Why the hell would I go back to 2019 and cite a Nancy Altman complaint about Trump’s Executive Order? Some Introduction There were already issues with Medicare Advantage in $billions of over charges as Ms. Altman cites in her commentary. Secondly, Medicare Advantage is not “single payer” like Medicare (even without creating hospital budgets, setting doctor fees, and controlling pharma) is. We should be looking at improving Medicare to true Single Payer rather than fooling around with more commercial insurance hoping it will do better than traditional Medicare in care and costs to provide care.. Thirdly, without government help and Medicare, Medicare Advantage can not and will not compete with Medicare. This is nothing new and during the

Topics:

run75441 considers the following as important: Featured Stories, Healthcare, Hot Topics, Medicare, Medicare Advantage, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Why the hell would I go back to 2019 and cite a Nancy Altman complaint about Trump’s Executive Order?

Some Introduction

There were already issues with Medicare Advantage in $billions of over charges as Ms. Altman cites in her commentary. Secondly, Medicare Advantage is not “single payer” like Medicare (even without creating hospital budgets, setting doctor fees, and controlling pharma) is. We should be looking at improving Medicare to true Single Payer rather than fooling around with more commercial insurance hoping it will do better than traditional Medicare in care and costs to provide care.. Thirdly, without government help and Medicare, Medicare Advantage can not and will not compete with Medicare.

This is nothing new and during the trump administration insurance companies were on vacation as CMS Administrator Seema Verma did little to recoup overpayments to insurance companies. Indeed, the practice of overcharges continues.

Aetna Medicare Advantage program targeted in OIG audit, Modern Healthcare, Nona Temper

(Washington, DC) — The following statement from Nancy Altman, President of Social Security Works, on the Medicare executive order Donald Trump signed October 2019 sums up the issues with Medicare Advantage.

“Medicare Advantage is a hustle designed to allow for-profit corporations to suck up public dollars. For years, Republicans have shoveled money into Medicare Advantage plans and allowed them to offer benefits that traditional Medicare is forbidden from covering. This is a ploy to push seniors into Medicare Advantage plans instead of traditional Medicare. Medicare Advantage is stealth privatization intended to undermine traditional Medicare, which is an effective, popular government program and therefore loathed by Republican ideologues.

Under the Trump Administration, the thumb on the scale has turned into an entire arm. They’ve been flooding seniors’ inboxes with advertisements for Medicare Advantage. What these emails don’t mention is Medicare Advantage plans often have narrow networks, restricting which doctors and hospitals patients are allowed to use. Worse, a recent government report found Medicare Advantage plans improperly deny care “in an attempt to increase their profits.” It’s no surprise older, seniors are more likely to drop Medicare Advantage plans.

Medicare Advantage plans are also a terrible waste of public dollars. They have overcharged Medicare by $30 billion in the past three years alone.

Today’s executive order (Trump) is yet another giveaway to the corporations that run Medicare Advantage plans. Ironically, the Trump Administration is framing the executive order as an attack on Medicare for All. In fact, the massive flaws of Medicare Advantage epitomize the need to get for-profit greed out of health care by improving Medicare and expanding it to cover all Americans.

Medicare, like Social Security, works. Republicans want to privatize both of them. We have to stop them and instead, expand both.”

Medicare Advantage Health Plans Overbill Taxpayers By Billions Annually, Audits Show : Shots – Health News : NPR

Tossing more money into Medicare Advantage is symptomatic of what is wrong with healthcare today. Healthcare in the US is little more than a money pit and inefficient. No matter how much money patients and the government shovel into it, it will never be enough as prices rise regardless of costs remaining the same (something called increased value of the medicine in question). Until we begin to talk about cost versus price and whether the value claimed justifies the increased price, we will always be at odds with the healthcare industrial complex. Medicare Advantage is no more sustainable than ordinary Commercial Healthcare insurance.

