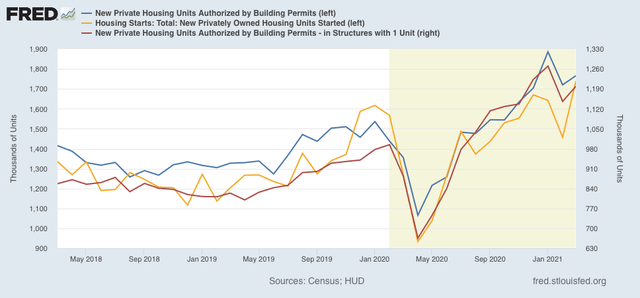

March housing permits and starts – don’t get too excited Don’t get too excited about this morning’s big jump in housing starts for March. In the first place, it wasn’t confirmed in either total or single-family permits, which both remain down from December and January, and the latter of which is the least of all housing numbers: Also, the big jump in starts is mainly a rebound from February’s Big Texas Freeze. February and March starts together average 1599 annualized, which is significantly below the December and January pace. And no, I’m not cherry picking. I checked, and here is how I led my report on housing permits and starts one month ago: The headline numbers for both permits and starts for February, released this morning,

Topics:

NewDealdemocrat considers the following as important: housing permits and starts, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

March housing permits and starts – don’t get too excited

Don’t get too excited about this morning’s big jump in housing starts for March. In the first place, it wasn’t confirmed in either total or single-family permits, which both remain down from December and January, and the latter of which is the least of all housing numbers:

Also, the big jump in starts is mainly a rebound from February’s Big Texas Freeze. February and March starts together average 1599 annualized, which is significantly below the December and January pace.

And no, I’m not cherry picking. I checked, and here is how I led my report on housing permits and starts one month ago:

The headline numbers for both permits and starts for February, released this morning, were both poor, off -10.8% and -10.3%, respectively. The temptation is to say, “higher interest rates, We’re DOOOMED!!!” Not so fast. In context, the declines were well within normal month to month variation, and at least some of the declines looks like more fallout from the Big Texas Freeze that we saw yesterday in industrial production and retail sales.

Higher mortgage interest rates and surging prices are having an effect. To the extent there is a surprise, it’s that there hasn’t been a bigger effect so far.

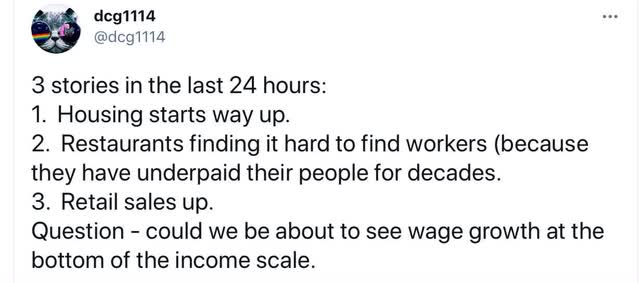

Finally, here is something that concerns me. One twitter account I usually peak in on, more for political tweets than anything else, had this to say:

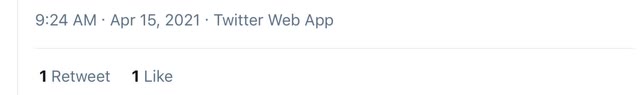

Here’s the problem. Here’s the time stamp of the above tweet:

How did this person know about a big jump in housing starts 24 hours before the Census Bureau published the information?