May manufacturing continues white hot; April construction spending shows signs of being constrained by materials and costs It’s the first of the month, which means we get our first look at May data in the form of the ISM manufacturing index, as well as April construction spending. The questions we are looking for information to answer from these two leading sectors of the economy, manufacturing and residential construction, are: (1) is the Boom still ongoing, and is it likely to continue in the coming few months; and (2) is there evidence that inflation is creating a bottleneck on growth? The answers for the two sectors appear to be different. First, the May ISM manufacturing index increased slightly from 60.7 to 61.2. The new orders

Topics:

NewDealdemocrat considers the following as important: manufacturing and construction, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

May manufacturing continues white hot; April construction spending shows signs of being constrained by materials and costs

It’s the first of the month, which means we get our first look at May data in the form of the ISM manufacturing index, as well as April construction spending. The questions we are looking for information to answer from these two leading sectors of the economy, manufacturing and residential construction, are: (1) is the Boom still ongoing, and is it likely to continue in the coming few months; and (2) is there evidence that inflation is creating a bottleneck on growth?

The answers for the two sectors appear to be different.

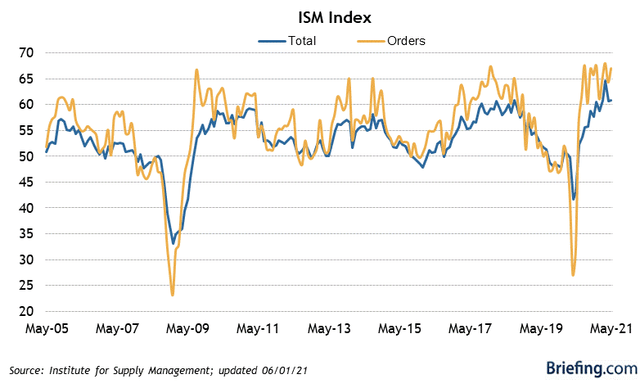

First, the May ISM manufacturing index increased slightly from 60.7 to 61.2. The new orders component of the index, which is the most leading, increased even more, up 2.7 from 64.3 to 67.0, very close to its December and March highs:

Figure 1

Figure 1

The boom in manufacturing is continuing, with no evidence of a slowdown in the near future.

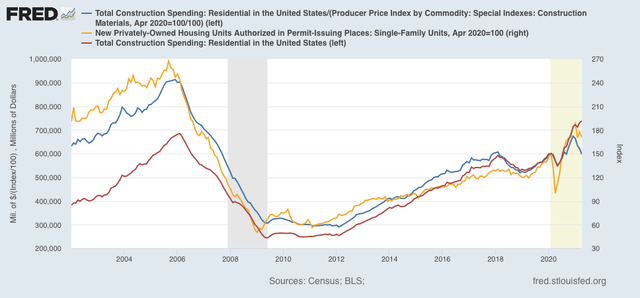

Residential construction spending is not quite as leading as new home sales or permits, but it has the virtue of having very little noise and almost all signal. But there is a quandary, because for the first time in 20 years, the direction of this indicator differs sharply depending on whether or not one factors in the prices of construction materials.

The below graph shows residential construction spending unadjusted for inflation (red), which made another all-time high in April; compared with the same but adjusted for the cost of building materials (blue), which has turned down by 11.5% since December (red); and single family permits (gold), which have turned down by 9.5% since January:

This looks like a bottleneck putting the brakes on growth. Spending is growing, but only because the price of materials has gone up sharply. That the downturn in construction permits and spending adjusted for the cost of materials occurred nearly simultaneously and by similar percentages looks like it is the cost of materials which is decisive – I.e., costs – due to shortages in materials – are driving the numbers.