July consumer inflation: the spike subsides somewhat, but we are close to the limit of “transitory” For the last two months, my theme has been that if the spike in inflation only lasted two or three months, it was not a big deal, but if the trend were to continue longer, it would begin to impact consumer spending, and it will get the Fed’s attention. In that regard, the “good” news is that in July consumer inflation was “only” 0.5%. The bad news is that for the last 5 months alone, consumer prices have risen 3.5%. Further, while inflation was only confined to a few sectors, those sectors were houses and cars – the two most important purchases made by most consumers – and the gas with which to power those cars, the most visible of all

Topics:

NewDealdemocrat considers the following as important: consumer inflation, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

July consumer inflation: the spike subsides somewhat, but we are close to the limit of “transitory”

For the last two months, my theme has been that if the spike in inflation only lasted two or three months, it was not a big deal, but if the trend were to continue longer, it would begin to impact consumer spending, and it will get the Fed’s attention.

In that regard, the “good” news is that in July consumer inflation was “only” 0.5%. The bad news is that for the last 5 months alone, consumer prices have risen 3.5%. Further, while inflation was only confined to a few sectors, those sectors were houses and cars – the two most important purchases made by most consumers – and the gas with which to power those cars, the most visible of all prices.

Let’s break it down.

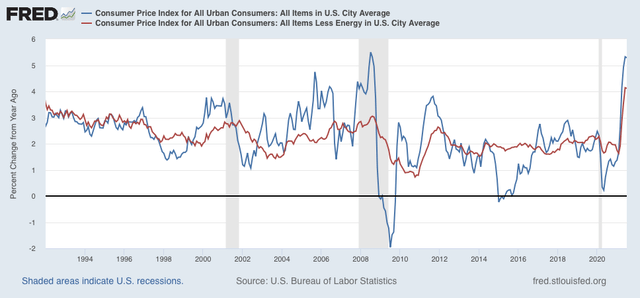

While YoY inflation was 5.3% (blue in the graph below), typically it has not been a concern unless inflation ex-gas (red) has been in excess of 3.0%. Since it is now over 4%, unless it ramps down shortly, as in 2011, this is indeed a concern:

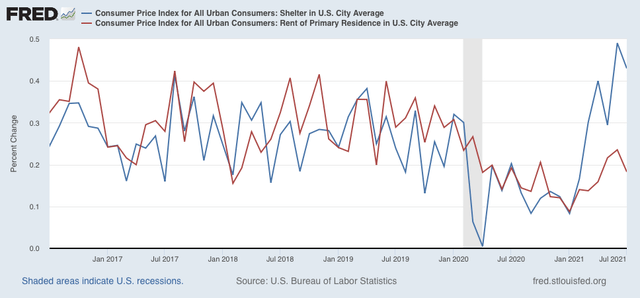

Inflation in shelter (blue in the graph below) has risen sharply m/m for the past 6 months. In the past 4 months, the trend in rent increases (red) have also increased m/m (although they are not up nearly as much as they were before the pandemic)

:

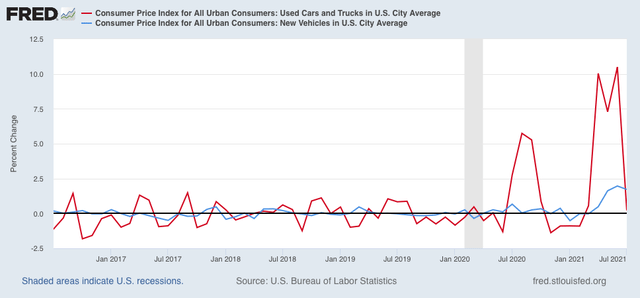

New car prices have increased sharply each month for the past few months, while in July used car prices may finally have hit a wall:

:

The building of new houses and the manufacture of new vehicles are the two most forward-looking, learning sectors of the “real” economy. That price pressures are now constraining both is not good for the economy going forward into 2022.

Returning to inflation ex-energy, now over 4% YoY, If this number goes back down below 3% quickly, then consumers can live with that. If not, however, and particularly if wages fail to keep up, then consumers may cut back on other purchases. In fact, wages (more broadly, household income) failing to keep pace with inflation has been one of the traditional “real” harbingers of a recession. Here the news is mixed.

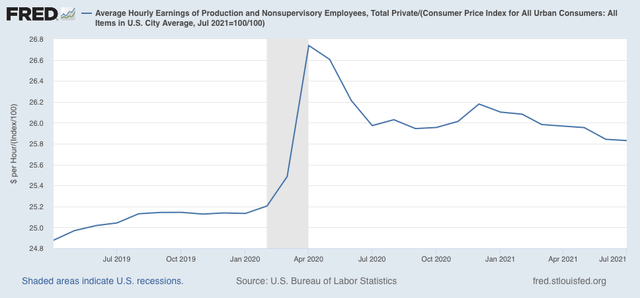

Real hourly wages, I.e., wages deflated by consumer prices, declined slightly in July. Further, while real wages have been more or less flat in the past year, they are down over 1% from their pandemic peak. But on the other hand, they are still up over 1.5% since before the pandemic began:

The big fly in the ointment here is the expiration of many emergency pandemic programs, even as the Delta wave rages.

We really need to see the main drivers of this so-far transitory inflation spike subside: microprocessors for vehicles, and construction materials for houses. The latter will be reported for July as part of the PPI which will be released tomorrow.

The other two important variables are the course of the pandemic, and whether or not emergency measures are renewed if the pandemic does not subside. So far the bond market does not seem concerned, and bank credit as I reported recently has been expanding. If that continues, the economy should continue to do well. But if the pandemic itself, or an inept government response to it cause a crash landing, all bets are off.

Addendum: I note where, inter alia, Paul Krugman lauds this report as demonstrating that inflation has indeed been transitory. I demur. For example, used car prices only increased 0.2% in July. But they are still up 41.7% YoY! Truly transitory inflation in a resource-constrained boom shouldn’t just plateau after a huge price increase, it should ramp right back down, as lumber prices in housing have done, plummeting all the way back down to 2018 prices. It is this ramping back down which was missing in yesterday’s consumer inflation report.