RJS: MarketWatch 666 ~~~~~~~~ Summary: April Trade Deficit Decreased by a record 19.1%, Led by Lower Imports of Consumer Goods and Industrial Supplies and Materials ~~~~~~~~ Our trade deficit was 19.1% lower in April, as our exports increased while our imports decreased. The Commerce Dept report on our international trade in goods and services for April, incorporating an annual revision, indicated that our seasonally adjusted goods and services trade deficit fell by a record .6 billion to .1 billion in April. From a March deficit that was revised from the originally reported 9.8 billion to 7.7 billion. A revision which should result in an upward revision of about 0.14 percentage points to 1st quarter GDP when the third

Topics:

Angry Bear considers the following as important: immigration, MarketWatch 666, RJS, US trade deficit, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

RJS: MarketWatch 666

~~~~~~~~

Summary: April Trade Deficit Decreased by a record 19.1%, Led by Lower Imports of Consumer Goods and Industrial Supplies and Materials

~~~~~~~~

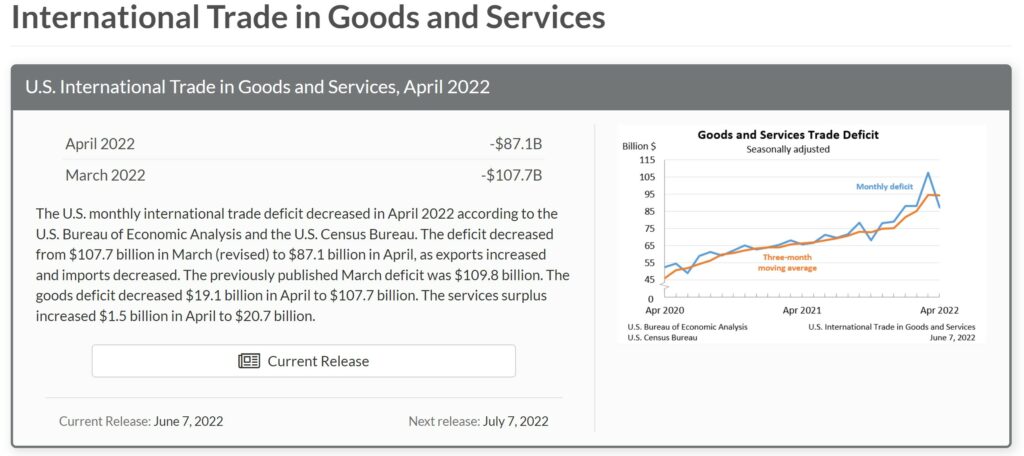

Our trade deficit was 19.1% lower in April, as our exports increased while our imports decreased. The Commerce Dept report on our international trade in goods and services for April, incorporating an annual revision, indicated that our seasonally adjusted goods and services trade deficit fell by a record $20.6 billion to $87.1 billion in April. From a March deficit that was revised from the originally reported $109.8 billion to $107.7 billion. A revision which should result in an upward revision of about 0.14 percentage points to 1st quarter GDP when the third estimate is released at the end of June. However, this month’s report also reflects revised statistics on trade in goods on both a Census basis and a balance of payments (BOP) basis going back to 2017, and revised statistics on trade in services beginning with 2015, the 4th quarter basis for the 1st quarter’s growth in trade will also need to be revised to determine the ultimate impact on 1st quarter GDP. The BEA will not make that revision until the annual revision to GDP is released at the end of July…

In rounded figures, the value of our April exports rose by $8.5 billion, or 3.5%, to $252.6 billion. This comes on a $6.1 billion increase to $176.1 billion in our exports of goods and a $2.4 billion increase to $76.5 billion in our exports of services. Our imports fell by $12.1 billion, or 3.4% to $339.7 billion on a $13.0 billion decrease to $283.8 billion in our imports of goods, which was partly offset a $0.9 billion increase to $55.9 billion in our imports of services. Export prices averaged 0.6% higher in April, which means the relative real increase in exports for the month was less than the nominal increase by that percentage, while import prices were unchanged, which suggests the decrease in real imports was close to the nominal dollar decrease for the month….

The increase in our April exports of goods came about largely as a result of higher exports of industrial supplies and materials, soybeans, and capital goods. Referencing the Full Release and Tables for April (pdf), in Exhibit 7 we find that our exports of industrial supplies and materials rose by $2,302 million to $69,585 million on a $885 million increase in our exports of natural gas, a $667 million increase in our exports of petroleum products other than fuel oil, a $360 million increase in our exports of coal and other fuels, a $352 million increase in our exports of fuel oil, and a $351 million increase in our exports of metallurgical grade coal. These were partly offset by a $369 million decrease in our exports of natural gas liquids and a $701 million decrease in our exports of precious metals other than gold, while our exports of foods, feeds and beverages rose by $2,185 million to $17,513 million on a $2,111 million increase in our exports of soybeans…in addition, our exports of capital goods rose by $1,238 million to $47,481 million on a $1,273 million increase in our exports of civilian aircraft, our exports of consumer goods rose by $401 million to $20,715 million on a $574 million increase in our exports of artwork and other collectibles, a $405 million increase in our exports of jewelry and a $309 million increase in our exports of gem diamonds, which were partly offset by a $869 million decrease in our exports of pharmaceutical preparations, and that our exports of automotive vehicles, parts, and engines rose by $92 million to $13,024 million…slightly offsetting the increases in those export categories, our exports of other goods not categorized by end use fell by $221 million to $6,266 million….

