Jobless claims make new pandemic lows at last New jobless claims are likely to the most important weekly economic data for the next 3 to 6 months. They are going to tell us whether, as the number of those vaccinated continues to increase, there will be a veritable surge in renewed commercial and social activities and attendant consumer spending, leading in turn to a strong rebound in monthly employment gains. Two weeks ago I set a few objective targets: I am looking for new claims to be under 500,000 by Memorial Day, and below 400,000 by Labor Day. This morning was (relatively!) good news, as we finally made new pandemic lows for initial claims. On a unadjusted basis, new jobless claims fell by 100,412 to 656,789. Seasonally adjusted claims

Topics:

NewDealdemocrat considers the following as important: jobless claims, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Jobless claims make new pandemic lows at last

New jobless claims are likely to the most important weekly economic data for the next 3 to 6 months. They are going to tell us whether, as the number of those vaccinated continues to increase, there will be a veritable surge in renewed commercial and social activities and attendant consumer spending, leading in turn to a strong rebound in monthly employment gains. Two weeks ago I set a few objective targets: I am looking for new claims to be under 500,000 by Memorial Day, and below 400,000 by Labor Day.

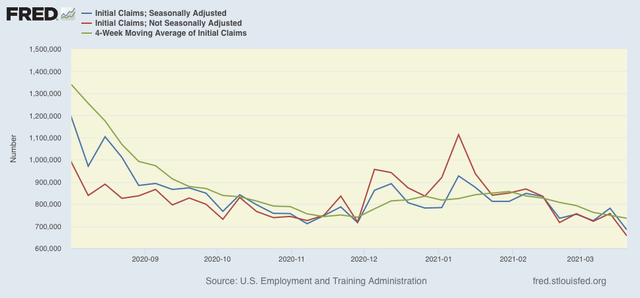

This morning was (relatively!) good news, as we finally made new pandemic lows for initial claims. On a unadjusted basis, new jobless claims fell by 100,412 to 656,789. Seasonally adjusted claims also declined by 97,000 to 684,000. The 4 week average of claims declined as well by 13,000 to 736,000. Seasonally adjusted claims also declined All of these were new pandemic lows.

Here is the close up since the end of July (recall that these numbers were in the range of 5 to 7 million at their worst in early April):

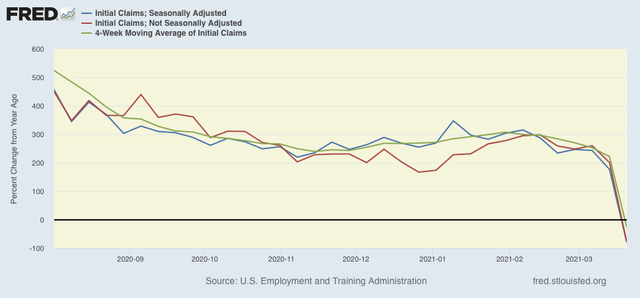

Because of the huge weekly swings caused by the scale of the pandemic, a few months ago I began posting the YoY% change in the numbers as well, since until now they have been much less affected by scale, so there is less noise in the numbers, and the trend can be seen more clearly:

This is probably the last time I will use this graph, as YoY comparisons will be distorted by the lockdowns of last March and April. Indeed, this week, all 3 metrics were down YoY.

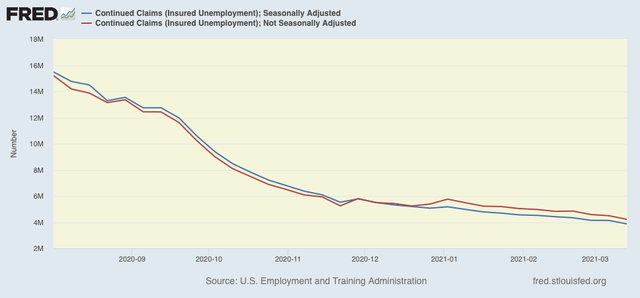

Continuing claims, which historically lag initial claims typically by a few weeks to several months, also made new pandemic lows yet again this week. Seasonally adjusted continuing claims declined by 264,000 to 3,874,000, while the unadjusted number declined by 278,573 to 4,217,259:

Nevertheless seasonally adjusted continued claims remain at levels last seen early in 2011.

I remain bullish that the ever-increasing pool of fully vaccinated adults – 46,000,000 as of yesterday, or 18% of the adult population – together with a seasonal shift from indoor to outdoor activities, is going to continue to result in a dramatic fall in jobless claims over the next few months.

Based on the month-over-month decline in initial claims of roughly 15,000, a gain was last seen in October. I expect that the March jobs report will show a gain in the range of last month’s 264,000 gain, and quite possibly much better.