Q2 GDP does not bode well for early 2021 There are two components of quarterly GDP that are long leading indicators, giving us information about the economy 12 months from now. If you think, as I do, that it is likely there will be a new Administration in Washington next year, which will competently follow the science, then there is every reason to believe that by 12 months from now the pandemic will have been contained, and so the long leading indicators are more likely to be valid. In that regard, this morning’s Q2 2020 GDP was not grounds for optimism. As an initial matter, the GDP decline of -9.5% annualized was the biggest decline since the Great Depression: The two forward-looking components of GDP are (1) private fixed residential

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Q2 GDP does not bode well for early 2021

There are two components of quarterly GDP that are long leading indicators, giving us information about the economy 12 months from now. If you think, as I do, that it is likely there will be a new Administration in Washington next year, which will competently follow the science, then there is every reason to believe that by 12 months from now the pandemic will have been contained, and so the long leading indicators are more likely to be valid.

In that regard, this morning’s Q2 2020 GDP was not grounds for optimism.

As an initial matter, the GDP decline of -9.5% annualized was the biggest decline since the Great Depression:

The two forward-looking components of GDP are (1) private fixed residential investment, and (2) corporate profits. Because corporate profits are delayed by one more month, I use proprietors’ income as a temporary proxy. Let’s look at each in turn.

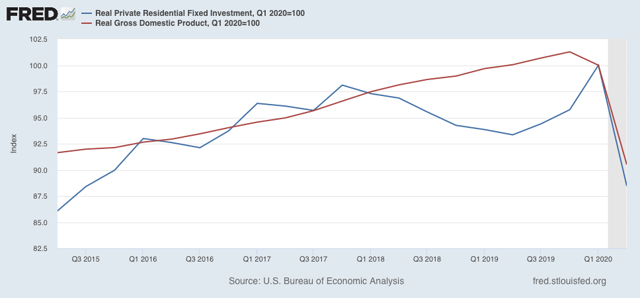

Real private residential fixed investment decreased by over 10% q/q. Real GDP decreased a little less than 10%:

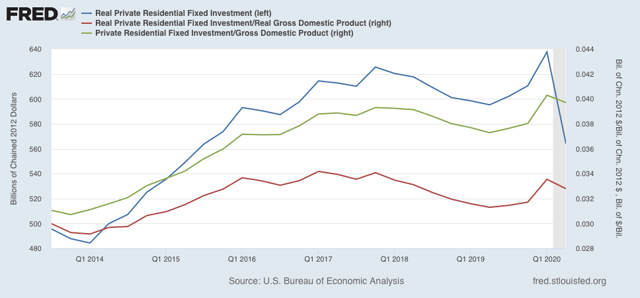

Thus real private fixed residential investment as a share of GDP declined slightly (red in the graph below) as did nominal investment as a share of nominal GDP:

This is a negative.

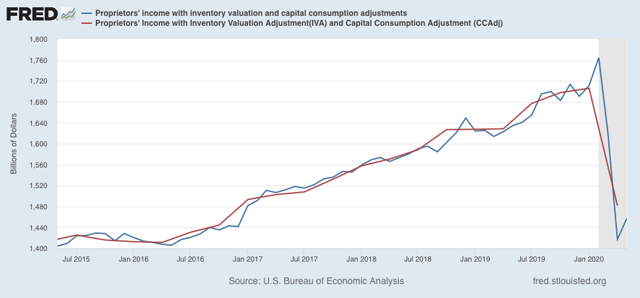

Meanwhile, proprietors income declined -13.2% in Q2:

Since the GDP implicit price deflator declined -2.1%, this was also a large negative.

In sum, both long leading indicators in the GDP report suggest that the economy will not be doing that well by summer 2021, even if the coronavirus is contained.