RJS: MarketWatch 666 Summary: 1st quarter GDP revision; April’s personal income and outlays, durable goods, and new home sales 1st Quarter GDP Revised to Show Our Economy Shrunk at a 1.5% Rate The Second Estimate of our 1st Quarter GDP from the Bureau of Economic Analysis indicated that our real output of goods and services shrunk at a 1.5% annual rate in the 1st quarter, revised from the 1.4% contraction rate reported in the advance estimate last month, as growth of inventories and of fixed investment were revised lower, more than offsetting an upward revision to the quarter’s growth of personal consumption expenditures . . . in current dollars, our first quarter GDP grew at a 6.51% annual rate, increasing from what would work out to be a

Topics:

Angry Bear considers the following as important: Hot Topics, MarketWatch 666, RJS, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

RJS: MarketWatch 666

Summary: 1st quarter GDP revision; April’s personal income and outlays, durable goods, and new home sales

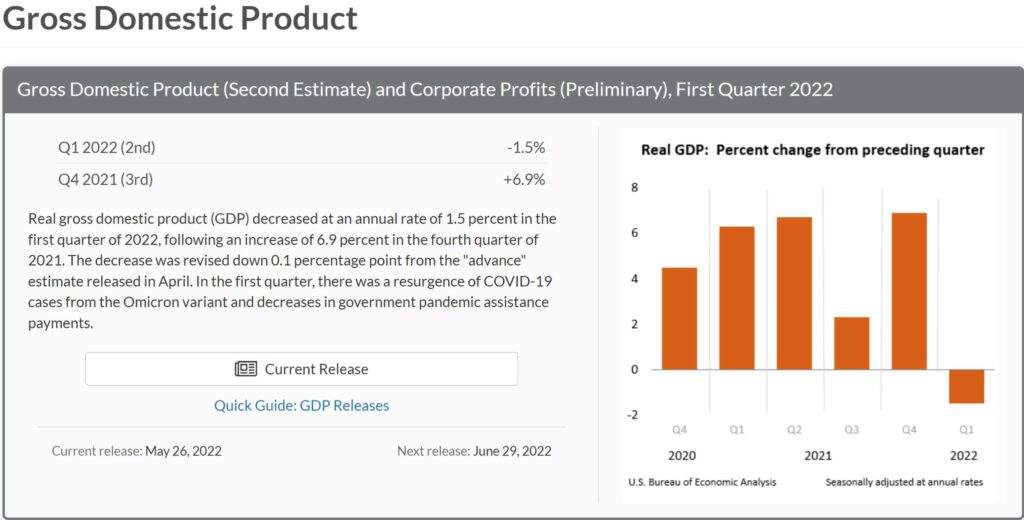

1st Quarter GDP Revised to Show Our Economy Shrunk at a 1.5% Rate

The Second Estimate of our 1st Quarter GDP from the Bureau of Economic Analysis indicated that our real output of goods and services shrunk at a 1.5% annual rate in the 1st quarter, revised from the 1.4% contraction rate reported in the advance estimate last month, as growth of inventories and of fixed investment were revised lower, more than offsetting an upward revision to the quarter’s growth of personal consumption expenditures . . . in current dollars, our first quarter GDP grew at a 6.51% annual rate, increasing from what would work out to be a $24,002.8 billion a year output rate in the 4th quarter of last year to a $24,384.3 billion annual rate in the 1st quarter of this year, with the headline 1.5% annualized rate of decrease in real output arrived at after an annualized inflation adjustment averaging inflation adjustment averaging 8.1%, aka the GDP deflator, was computed from the price changes of the GDP components and applied to their current dollar change . . . since that inflation adjustment was revised from the 8.0% adjustment indicated in the advance estimate, it thus accounts for the revision to GDP by itself…

As we review this month’s revisions, remember this release reports all quarter over quarter percentage changes at an annual rate, which means that they’re expressed as a change a bit over 4 times of that what actually occurred from one 3 month period to the next, and that the prefix “real” is used to indicate that each change has been adjusted for inflation using price changes chained from 2012, and then that all percentage changes in this report are calculated from those 2012 dollar figures, which would be better thought of as a quantity indexes than as any reality based dollar amounts…for our purposes, all the data that we’ll use in reporting the changes here comes directly from the Full Release & Tables for the second estimate of 1st quarter GDP, which is linked to on the BEA’s main GDP page…specifically, we’ll be citing data from table 1, which shows the real percentage change in each of the GDP components annually and quarterly since the 2nd quarter of 2018; table 2, which shows the contribution of each of the components to the GDP figures for those months and years; table 3, which shows both the current dollar value and the inflation adjusted value in 2012 dollars of each of those components; and table 4, which shows the change in the price indexes for each of the GDP components . . . the full pdf for the 1st quarter advance estimate, which this estimate revises, is here….

