Big (weather related) declines in February production and sales This morning (Tuesday) we got the most important single metrics for both the consumer and producer side of the economy for February, respectively, retail sales and industrial production. Both were big misses, one explicitly and the other likely due to the big freeze in Texas and neighboring States.Let’s turn to production first. Total industrial production declined by -2.2% in February, while manufacturing production declined -3.1%. Both of these were the first declines of any significance since last April: Before the DOOOMERS go screaming, “Double-dip!” however, here is what the Fed itself had to say about this report: The severe winter weather in the south-central

Topics:

NewDealdemocrat considers the following as important: production and sales, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Big (weather related) declines in February production and sales

This morning (Tuesday) we got the most important single metrics for both the consumer and producer side of the economy for February, respectively, retail sales and industrial production. Both were big misses, one explicitly and the other likely due to the big freeze in Texas and neighboring States.

Let’s turn to production first.

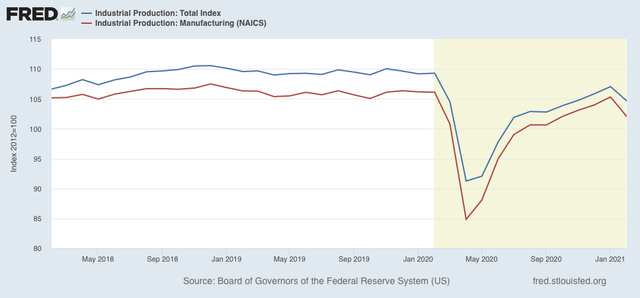

Total industrial production declined by -2.2% in February, while manufacturing production declined -3.1%. Both of these were the first declines of any significance since last April:

Before the DOOOMERS go screaming, “Double-dip!” however, here is what the Fed itself had to say about this report:

The severe winter weather in the south-central region of the country in mid-February accounted for the bulk of the declines in output for the month. Most notably, some petroleum refineries, petrochemical facilities, and plastic resin plants suffered damage from the deep freeze and were offline for the rest of the month. Excluding the effects of the winter weather would have resulted in an index for manufacturing that fell about 1/2 percent and in an index for mining that rose about 1/2 percent.

Because manufacturing is the biggest component of the report, even without the Big Texas Freeze the total index probably would have declined, but by something less than -0.5%. Since in January the total index rose a revised 1.1%, the combined January-February number would still be positive, and the highest since the onset of the pandemic last March.

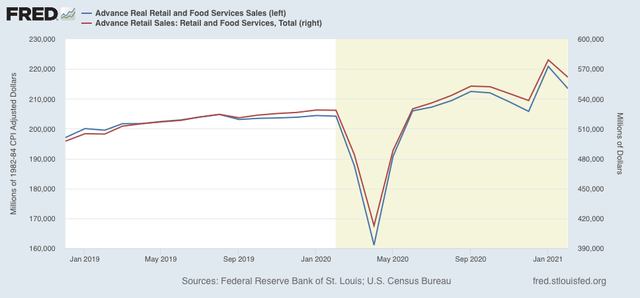

A similar dynamic was present in the retail sales report, although the Census Bureau explicitly does not take weather into account. Nominal retail sales declined -3.0%. After adjusting by the CPI, real retail sales declined -3.4%.

Here’s what the last 2.5 years including February look like:

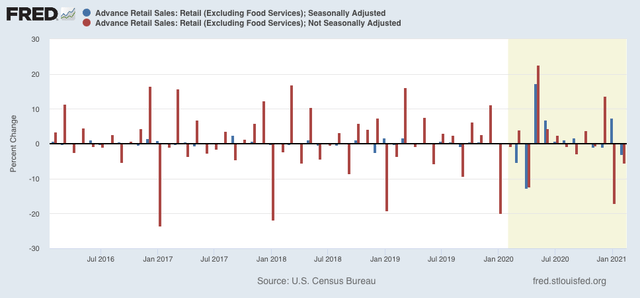

Of course, winter occurs every year, but if and when a particularly bad stretch happens might be in December one year, January another, and February still another. So the below graph shows the unadjusted as well as the seasonally adjusted percentage change each month for the same time period. Note that January and February each year, combined, show the steepest month over month decline:

If you look at the unadjusted numbers, it’s pretty clear that January this year had the least decline of the last 5 years, while February’s was the worst. So the below lists the combined January + February declines for the previous 5 years and compares them with this year:

2016: -21.8%

2017: -24.3%

2018: -23.6%

2019: -22.1%

2020: -20.6%

2021: -21.6%

Of the 5 previous years, only 2020 was better than this year. On a seasonally adjusted basis, the combined January-February period this year still showed a gain of 3.7% from December, which would be the highest total since the pandemic started.

In conclusion, don’t sweat these two declines. Ex-the Big Texas Freeze, both production and sales probably did decline, but only slightly, and real retail sales for the two-month period combined absolutely rose.