Payments to Medicare Advantage

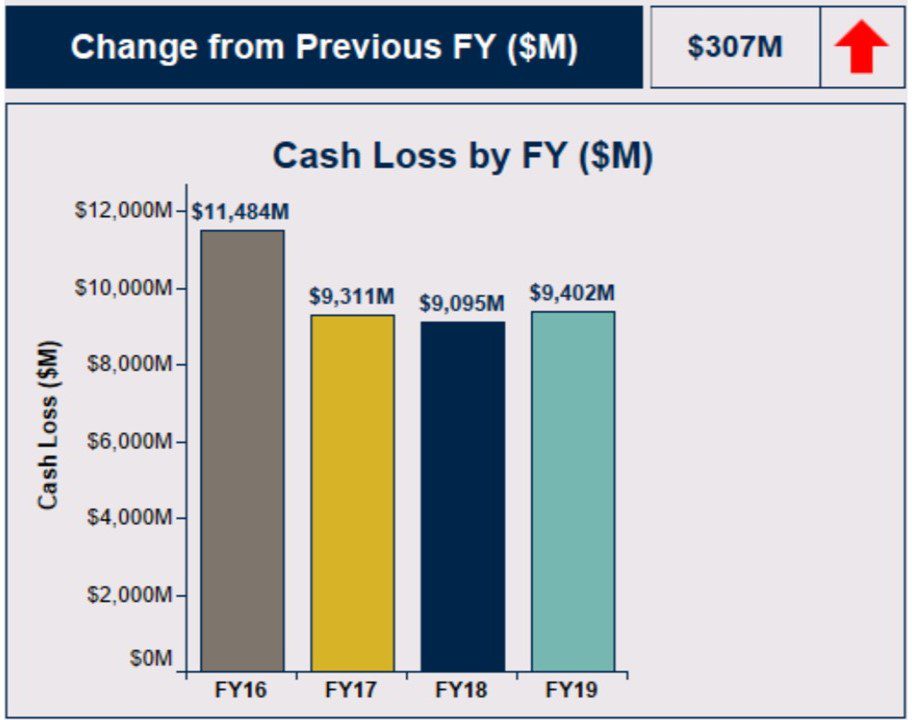

Discrepancies in payments attributed to patient risk analysis are still a major issue with Medicare Advantage as reported in the 2020 Agency Financial Report .

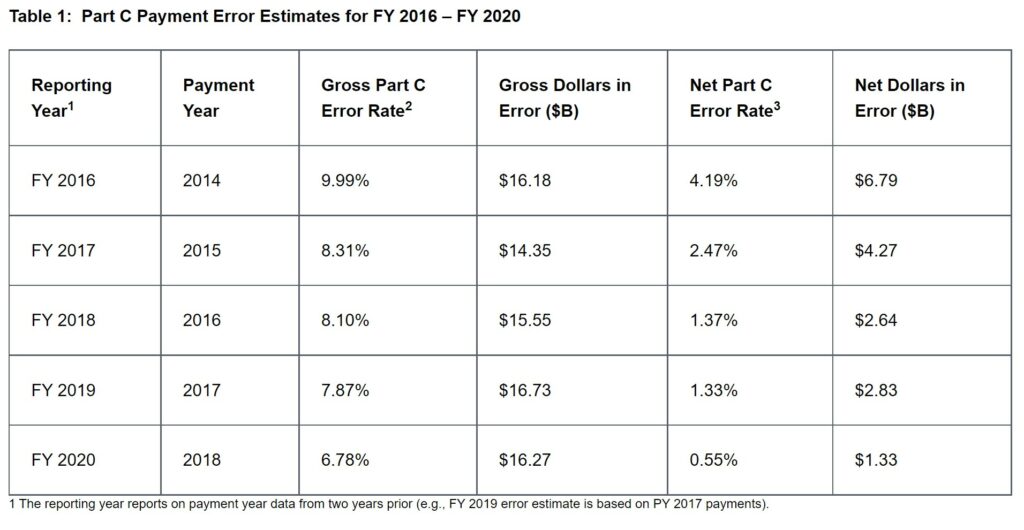

“The Medicare Part C gross improper payment estimate for FY 2020 covering 2018 is 6.78 percent or $16.27 billion of funds paid out to Insurance companies. This is a decrease from the prior year’s estimate of 7.87 percent.” Page 39 of 45, FY 2020 OMB Supplemental Data Call, Department of Health and Human Services, HHS.pdf (cfo.gov).

