Jobless claims: only one week’s data, but cause for significant concern Today marked the biggest increase in new jobless claims in two months, and one of the two biggest increases since May, while the slightly lagging continuing claims continued to decline. On a non-seasonally adjusted basis, new jobless claims rose by 76,670 to 885,885. After seasonal adjustment (which is far less important than usual at this time), claims rose by 53,000 to 898,000. The 4-week moving average also increased by 8,000 to 866,250: Here is a close-up of the last four months highlighting the overall glacial progress in initial claims since the beginning of August: Continuing claims declined on a non-adjusted basis declined by -1,188,202 to 9,631,790. With seasonal

Topics:

NewDealdemocrat considers the following as important: politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Jobless claims: only one week’s data, but cause for significant concern

Today marked the biggest increase in new jobless claims in two months, and one of the two biggest increases since May, while the slightly lagging continuing claims continued to decline.

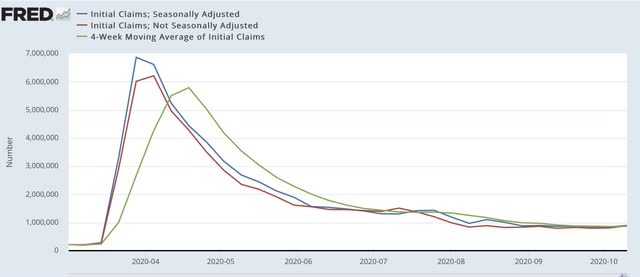

On a non-seasonally adjusted basis, new jobless claims rose by 76,670 to 885,885. After seasonal adjustment (which is far less important than usual at this time), claims rose by 53,000 to 898,000. The 4-week moving average also increased by 8,000 to 866,250:

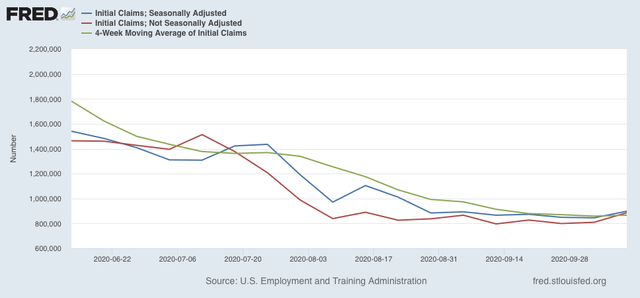

Here is a close-up of the last four months highlighting the overall glacial progress in initial claims since the beginning of August:

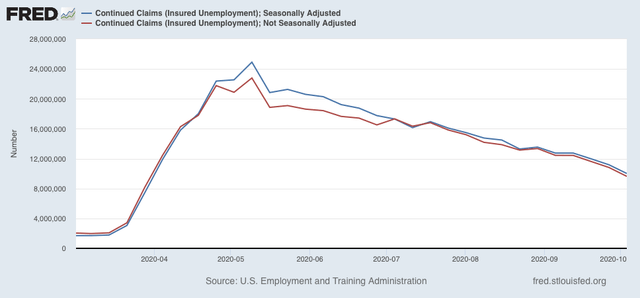

Continuing claims declined on a non-adjusted basis declined by -1,188,202 to 9,631,790. With seasonal adjustment they declined by 1,165,000 to 10,018,000. On the bright side, both of these numbers are new pandemic lows:

Continuing claims are now about 60% below their worst level from the beginning of May, but remain about 3 to 3.5 million higher than their worst levels during the Great Recession.

Only one week’s data, but it is a significant concern that claims have risen, after largely stalling for two months. The situation is at best only improving at a snail’s pace, and at worst is deteriorating again as we head into winter and a likely renewed increase in COVID cases.