Exhibit 8 in the Full Release and Tables gives us seasonally adjusted details on our imports of goods and indicates that lower imports of consumer goods, industrial supplies and materials, and capital goods were largely responsible for the April decrease in our imports. While those decreases were partly offset by an increase in our imports of automotive goods…our imports of consumer goods fell by $6,331 million to $76,393 million on a a $1,344 million decrease in our imports of apparel and textiles other than those of wool or cotton, a $1,102 million decrease in our imports of toys, games, and sporting goods, a $958 million decrease in our imports of pharmaceutical preparations, a $625 million decrease in our imports of furniture and related household goods, a $595 million decrease in our imports of household appliances, a $473 million decrease in our imports of footwear, and a $323 million decrease in our imports of cookware, cutlery, and kitchen tools, while our imports of industrial supplies and materials fell by $5,337 million to $70,690 million on a $5,609 million decrease in our imports of finished metal shapes, a $712 million decrease in our imports of nonmonetary gold, and a $669 million decrease in our imports of inorganic chemicals not itemized separately, which were partly offset by a $788 million increase in our imports of crude oil, a $732 million increase in our imports of organic chemicals, and a $402 million increase in our imports of natural gas….at the same time, our imports of capital goods fell by $2,581 million to $71,682 million on a $1,932 million decrease in our imports of computers, a $573 million decrease in our imports of computer accessories, and a $544 million decrease in our imports of drilling & oilfield equipment, partly offset by a $321 million increase in our imports of semiconductors, and our imports of other goods not categorized by end use fell by $539 million to $10,508 million….partly offsetting the decreases in those end use categories, our imports of automotive vehicles, parts and engines rose by $1,375 million to $33,727 million on a $1,174 million increase in our imports of trucks, buses, and special purpose vehicles, and our imports of foods, feeds, and beverages rose by $473 million to $14,546 million on increased imports in several food categories…

The Full Release and Tables pdf for this report also gives us surplus and deficit details on our goods trade with selected countries:

The April figures show surpluses, in billions of dollars with: South and Central America ($7.7), Netherlands ($3.0), Brazil ($2.4), Hong Kong ($2.2), Australia ($1.4), United Kingdom ($1.0), Belgium ($0.6), and Singapore ($0.6). Deficits were recorded, in billions of dollars, with China ($34.9), European Union ($17.0), Mexico ($11.5), Vietnam ($11.1), Canada ($8.7), Ireland ($6.0), Japan ($5.6), Germany ($5.2), South Korea ($3.9), Taiwan ($3.9), India ($3.8), Italy ($3.3), Malaysia ($3.1), Switzerland ($2.9), France ($1.7), Saudi Arabia ($0.9), and Israel ($0.6).

- The deficit with China decreased $8.5 billion to $34.9 billion in April. Exports decreased $1.6 billion to $12.0 billion and imports decreased $10.1 billion to $46.9 billion.

- The deficit with Switzerland decreased $4.7 billion to $2.9 billion in April. Exports increased $0.7 billion to $2.2 billion and imports decreased $4.1 billion to $5.1 billion.

- The deficit with Mexico increased $1.7 billion to $11.5 billion in April. Exports increased $0.3 billion to $27.8 billion and imports increased $2.0 billion to $39.3 billion.

To gauge the impact of April’s trade on 2nd quarter growth, we use exhibit 10 in the pdf for this report, which gives us monthly goods trade figures by end use category and in total, already adjusted for inflation in chained 2012 dollars, the same inflation adjustment that’s used by the BEA to compute trade figures for GDP, with the only difference being that they are not annualized in the table here…from that table, we can figure that 1st quarter real exports of goods averaged 148,629.7 million monthly in 2012 dollars, while April’s inflation adjusted exports were at 155,006 million in that same 2012 dollar quantity index representation… figuring the annualized change between those two figures, we find that April’s real exports of goods were rising at a 18.30% annual rate from those of the 1st quarter, or at a pace that would add about 1.28 percentage points to 2nd quarter GDP if it were continued through May and June…..from that same table, we can figure that our 1st quarter real imports averaged 270,993.7 million monthly in chained 2012 dollars, while inflation adjusted April imports were at 271,207 million in that same 2012 dollar representation…that would indicate that so far in the 2nd quarter, our real imports have increased at a 0.32% annual rate from those of the 1st quarter…since imports are subtracted from GDP because they represent the portion of consumption or investment that occurred during the quarter that was not produced domestically, their increase at a 0.32% rate would subtract about 0.03 percentage points from 2nd quarter GDP….hence, if the April trade deficit is maintained at the same level throughout the 2nd quarter, our improving balance of trade in goods would add about 1.25 percentage points to the growth of 2nd quarter GDP….however, note that we have not estimated the impact of the change in services here, largely because the Census does not provide handy inflation adjusted data on those, but that with our nominal exports of services up by $2.4 billion while our nominal imports of services were up by $0.9 billion in April, we can figure that the change in our balance of trade in services would also likely have a positive impact on 2nd quarter GDP…