First I should note that at a time when I had totally messed up my life, Larry Summers saved me from well earned unemployment. As my PhD Supervisor, he was amazingly patient about the amazing delays preceding my actually producing anything along the lines of a written document. The title is a reference to a hypothetical dog. an economics professor, Solomon Fabricant, coined the term ”growth recession” to describe a period in which the economy slows dramatically but keeps sputtering forward. [skip]Not everyone approved of the term. Herbert Stein of President Nixon’s Council of Economic Advisers suggested that one might as well call a dog ”a growth horse.” (by the way, I just linked to an article in the New York Times written less than 3

Topics:

Robert Waldmann considers the following as important: US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

First I should note that at a time when I had totally messed up my life, Larry Summers saved me from well earned unemployment. As my PhD Supervisor, he was amazingly patient about the amazing delays preceding my actually producing anything along the lines of a written document.

The title is a reference to a hypothetical dog.

[skip]

Not everyone approved of the term. Herbert Stein of President Nixon’s Council of Economic Advisers suggested that one might as well call a dog ”a growth horse.”

(by the way, I just linked to an article in the New York Times written less than 3 years after I graduated from college written by a guy who graduated the same day (and place) I did. WTF !!! (clearly he doesn’t have the same problem with deadlines that I do).

Some time ago, Summers wrote

Some time later, I read his op-ed. I immediately thought “what about the growth recession of 1965?” Some time later, I looked at data and found it was the growth recession of 1966 or maybe 1967 but definitely not 1965. Still later, I made a graph. Finally today, I might or might not publish a post on the topic.

I am inclined to ungratefully assert that Summers’s claim is tautological, false, or both (it’s hard to be both but “or” makes the claim true).

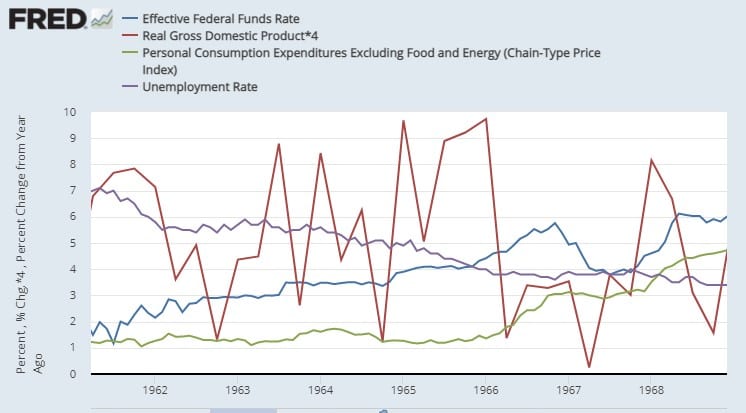

Going back to my childhood, In 1966, the Federal Reserve open market committee (FOMC) was clearly concerned about over-heating — there were two wars — one in Vietnam and one on poverty — the unemployment rate fell to below 4% which was considered dangerously low (also before Milton Friedman coined the phrase “natural rate of unemployment” which was not at all a new concept to people like Samuelson and Solow . Quarterly real GDP growth reached and annualized (I mean multiplied by 4) rate of The FOMC cranked the Federal Funds rate up to the then shocking level over 9.73%. The FOMC cranked the Federal Funds rate up to 5.76% (it was 2% in 1961). I’m not saying that they were following the Federal Funds rate (I have not and probably will never read their minutes and do not know on which interest rate they were focused).

The result was a very meaningful reduction of annualized quarterly GDP growth from over 9.21% in 1965Q4 and 9.73% in 1966Q1 to under 1.37% in 1966q2 and under 0.25% in 1967Q2. I call that slowing growth “meaningfully”. However, the NBER business cycle timing committee did not call that a recession.

1966 was a long time ago, but 1981 wasn’t yesterday. I think that was the last time that the FOMC decided to hit the breaks. I classify the last 4 recessions and 3 bubbles bursting, two financial crises, and a Covid Epidemic. None was preceded by accelerating inflation (the alarming acceleration from 1 to 3% was long long ago).

So what was Summers thinking ? I am tempted to insinuate that he defines a meaningful decrease in GDP growth as a reduction to less than 0 which lasts at least 2 quarters — in other words, a recession. So the claim becomes “whenever the Fed triggers a recession, the Fed triggers a recession” which tautological, but he is much much too smart to do that. I think one argument is that the FOMC didn’t manage the task, because core inflation reached the alarming level of almost 5% and then there was a recession in 1970. However, I don’t think that 4 years later is “whenever” by business cycle standards. Also the recession caused unemployment to reach 6.1% and unemployment is now 6.1%. I don’t think that the risk that unemployment might reach 6.1% at some time in the indefinite future is critical right now.

I ask what would happen if the Fed learned how to prevent over-heating without causing a recession ? I answer that one might have 4 decades without overheating, which does not imply 4 decades without a recession.

More after the jump.

One thing is that I recall DeLong and Summers arguing that a 2% inflation target is too low. A higher target tends to imply not worrying about inflation now.

Summers also wrote

Inflationary pressures are mounting from the boost in demand created by the $2 trillion-plus in savings that Americans have accumulated during the pandemic; from large-scale Federal Reserve debt purchases, along with Fed forecasts of essentially zero interest rates into 2024; from roughly $3 trillion in fiscal stimulus passed by Congress; and from soaring stock and real estate prices.

In order, the effect of wealth on consumption is much smaller than the effect of income on consumption. The Fed’s forecast of essentially zero interest rates is a forecast that there will not be over-heating. I know that Summers trusts his forecasts more than those of others, but here he seems to consider Fed forecasts to be of substantial negative value.

But finally, what about those stock and real estate prices ? I personally find them much more alarming that inflation (meaning inflation up to 10% per year which I consider no big deal). 3 of the last 4 recessions were preceded by asset price bubbles — Commercial real estate (and in particular empty office buildings), tech stocks, then houses. 0 of the last 4 recessions were preceded by accelerating inflation. Why worry about consumer prices (or GDP deflators) when the stock and housing markets are going crazy ?