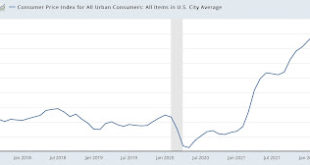

Consumer inflation remains all about the lagged effect of house prices – by New Deal democrat Consumer inflation in December continued to be a tale of the relative importance of gas prices vs. the lagged effect of home prices. Headline inflation increased 0.3%, and was up 3.4% YoY. YoY headline inflation has bounced between 3.1%-3.7% for the past 6 months, i.e., ever since the gas price peak of June 2022 passed out of the YoY comparisons....

Read More »Except for fictitious shelter and motor vehicle insurance and repairs, consumer inflation is thoroughly contained

It appears inflation is coming down this year and probably into next year also. Maybe Biden will not have to twist the Fed’s arm to get them to lower the Fed rate. Except for fictitious shelter and motor vehicle insurance and repairs, consumer inflation is thoroughly contained – by New Deal democrat The October CPI report confirmed yet again what I have been saying for months: except for fictitious shelter, both headline and core inflation...

Read More »August consumer inflation confirms “Goldilocks” “soft landing” may well be “transitory”

August consumer inflation confirms “Goldilocks” “soft landing” may well be “transitory” – by New Deal democrat Let me start by quoting from my post yesterday: “As to consumer prices, I am most interested in the relative weights of decelerating shelter increases (which as I have written many times are well-forecasted by the more current home price indexes and new rent indexes) vs. increasing gas prices “I suspect that the increase in gas...

Read More »September consumer inflation; function of fictitious “owners’ equivalent rent”+ new cars

“September consumer inflation: primarily a function of the fictitious “owners’ equivalent rent” plus new cars” – by New Deal democrat Since last November I’ve been hammering the fact that the official CPI measure of housing inflation, “owners’ equivalent rent,” seriously lagged, as in by a year or more, actual house prices as measured by the most popular housing indexes. At the time I wrote that OER was only up 3.1% YoY and core inflation...

Read More »July consumer inflation: a tale of two disparate trends

July consumer inflation: a tale of two disparate trends – by New Deal democrat Consumer prices were unchanged in July, as two very disparate trends canceled out one another. YoY prices increased 8.5%, below June’s multi-decade record of 9.0%: The two disparate trends are shown in the below bar graph of monthly changes since the end of last year. On the one hand, energy prices (red) declined -4.6% in July; but owner’s equivalent rent (gold)...

Read More »March consumer inflation part 2: I told you so

March consumer inflation part 2: I told you so; the Fed *must* start paying attention to house price indexes This is the second part of my take on the March consumer inflation report. As you may have already read, total inflation clocked in at +1.2% for March alone! YoY consumer prices are up 8.6%, the highest 12-month rate since 1981. As anticipated, gas prices were a huge contributor; less energy, prices were up 0.4%; less both food and...

Read More »March consumer inflation part 1: real wages decline sharply

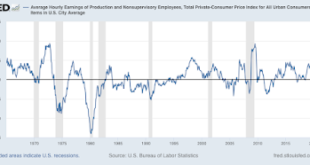

March consumer inflation part 1: real wages decline sharply The March consumer inflation report was particularly important, and particularly bad. So much so that I am going to divide my comments into two separate posts. First, the news on real wages was terrible. While nominally nonsupervisory wages rose 0.4% in March, since inflation rose 1.2%, “real” wages declined -0.8% in March alone. On a YoY basis, real wages were down -1.8%:...

Read More »Another big increase in consumer prices in February

Another big increase in consumer prices in February, as the yield curve tightens Consumer prices increased 0.8% in January, the fourth time in five months that it has exceeded 0.5%. YoY inflation is now 7.9%, the highest rate since 1982. My favorite measure, CPI ex energy, is also up 6.6% YoY, the worst since the 1981-82 recession as well: My rationale for tracking CPI ex-energy is that, unless energy costs filter through into the...

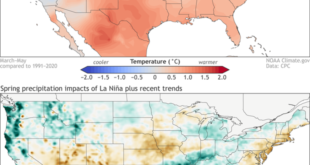

Read More »Another Trying Season, La Nina Now Through Summer

The good folks over at the National Weather Service have posted that La Nina, the ENSO negative Pacific Ocean pattern is here to stay for a threepeat. What this typically means for us in the US is that we are looking at drought. More drought. From the Texas South to the Dakota’s. This also means more rainfall in northern spots, flooding in the Ohio River Valley, much like we saw in Tennessee last year, and an uptick in hurricane activity coming...

Read More »Consumer inflation lessens in December

Consumer inflation lessens in December; real wages increase, but a consumer slowdown remains likely Consumer prices increased 0.5% in December, a deceleration from the past several months. But this is still well above the typical monthly increase in prices pre-pandemic: On a YoY basis, at 7.1% consumer inflation is the highest since the big Reagan recession of 1981-82. My favorite measure, CPI ex energy, is also up 5.6% YoY, and tied for...

Read More » Heterodox

Heterodox