CMS submits an annual Part C improper payment estimate (Table 1 [below]) taken from the sampling of data (estimation methodology) to Congress in the Agency Financial Report (AFR). The report highlights important details about the payment error rate and provides useful links and resources to learn more.

The Cash Loss by FY ($M) in the OMB Supplemental Data Call (above) is taken from the Improper Payment Report (IPM) as shown below in the Part C (Medicare Advantage) Error Estimates for FY 2016 – FY 2020.

Part C (Medicare) Payment Error Rates from FY 2016 – FY 2020

The Gross Part C Payment Error Rate steadily declined from 9.99% in FY 2016 to 6.78% in FY 2020. Table 1 presents results from the Part C Payment Error Estimates for FY 2016 – FY 2020 as taken from batch sampling.

Sampling Detail Explained: “The sample for each payment year is a stratified random sample of 930 beneficiaries, with 310 beneficiaries selected from each of three risk score groups: low, medium, and high. The eligible cohort consists of beneficiaries who were enrolled in contracts active in January of the year for which risk adjustment payments were made. The data collection period for each calendar year Part C IPM sample spans January 1 through December 31 of the previous year.”

Recent Sampling Results:

From Modern Healthcare, we get an update on two more Medicare Advantage plans or offerings caught with their hand in the cookie jar.

– In April 2021, the OIG recommended that Louisville, Kentucky-based Humana return nearly $200 million to CMS. The OIG found. Humana charged taxpayers for care its Medicare Advantage members did not need in 2015.. This was the largest gap ever recorded between reported care costs and the actual price of the treatments (OIG report).

– A month later, the OIG issued a similar report recommending Indianapolis-based Anthem return about $3.5 million to CMS after finding that the insurer miscoded more than half of its Medicare Advantage claims which resulted in inflated payments. The OIG declined to comment on CVS Health’s ongoing audit.

Similar to other Medicare Advantage programs, Aetna’s Medicare Advantage reimbursement is based on regional trends and utilization in traditional fee-for-service Medicare. The adjustments are based on policyholder’s risk scores determined from there health. A patient with chronic healthcare conditions such as cholesterol, blood pressure, obesity, etc. has a higher risk score. The government adjusts payment to each Medicare Advantage plan according to the risk scores determined by the insurance company.

Payment based upon risk assessment is meant to incentivize plans to cover all Medicare-eligible people, regardless of risk rather than cherry-pick the healthy to reduce payouts. Recent whistleblower lawsuits allege health plans have been adding unnecessary codes or inflating scores to increase the health-risk allowing them to be eligible for more money.

It is the numerous and/or additional risk assessments made by the plans which are being disputed by CMS. By sampling the medical findings of Aetna, Humana, etc., and finding errors in the sampling; CMS can determine a percentage of medical assessments which may be erroneous.

The companies dispute the findings, how they are found, and push for the CMS to review all of the coded assessments to identify each and every erroneous finding to date. To date, it has been a stand-off between insurance companies and the CMC. The erroneous findings are what fueled the commentary by Nancy Altman about the $30 billion in over charges more-than-likely owed to the US.

What Medicare Advantage companies proposes (CMS reviews all the data rather than sampling) is the opposite of what is done in other samplings (ie. parts and data) when errors are found are found by companies with suppliers. In which case upon reporting the errors or rejected parts, the issue lies with the supplier and not the buyer (Medicare) of the service, material, or components. When errors are found during the process or in inspection, the entire lot is rejected and the supplier inspects the lot for more flawed parts. Payment is withheld until the parts are reviewed and found to be within specification. Too many occurrences and a supplier can be decertified and/or placed on probation which may require 100% inspection.

Risk calculations are made from the previous year’s patient evaluations and updated in the present year.

The Medicare Advantage companies have backed themselves into a corner by over assessing risk. If there is no or a lesser medical issue, they have shown a degree of medical incompetency or are deliberately mischaracterizing a finding. The CMS must force them to refund monies paid to the MA companies and also force the accuracy of charges. I stop short here.

