New jobless claims continue strong decline, consistent with ongoing recovery, while continuing claims continue mixed New jobless claims continue to be the most important weekly economic datapoint, as increasing numbers of vaccinated people and outdoor activities have led to an abatement of the pandemic – deaths are at their lowest point in over a year, and new infections at their lowest points since the onset of the pandemic. Several weeks ago we hit my objective for claims to be under 500,000 before Memorial Day, and this week we hit second objective, for claims to be below 400,000 by Labor Day. REMINDER: Because of the unprecedented number of layoffs during the April and May 2020 lockdowns, for the last year I have given heightened

Topics:

NewDealdemocrat considers the following as important: jobless claims, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

New jobless claims continue strong decline, consistent with ongoing recovery, while continuing claims continue mixed

New jobless claims continue to be the most important weekly economic datapoint, as increasing numbers of vaccinated people and outdoor activities have led to an abatement of the pandemic – deaths are at their lowest point in over a year, and new infections at their lowest points since the onset of the pandemic.

Several weeks ago we hit my objective for claims to be under 500,000 before Memorial Day, and this week we hit second objective, for claims to be below 400,000 by Labor Day.

REMINDER: Because of the unprecedented number of layoffs during the April and May 2020 lockdowns, for the last year I have given heightened importance to the non-seasonally adjusted numbers. This will be the last week I include them.

New jobless claims declined 20,000 to 385,000. On a unadjusted basis, however, new jobless claims rose 6,014 to 425,450. The 4 week average of claims declined by 30,500 to 428,000. Both seasonally adjusted numbers were new pandemic lows.

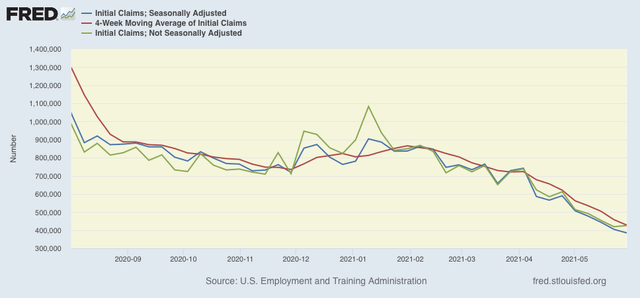

At the peak of the pandemic lockdowns, new claims were running 6 million to 7 million per week. Here is the trend since the beginning of last August:

I

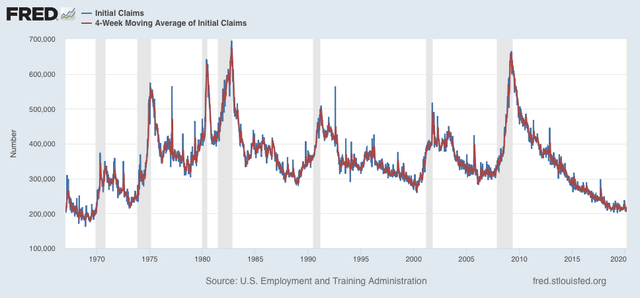

n the past 3 months, claims have trended down an average of roughly 100,000 per month. If this continues for just 3 more weeks, new claims will be at levels which in the past have been consistent with full or nearly full employment deep into expansions. At their current level, claims are consistent with early to mid-recovery levels in the past:

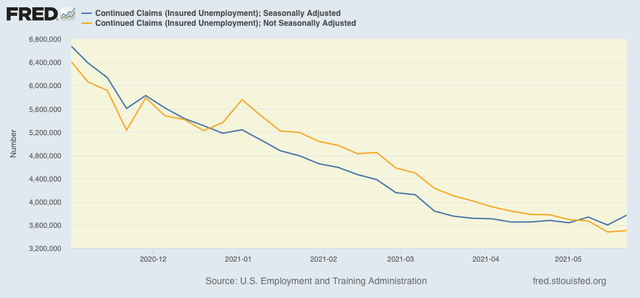

Continuing claims, which are reported with a one week lag, and lag the trend of initial claims typically by a few weeks to several months, rose 169,000 from their revised pandemic low of 3,602,000 last week to 3,771,000. On an unadjusted basis (gold), they also rose 22,860 from their revised pandemic low of 3,504,163 last week to 3,504,163:

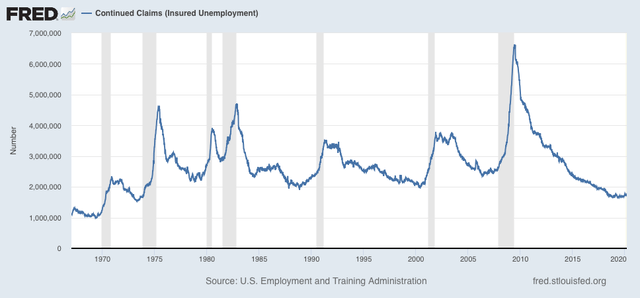

The long term perspective again shows that these are equivalent to the worst levels of most previous recessions, versus at 2,000,000 or below during strong expansions:

I am not sure if the recent strong declines in new jobless claims will continue from here, as we approach past levels of full or nearly full employment. The issue with continuing claims has become more complex, as unadjusted claims show a slowly declining trend, while after adjustments they have essentially been flat since the beginning of March. The picture has become much more clouded as half of the States have announced early terminations of supplemental pandemic benefits for ideological reasons.

Finally, as I wrote two weeks ago, March’s employment gains may have been more of an outlier than April’s. If we simply averaged the 2 months together that would be an average jobs gain of 518,000, then the continued big decline in initial claims would give us a May jobs gain of over 500,000 when that report is issued tomorrow (June 4). There may also be big revisions to March and April’s numbers as well. We’ll see.