House prices continue to surge. But maybe . . . Both the FHFA and Case-Shiller house price indexes for July were released this morning. Both showed a continued surge in house prices, with one difference that may be of importance. First, here are both indexes normed to 100 as of January 1991, when the FHFA index began: Both are currently within 2% of an identical 250% increase since then. Further, YoY gains in both continued to accelerate, with the FHFA index now up 19.2% YoY, and Case Shiller up 19.7%: BUT, note that usually the FHFA index has decelerated, and made a peak or trough a month or two before the Case Shiller index (note for example, 1994, 2006, 2009, 2010, and 2013). With that in mind, here is the same data

Topics:

NewDealdemocrat considers the following as important: housing affordability, Housing Prices, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

House prices continue to surge. But maybe . . .

Both the FHFA and Case-Shiller house price indexes for July were released this morning. Both showed a continued surge in house prices, with one difference that may be of importance.

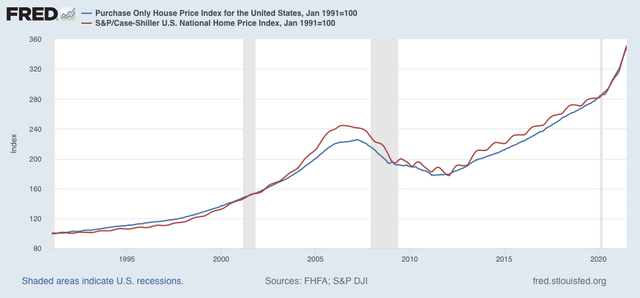

First, here are both indexes normed to 100 as of January 1991, when the FHFA index began:

Both are currently within 2% of an identical 250% increase since then.

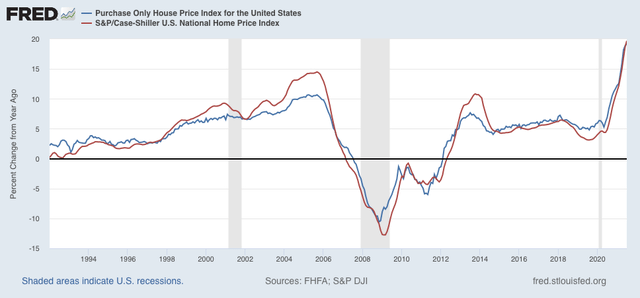

Further, YoY gains in both continued to accelerate, with the FHFA index now up 19.2% YoY, and Case Shiller up 19.7%:

BUT, note that usually the FHFA index has decelerated, and made a peak or trough a month or two before the Case Shiller index (note for example, 1994, 2006, 2009, 2010, and 2013).

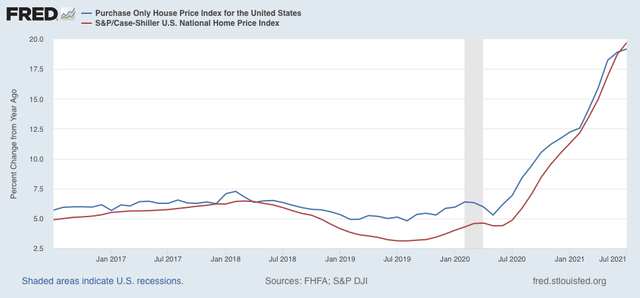

With that in mind, here is the same data zoomed in on the last 5 years (again, note that the FHFA index turned slightly ahead of the Case Shiller index in 2018 and 2020):

While the Case Shiller index shows no signs of decelerating, the FHFA index has decelerated to a 1% increase in YoY gain in each of the last two months. This may just be noise, but I suspect it is a signal, indicating that price gains are beginning to slow (but not reverse).