Real retail sales gains join industrial production in sharp deceleration Two days ago we saw that gains in industrial production had decelerated sharply in August. This morning we saw the same thing with real retail sales, one of my favorite indicators. Nominal retail sales were up +0.6% in August. Meanwhile, July’s reading was revised downward by -0.3%. Since in July and August consumer inflation was up +0.6% and +0.4%, respectively, that means revised *real* retail sales rose +0.3% in July and +0.2% in August. This means that the net result over two months was lower than previously thought for the month of July alone. Nevertheless real retails sales did establish a new record high, above any reading from before the pandemic: Historically

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Real retail sales gains join industrial production in sharp deceleration

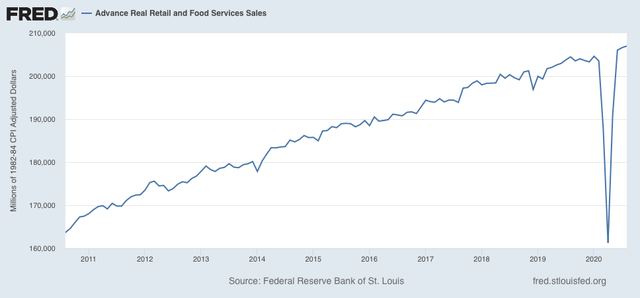

Nominal retail sales were up +0.6% in August. Meanwhile, July’s reading was revised downward by -0.3%. Since in July and August consumer inflation was up +0.6% and +0.4%, respectively, that means revised *real* retail sales rose +0.3% in July and +0.2% in August. This means that the net result over two months was lower than previously thought for the month of July alone.

Nevertheless real retails sales did establish a new record high, above any reading from before the pandemic:

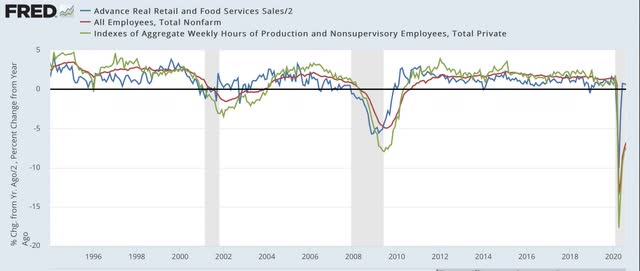

Historically consumption has led employment (/2) by several months (albeit with lots of noise), and has an even closer relationship with aggregate hours (all shown YoY below):

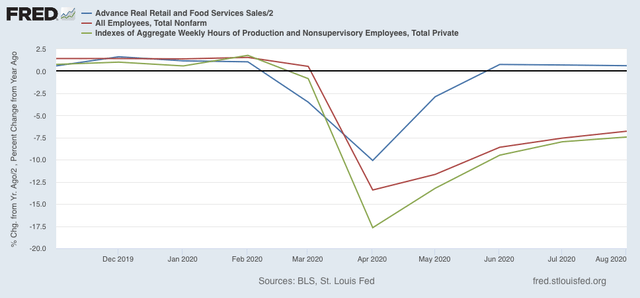

Here is the short-term view of the past 9 months:

Because sales have made a full recovery, I expect employment and hours worked to continue to show gains for the next several months, although at a slower pace, particularly if employers suspect – as most economic watchers including myself appear to – that the end of the emergency Congressional relief will lead to a renewed downturn in spending.