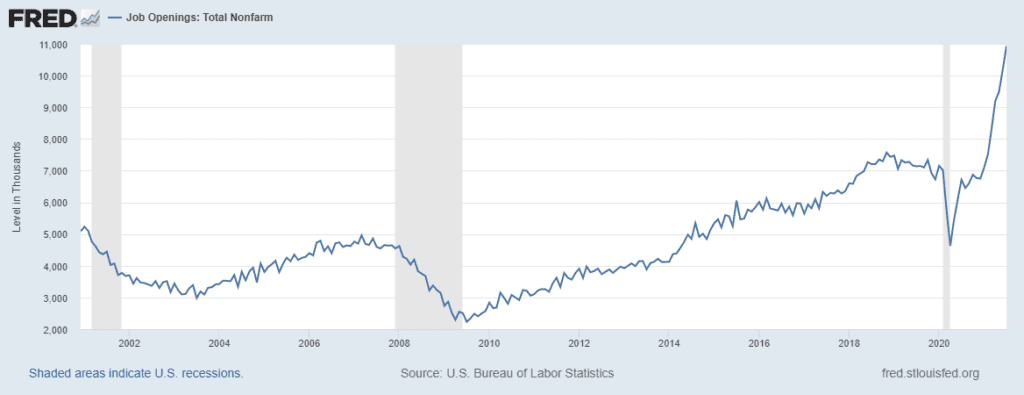

MarketWatch 666’s RJS: 5th record in a row; job openings have risen 62% so far this year . . . Here is the Fred graph. Job Openings: Total Nonfarm (JTSJOL) | FRED | St. Louis Fed (stlouisfed.org)Despite record highs, hiring is down and layoffs are up . . . Something is clearly broken. July Job Openings at Record High after June Record Revised Higher; Hiring Down, Job Quitting and Layoffs Higher The Job Openings and Labor Turnover Survey (JOLTS) report for July from the Bureau of Labor Statistics estimated that seasonally adjusted job openings rose by 749,000, from 10,185,000 in June to a record high of 10,934,000 in July, after June’s record job openings were revised 112,000 higher, from the 10,073,000 reported a month

Topics:

run75441 considers the following as important: Employment, Hot Topics, MarketWatch 666, RJS, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Joel Eissenberg writes How Tesla makes money

NewDealdemocrat writes January JOLTS report: monthly increases, but significant downward revisions to 2024

MarketWatch 666’s RJS: 5th record in a row; job openings have risen 62% so far this year . . . Here is the Fred graph.

Despite record highs, hiring is down and layoffs are up . . . Something is clearly broken.

July Job Openings at Record High after June Record Revised Higher; Hiring Down, Job Quitting and Layoffs Higher

The Job Openings and Labor Turnover Survey (JOLTS) report for July from the Bureau of Labor Statistics estimated that seasonally adjusted job openings rose by 749,000, from 10,185,000 in June to a record high of 10,934,000 in July, after June’s record job openings were revised 112,000 higher, from the 10,073,000 reported a month ago to 10,185,000 with this report…July’s jobs openings were also 62.8% higher than the 6,717,000 job openings reported for July a year ago, as the job opening ratio expressed as a percentage of the employed rose from 6.5% in June to 6.9% in July, and was up from 4.6% in July a year ago….a 202,000 job opening increase to 548,000 job openings in the financial sector appears to be the largest percentage increase for this month, while a decrease from 1.195,000 to 1,100,000 retail job openings looks to be the largest percentage decrease… (see table 1 for more details)…like most BLS releases, the press release for report is easy to understand and also refers us to the associated table for the data cited, which are linked at the end of the release…

The JOLTS release also reports on labor turnover, which consists of hires and job separations, which in turn is further divided into layoffs and discharges, those who quit, and ‘other separations’, which includes retirements and deaths….in July, seasonally adjusted new hires totaled 6,667,000, down by 160,000 from the revised 6,827,000 who were hired or rehired in June, as the hiring rate as a percentage of all employed fell from 4.7% in June to 4.5% in July, which was the same hiring rate as in July a year earlier (details of hiring by sector since March are in table 2)….meanwhile, total separations rose by 174,000, from 5,612,000 in June to 5,786,000 in July, while the separations rate as a percentage of the employed rose from 3.8% to 3.9%, which was the same as the separations rate in July a year ago (see table 3)…subtracting the 5,786,000 total separations from the total hires of 6,667,000 would imply an increase of 881,000 jobs in July, somewhat less than the revised payroll job increase of 1,053,000 for July reported by the August establishment survey last week, with at least some of that difference likely due to the difference in the date of the surveys, which is at month end for this report but is during the week of the 12th for the employment situation report…

Breaking down the seasonally adjusted job separations, the BLS finds that 3,977,000 of us voluntarily quit our jobs in July, up by 107,000 from the revised 3,870,000 who quit their jobs in June, while the quits rate, widely watched as an indicator of worker confidence, remained at 2.7% of total employment, while still up from 2.3% in July a year earlier (see details in table 4)….in addition to those who quit, another 1,459,000 were either laid off, fired or otherwise discharged in July, up by 105,000 from the revised 1,354,000 who were discharged in June, as the discharges rate rose from a record low of 0.9% in June to 1.0% of all those who were employed during the month, which still left it down from the 1.3% discharges rate of a year earlier….meanwhile, other separations, which includes retirements and deaths, were at 350,000 in July, down from the revised record 389,000 in June, for an ‘other separations’ rate of 0.2%, which was down from the 0.3% rate in June and in July of last year….both seasonally adjusted and unadjusted details by industry and by region on hires and job separations, and on job quits and discharges can be accessed using the links to tables at the bottom of the press release…