A more “normal” consumer inflation reading for August belies damage to the economy going forward Inflation, along with the expiration of the emergency pandemic payment, is one of the two big threats to this expansion. This morning August consumer inflation was the lowest in 6 months, up only 0.3% – within the range of a normal reading in normal times. Since wages increased 0.5% in August, this means that real wages increased. Let’s take a closer look. YoY inflation is now 5.2% (blue in the graph below), but typically inflation has not been a concern unless inflation ex-gas (red) has been in excess of 3.0%. After peaking two months ago at 4.1%, it is now 3.9%: The spike in inflation has gone on long enough at this point that I expect

Topics:

NewDealdemocrat considers the following as important: consumer inflation, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

A more “normal” consumer inflation reading for August belies damage to the economy going forward

Inflation, along with the expiration of the emergency pandemic payment, is one of the two big threats to this expansion. This morning August consumer inflation was the lowest in 6 months, up only 0.3% – within the range of a normal reading in normal times. Since wages increased 0.5% in August, this means that real wages increased. Let’s take a closer look.

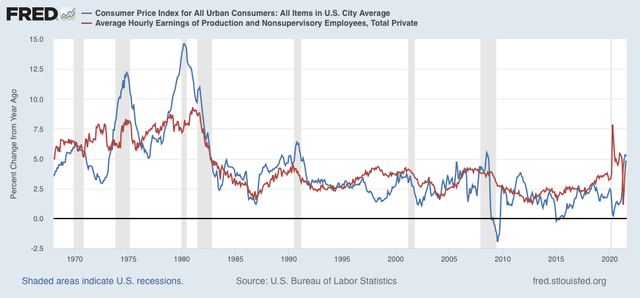

YoY inflation is now 5.2% (blue in the graph below), but typically inflation has not been a concern unless inflation ex-gas (red) has been in excess of 3.0%. After peaking two months ago at 4.1%, it is now 3.9%:

The spike in inflation has gone on long enough at this point that I expect it to inflict some actual damage on the economy.

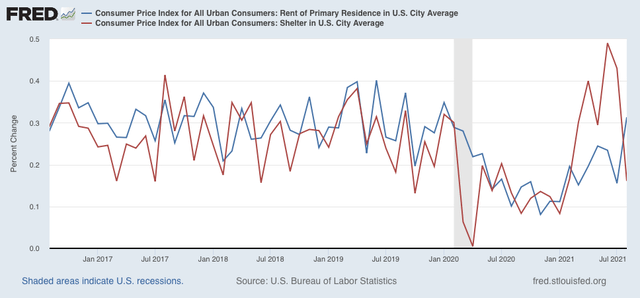

Housing (shelter) is over 1/3 of the entire index and reflects households’ biggest monthly expense. The good news is that on a monthly basis both inflation in shelter (blue in the graph below) and rent increases (red) were within their normal ranges in August:

With the expiration of the eviction moratorium due to COVID, most observers are expecting a rapid increase in rents, which will bleed over into the general shelter index (note that the situation would be much different if price increases in housing as measured by the FHFA or Case-Shiller Indexes were employed).

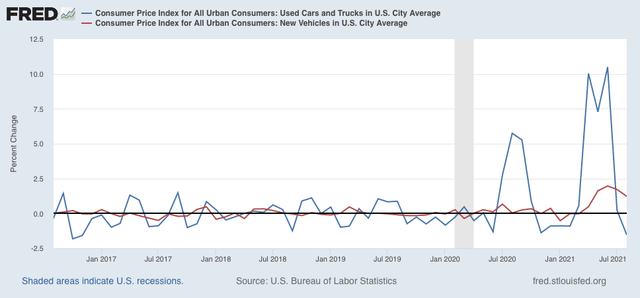

Further, the increase in new car prices decelerated this month, and used car prices finally hit a wall and actually decreased in August:

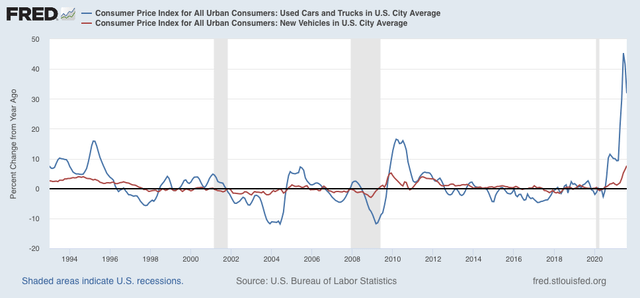

On a YoY basis, new car prices are still up nearly 10%, while used car prices are up over 30%!:

Almost certainly, price pressures in these two most important sectors of the consumer economy are now constraints going forward into 2022.

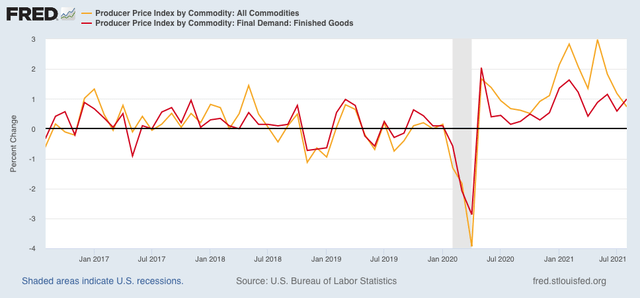

There is some limited good news “upstream” in commodities and finished consumer goods, as the former (gold in the graph below) increased a more “normal” 0.7% in August. While finished producer goods increased a fairly “hot” 1.0% (red):

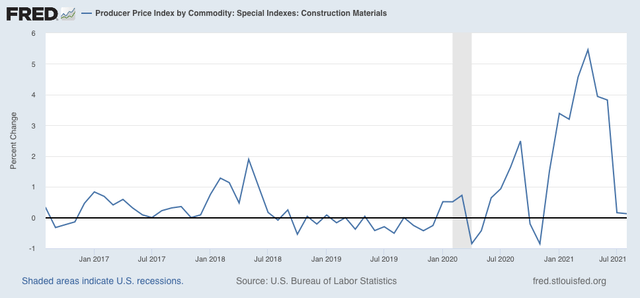

Residential building materials for the second month in a row held almost steady:

But they are still up over 30% YoY. We need this to decline, sharply, and soon.

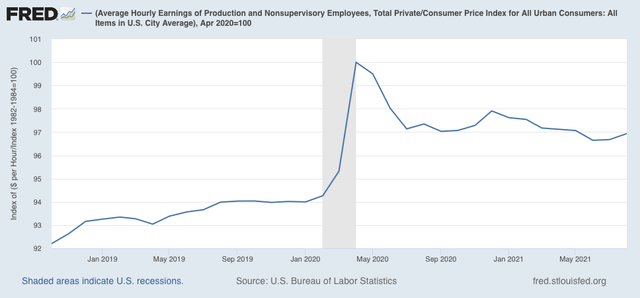

There is also some limited good news in the real wages department. Wages (more broadly, household income) failing to keep pace with inflation has been one of the traditional “real” harbingers of a recession:

After several months of decreases, real hourly wages, I.e., wages deflated by consumer prices, increased slightly in August. In the longer view real wages have been more or less flat in the past year, they are down about 3% from their pandemic peak:

As indicated above, heightened inflation has gone on long enough now that I expect some damage to show up in consumer spending. We will get that information on Thursday with the report on retail sales.