ago doesn’t just show up as microscopic squiggles.

What historically *has* happened as a recession approaches is that the rate of increase decelerates sharply, by 40% or more from the recent peak:

As of December, this threshold was breached. Although real personal income improved by +0.6% in January, once transfer receipts are subtracted the monthly gain shrank to +0.3%. Thus, YoY this metric “improved” to +1.9% YoY, or just -39% below its 12 month peak of +3.1% from last February.

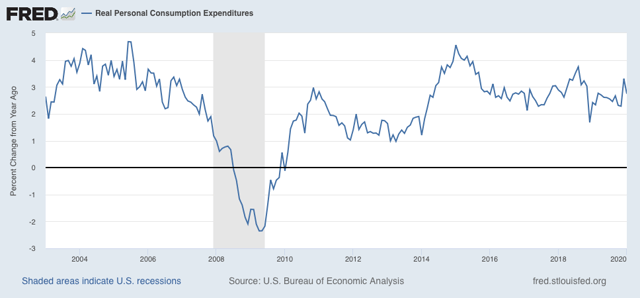

Meanwhile real personal spending rose only +0.1%, while YoY growth, at 2.7%, is in line with spending for the past four years:

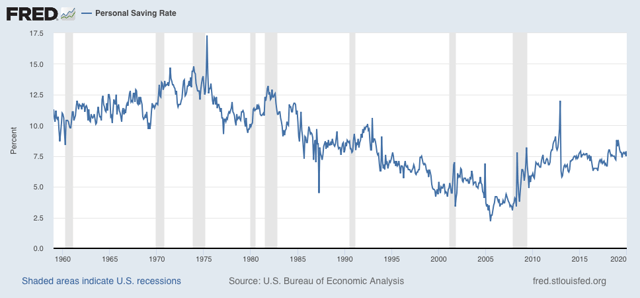

Finally, in the immediate prelude to a recession, consumers have typically decided to increase their savings rate. There was a small uptick in January, but no significant change compared with the past several years:

Bottomline: this coincident measure, just like real sales, is consistent with either a slowdown or an incipient recession. Industrial production continues to show an actual decline. Of the four most important coincident measures of the economy, only jobs growth is unambiguously positive. Any further knock to the economy (like, for example, the fear of a pandemic), could easily tip a slowdown into an outright downturn.