Jobless claims continue in normal mid-cycle range Last week I encouraged readers to take the very low jobless claims number with a grain of salt due to Labor Day artifacts, and see if the big reduction was maintained or reversed this week. This week did indeed reverse the pattern somewhat, but not enough to interfere with the overall declining trend.Initial claims rose 20,000 to 332,000, while the 4-week average declined 4,250 to 335,750, the latter yet another pandemic low: Continuing claims declined 187,000 to 2,665,000, also another pandemic low (which, to reiterate, may have much to do with the expiration of emergency pandemic benefits in many States): Here are both the 4 week average of initial claims and continuing claims from

Topics:

NewDealdemocrat considers the following as important: jobless claims, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Jobless claims continue in normal mid-cycle range

Last week I encouraged readers to take the very low jobless claims number with a grain of salt due to Labor Day artifacts, and see if the big reduction was maintained or reversed this week. This week did indeed reverse the pattern somewhat, but not enough to interfere with the overall declining trend.

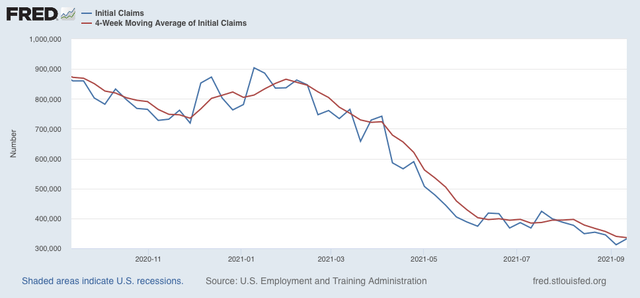

Initial claims rose 20,000 to 332,000, while the 4-week average declined 4,250 to 335,750, the latter yet another pandemic low:

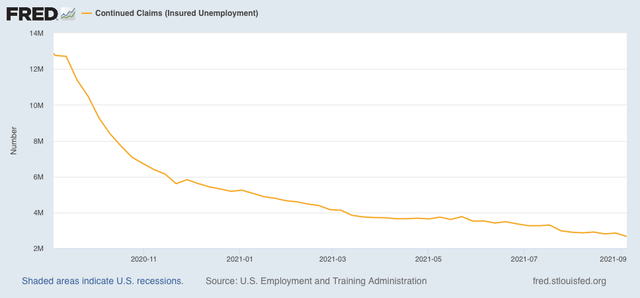

Continuing claims declined 187,000 to 2,665,000, also another pandemic low (which, to reiterate, may have much to do with the expiration of emergency pandemic benefits in many States):

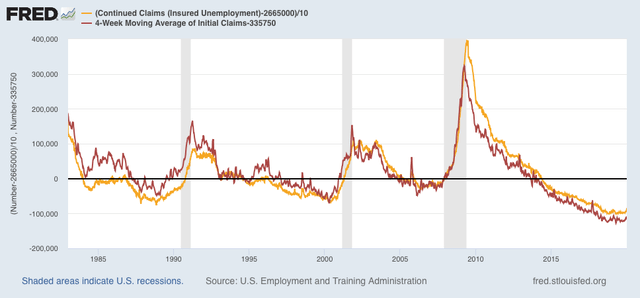

Here are both the 4 week average of initial claims and continuing claims from 1983 through the end of 2019 (both normed to zero as of this week’s numbers) for comparison:

As is easily seen, both numbers are in typical mid-expansion ranges.

It remains surprising how little impact the Delta wave has had on this “firing” side of the jobs equation.

If the 4 week average of new claims drops below 325,000 – I.e., if the numbers drop into completely normal strong expansion territory – I may discontinue weekly pandemic coverage of this metric.