Growth of real personal consumption expenditures (PCE), the largest component of GDP, was revised from the 2.7% growth rate reported last month to indicate real PCE growth a 3.1% rate with this estimate . . . that growth figure was arrived at by deflating the 10.3% growth rate in the dollar amount of consumer spending with the PCE price index, which indicated consumer inflation grew at a 7.0% annual rate in the 1st quarter, which was unrevised from the PCE inflation rate published a month ago . . . real consumption of durable goods grew at a 6.8% annual rate, which was revised from the 4.1% growth rate shown in the advance report, and added 0.57 percentage points to GDP, as growth in real consumption of motor vehicles and parts at a 16.5% rate accounted for more than 60% of the quarter’s growth in durable goods . . . on the other hand, real consumption of nondurable goods by individuals shrunk at a 3.7% annual rate, revised from the 2.5% decrease rate reported in the 1st estimate, and subtracted 0.57 percentage points from 1st quarter economic growth, as lower real consumption of gasoline and other energy goods accounted for more than half of the quarter’s nondurable goods pullback. Meanwhile, consumption of services rose at a 4.8% annual rate, revised from the 4.3% growth rate reported last month, and added 2.09 percentage points to the final GDP tally, as growth of the output of nonprofit institutions serving households accounted for more than 20% of the quarter’s growth in services….

At the same time, seasonally adjusted real gross private domestic investment grew at a 0.5% annual rate in the 1st quarter, revised from the 2.2% growth rate estimate reported last month, as real private fixed investment grew at a 6.8% rate, rather than at the 7.3% rate reported in the advance estimate, while inventory growth was also somewhat less than had been previously estimated . . . real investment in non-residential structures was revised from shrinking at a 0.9% rate to shrinking at a 3.6% rate, while real investment in equipment was revised to show it grew at a 13.2% rate, revised from the 15.3% growth rate previously reported…at the same time, the quarter’s investment in intellectual property products was revised from real growth at a 8.1% rate to real growth at a 11.6% rate, while growth in real residential investment was revised from a 2.1% annual rate down to growth at a 0.4% rate . . . after those revisions, the contraction in investment in non-residential structures subtracted 0.09 percentage points from the increase in 1st quarter GDP, while the increase in investment in equipment added 0.68 percentage points to the quarter’s growth, the increase in investment in intellectual property added 0.57 percentage points, and the increase in residential investment added 0.02 percentage points to the 1st quarter’s growth rate..

Meanwhile, the quarter’s growth of real private inventories was revised from the originally reported $158.7 billion in inflation adjusted dollars to show inventories grew at an inflation adjusted $149.6 billion rate…this came after inventories had grown at an inflation adjusted $193.2 billion in the 4th quarter, and hence the $43.6 billion negative change in real inventories from those of the 4th quarter subtracted 1.09 percentage points from the 1st quarter’s growth rate, revised from the 0.84 percentage point subtraction due to lower inventory growth shown in the advance estimate….however, since growth in inventories indicates that more of the goods produced during the quarter would have been left in storage or “sitting on the shelf”, the $43.65 billion reduction in their growth conversely means real final sales of GDP were actually greater by that amount, and therefore the BEA found that real final sales of GDP only fell at a 0.4% rate in the 1st quarter, revised from the 0.6% rate of decrease in real final sales shown in the advance estimate…

The previously reported decrease in real exports was revised lower with this estimate, but the previously reported increase in real imports was revised higher by more, and as a result our net trade was a bit larger subtraction from GDP than was previously reported . . . our real exports of goods and services shrunk at a 5.4% rate in the 1st quarter, revised from the 5.9% contraction shown in first estimate, and since exports are an addition to GDP because they are that part of our production that was not consumed or added to investment in our country, their decrease conversely subtracted 0.62 percentage points from the 1st quarter’s growth rate, less than the 0.68 percentage point export subtraction due to lower exports shown last month…on the other hand, the previously reported 17.7% increase in our real imports was revised to a 18.3% increase, and since imports subtract from GDP because they represent either consumption or investment that is added to GDP with those figures but was not produced in the US, their increase subtracted 2.61 percentage points from 1st quarter GDP, revised from the 2.53 percentage point subtraction shown a month ago . . . thus, the deteriorating trade balance that has accompanied the increase in consumer spending subtracted a rounded 3.23 percentage points from 1st quarter GDP, up from the 3.20 percentage point subtraction resulting from a worsening foreign trade balance that was indicated by the advance estimate..

Finally, there was also a tiny net upward revision to real government consumption and investment in this 2nd estimate, as the entire government sector is still shown to be shrinking at a 2.7% rate, the same contraction rate for government indicated by the 1st estimate. Real federal government consumption and investment was seen to have shrunk at a 6.1% rate from that of the 4th quarter in this estimate, which was revised from the 5.9% contraction rate shown in the 1st estimate, as real federal outlays for defense shrunk at a 8.5% rate, same as was previously reported, and subtracted 0.33 percentage points from 1st quarter GDP, while real non-defense federal consumption and investment shrunk at a 2.6% rate, revised from the 2.2 rate previously reported, and subtracted 0.07 percentage points from GDP….meanwhile, real state and local consumption and investment shrunk at a 0.6% rate in the quarter, revised from the 0.8% contraction shown in the 1st estimate, and subtracted 0.07 percentage points from 1st quarter GDP, which was revised from the 0.08 percentage points subtraction shown in the advance estimate . . . note that government outlays for social insurance are not included in this GDP component; rather, they are included within personal consumption expenditures only when such funds are spent on goods or services, thereby indicating an increase in the output of those goods or services…