Jobless claims show renewed downward trend; still some slack in continued claims Jobless claims declined 6,000 this week to 290,000, yet another pandemic low. The 4 week average also declined 15,250 to 319,750, also another pandemic low: With the exception of the last few years of the last expansion, this level of weekly initial claims would be very low for any point in the last 50 years, and the 4 week average would be average for late in an expansion: Continuing claims declined 124,000 to 2,481,000, also a new pandemic low: This level would also be normal for the middle of the last few expansions: Except for the last 2.5 years of the last expansion, continuing claims never dropped meaningfully below 2,000,000 at any

Topics:

NewDealdemocrat considers the following as important: jobless claims, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Jobless claims show renewed downward trend; still some slack in continued claims

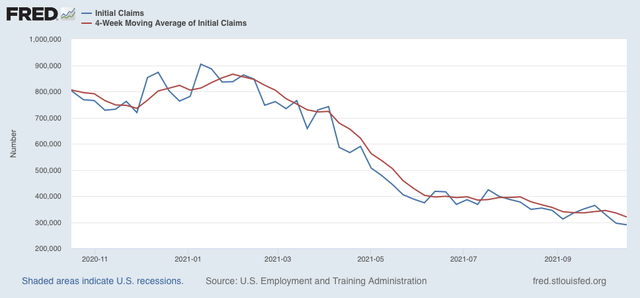

Jobless claims declined 6,000 this week to 290,000, yet another pandemic low. The 4 week average also declined 15,250 to 319,750, also another pandemic low:

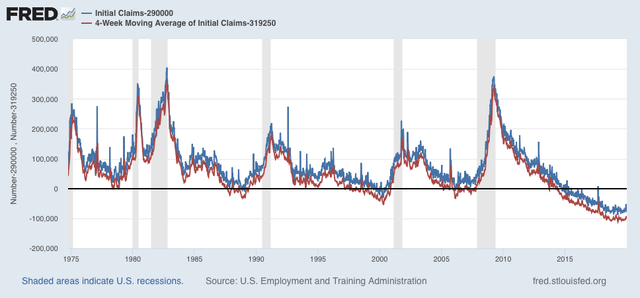

With the exception of the last few years of the last expansion, this level of weekly initial claims would be very low for any point in the last 50 years, and the 4 week average would be average for late in an expansion:

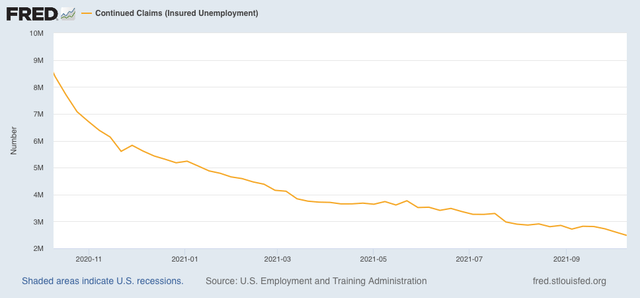

Continuing claims declined 124,000 to 2,481,000, also a new pandemic low:

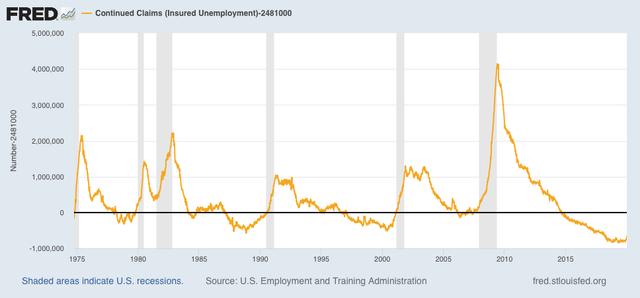

This level would also be normal for the middle of the last few expansions:

Except for the last 2.5 years of the last expansion, continuing claims never dropped meaningfully below 2,000,000 at any point since the 1974 oil embargo.

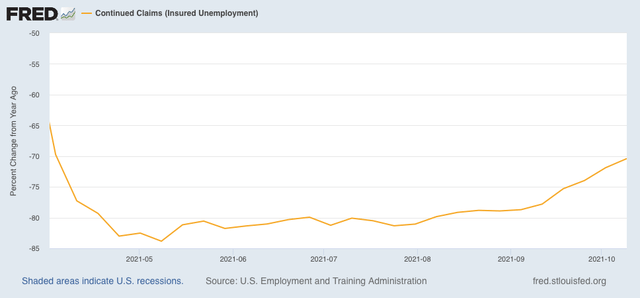

Finally, here is the YoY% change of continuing claims:

Based on the YoY change, it appears that the complete nationwide phase-out of all emergency pandemic benefits last month may be a cause for the decline in continued claims since then.

With this week’s confirming data, it appears that we have begun a renewed downward trend. Layoffs are at levels typically seen after very sustained expansions. But there is still some slack in workers who have not yet found new jobs, as evidenced in continuing claims. I suspect we will continue to see that number decrease.

The one big surprise is that all of this is happening while we still have about 80,000 new cases, and over 1600 deaths, of COVID daily.