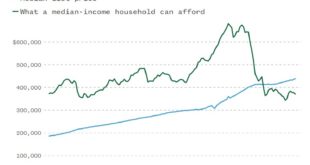

– By Jasmine Cui and Matthew Danbury NBC News Across the country, the prospect of home ownership is slipping out of reach for the ordinary buyer. The affordability gap — an estimate of the difference between an area’s median household income and how much income is necessary to afford payments on a median-priced home in that area — is near a 10-year high in the U.S., according to an NBC News analysis of housing data. The analysis and the...

Read More »Housing Affordability in the U.S.

One of several articles I picked up on over the last few days. and decided to post at Angry Bear. Younger people are having to overextend themselves financially to buy housing. Not so different than a few decades ago. Except they are more in debt and more apt to go bankrupt due to a lost job, etc. Income does not appear to be keeping up with the price of housing and loan interest rates. Or perhaps, mortgage increases have outstripped income? A...

Read More »Housing affordability: at or near the worst this Millennium

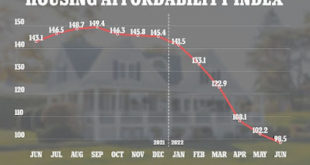

Housing affordability: at or near the worst this Millennium The NAR calculates a monthly “housing affordability index,” which estimates the median mortgage payment for the median priced existing home based on an estimate of median household income. For June that came in at 98.5: Not only has affordability deteriorated sharply this year, but the June reading was the lowest in over 20 years, i.e., even worse than at the peak of the housing...

Read More »The housing market’s downward turn begins

The housing market’s downward turn begins: new home sales in February, plus a comment about affordability As of this morning Mortgage News Daily shows the 30 year mortgage rate up to 4.72%, 1.9% higher than their lows 15 months ago, and the highest in four years. That means the housing market is in some serious trouble. Let’s take a look at that via this morning’s new home sales report for January. First, a reminder, that new home sales:...

Read More »House prices continue to surge. But maybe . . .

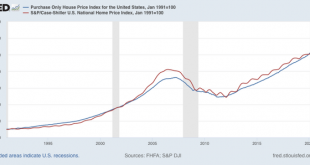

House prices continue to surge. But maybe . . . Both the FHFA and Case-Shiller house price indexes for July were released this morning. Both showed a continued surge in house prices, with one difference that may be of importance. First, here are both indexes normed to 100 as of January 1991, when the FHFA index began: Both are currently within 2% of an identical 250% increase since then. Further, YoY gains in both continued to...

Read More »Median household income and housing affordability

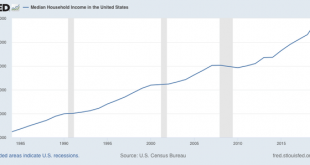

Median household income and housing affordability Let’s take a look at the affordability (or not!) of housing since there is no economic news of note today (Monday). Last week the Census Bureau released their annual report on median household income for the US, covering 2020. Since this is the best measure to gauge housing affordability, rather than average wages or income, this is a good time to update this information. Median household...

Read More »Michael Hudson — China’s housing: It Doesn’t Have to be This Way

Michael Hudson reports on his recent trip to China for a conference. Not only Chinese housing but US as well. Michael Hudson — On Finance, Real Estate And The Powers Of NeoliberalismChina’s housing: It Doesn’t Have to be This WayMichael Hudson | President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City, and Guest Professor at Peking...

Read More »Another Housing Bubble?

Another Housing Bubble? | Michael Hudson Your access to this service has been temporarily limited. Please try again in a few minutes. (HTTP response code 503) Reason: Exceeded the maximum global requests per minute for crawlers or humans. Important note for site admins: If you are the administrator of this website note that your access has been limited because you broke one of the Wordfence blocking rules. The reason your access was limited is: "Exceeded the maximum global requests per...

Read More » Heterodox

Heterodox