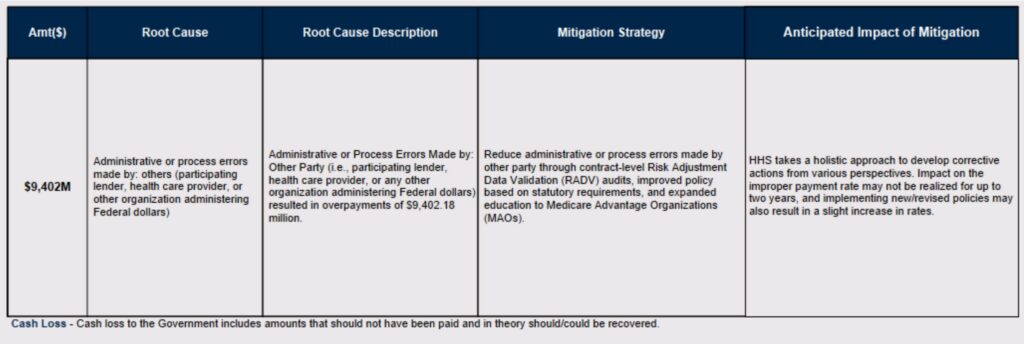

Health and Human Services is applying Root Case Analysis to guide and determine the resolution for supposed clerical and administrative errors causing over-payments to the companies providing Medicare Advantage.

Is Sampling Accurate?

It is not unusual to take a sampling of data to test for accuracy or to check parts to see if they meet specification. In lot-type of manufacturing, the Quality department will do a random sampling during and after completion of the lot. It will also check critical dimensions pre-startup of production to insure the parts are being made to specification. The data found points in a direction to which further action must be taken to find the “root” cause. Data gathered points in a direction and an analyst must do the additional study to make sure the findings are accurate. In this case SMS/OIG has done precisely the review and is pushing Medicare Advantage companies to fix their errors.

Denied Care or Reimbursement

The other route to increased profitability. Medicare Advantage uses a capitated payment model which pays a fixed amount per patient for a prescribed period of time. There is an incentive to deny access to care or deny reimbursement to patients for health care services in order to maximize profits. The result of which is increased profits for managed care plans. Since payment is already predetermined for an individual from the prior year, a plan can cut cost by denying care as being presently unneeded. HHS Office of Inspector General will be issuing a report in 2022 covering the denial of services.

Few people will appeal a denied claim or reimbursement. In which case, a denied claim leaves insurers free to avoid repayment (New York Times) resulting from the denial. Those who do appeal will often succeed. Historically, approximately three-quarters of appeals succeed on appeal at a first level of review.

Going to Medicare Advantage

As I have mentioned previously, signing up for traditional Medicare – MediGap, and Part D Pharmaceutical coverage must be done in the first year of eligibility. Leaving traditional Medicare and MediGap for Medicare Advantage in the first year or later can be problematic if one decides to return to traditional Medicare and MediGap. While Medicare will accept you back, you may be denied MediGap coverage or coverage for other conditions while not covered by MediGap.

Primary care doctors Kevin Burke, MD, and Deepak Azad, MD are members of a delegation sponsoring resolutions to explain the difference between traditional Medicare and Medicare Advantage making the difference more transparent upon enrollment. They believe Medicare should not let people with serious health risks enroll in MA plans from the beginning.

Medicare Advantage Benefits the Younger and Healthy

Part C Medicare can cover a broad array of health services at low cost when one is healthy. That same broad array of health services can become expensive when one gets sick. Out-of-pocket costs can soar. And getting out of a MA plan can make coverage even less affordable as I pointed out above.

I have covered an array of issues in this post. Medicare Advantage companies milking Medicare with over-charges, examination of yearly over-charges, briefly explaining the difference between traditional Medicare and Medicare Advantage, re-enrolling in traditional Medicare, MA denying coverage and payments, not allowing people with serious conditions to enroll in MA, etc.

I just scratched the surface . . .