The consumer spending spree continued in October, New Deal democrat Real personal income and spending held up well throughout the pandemic, due to a vigorous government response. With special benefits ended, the question has been: will they hold up? This month, the answer was a definite “yes.”In nominal terms, personal income increased 0.5% and spending rose 1.3%. In real terms, personal income (blue in the graph below) declined -0.2%, but real personal spending increased 0.7%. Both are well above their pre-pandemic levels: Since May, real income has declined -1.0%, while real spending has increased 1.9%. Last month I noted that consumers in the aggregate appeared to have gone through their cushion of saved pandemic assistance. The

Topics:

NewDealdemocrat considers the following as important: consumer spending, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

The consumer spending spree continued in October, New Deal democrat

Real personal income and spending held up well throughout the pandemic, due to a vigorous government response. With special benefits ended, the question has been: will they hold up? This month, the answer was a definite “yes.”In nominal terms, personal income increased 0.5% and spending rose 1.3%.

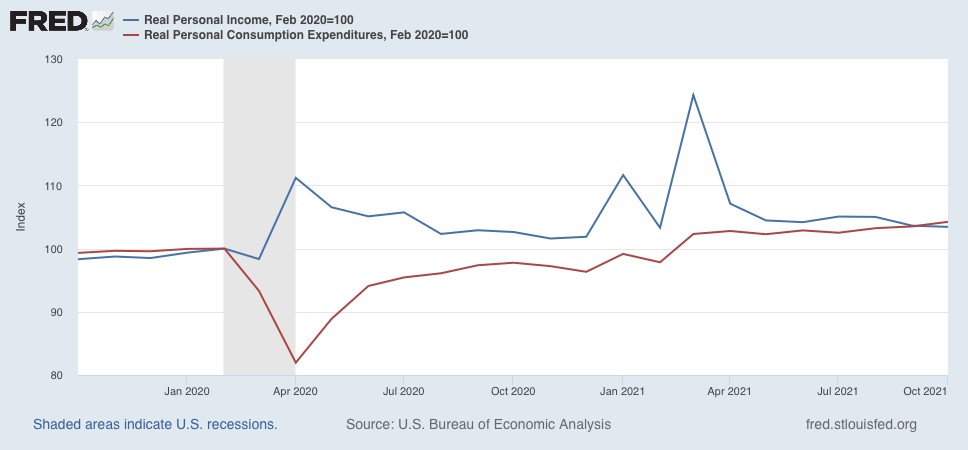

In real terms, personal income (blue in the graph below) declined -0.2%, but real personal spending increased 0.7%. Both are well above their pre-pandemic levels:

Since May, real income has declined -1.0%, while real spending has increased 1.9%.

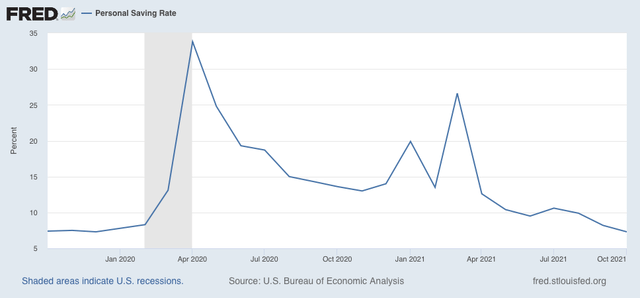

Last month I noted that consumers in the aggregate appeared to have gone through their cushion of saved pandemic assistance. The personal savings rate for October declined slightly from an upwardly revised September to 7.3%, below the 8.3% of February 2020 just before the pandemic hit, and about average for the 4 previous years:

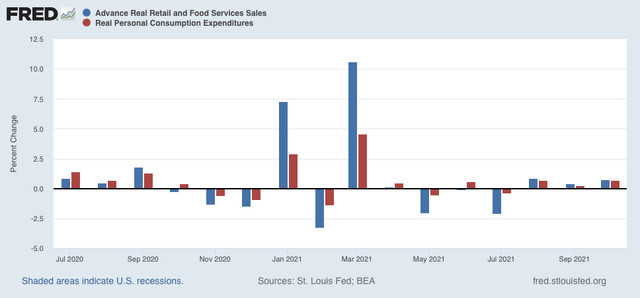

Finally, real personal spending is basically the other side of the coin compared with real retail sales, since they cover the seller and buyer of consumer transactions, which is over 2/3’s of the entire economy. Here is a graph comparing the monthly %age change in each since July 2020:

Both of these have returned to basically normal levels m/m, as both increased a very good 0.7% in October.

There is some evidence that many people began their Christmas shopping early, in October this year (due to news reports of shortages of items for sale). Whether the big increase can be sustained is obviously a question.