Consumer inflation lessens in December; real wages increase, but a consumer slowdown remains likely Consumer prices increased 0.5% in December, a deceleration from the past several months. But this is still well above the typical monthly increase in prices pre-pandemic: On a YoY basis, at 7.1% consumer inflation is the highest since the big Reagan recession of 1981-82. My favorite measure, CPI ex energy, is also up 5.6% YoY, and tied for the worst since the 1981-82 recession as well: Inflation in new and used vehicle prices has risen again to over 20% YoY; and gas prices YoY are still up at levels that in the past have been associated with economic slowdowns or recessions: As I have been forecasting for months, house price increases

Topics:

NewDealdemocrat considers the following as important: consumer inflation, Real Wages, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Consumer inflation lessens in December; real wages increase, but a consumer slowdown remains likely

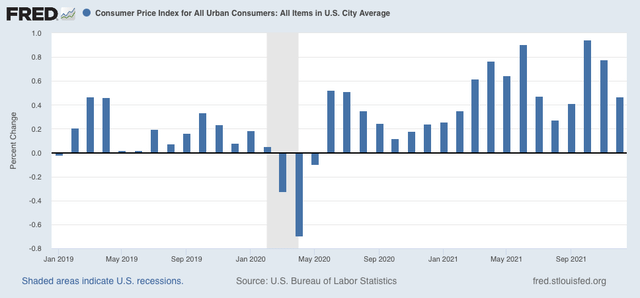

Consumer prices increased 0.5% in December, a deceleration from the past several months. But this is still well above the typical monthly increase in prices pre-pandemic:

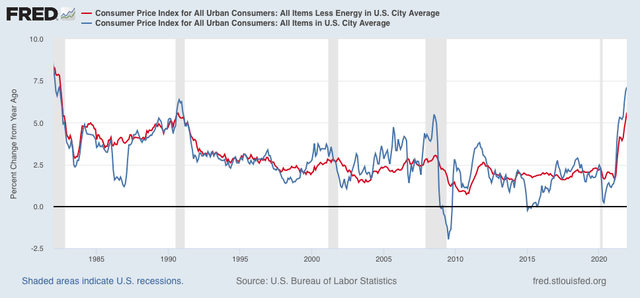

On a YoY basis, at 7.1% consumer inflation is the highest since the big Reagan recession of 1981-82. My favorite measure, CPI ex energy, is also up 5.6% YoY, and tied for the worst since the 1981-82 recession as well:

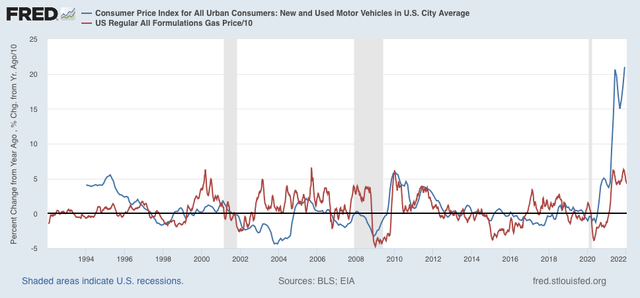

Inflation in new and used vehicle prices has risen again to over 20% YoY; and gas prices YoY are still up at levels that in the past have been associated with economic slowdowns or recessions:

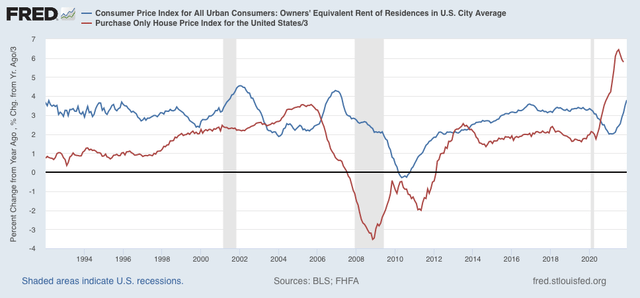

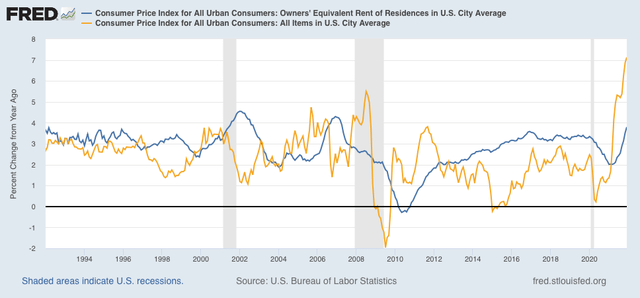

As I have been forecasting for months, house price increases have fed through into rents and “owners equivalent rent,” which has continued to increase:

Interestingly, in both prior cases where owners equivalent rent surged after house prices did – 2001 and 2006 – the surge in overall consumer prices (gold in the graph below) quickly ended and went into reverse:

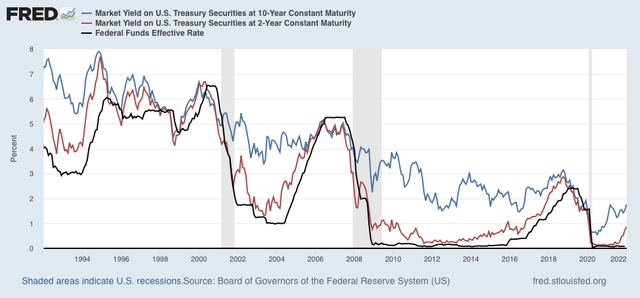

In both cases, however, the Fed had aggressively raised interest rates in the meantime, helping to cause a slowdown (2006) or recession (2001), which in turn led to lower inflation.

The bond market fully expects the Fed to do the same thing this year. Below I show the yield on the 10 year Treasury (blue), 2 year Treasury (red), and Fed funds rate (black):

Note that in recent decades bond market investors have almost always anticipated the Fed’s move, bidding up yields on the 2 year bond in advance of Fed interest rate hikes. There have been some false positives (1996, 2002, 2011) but more often the bond market has been right.

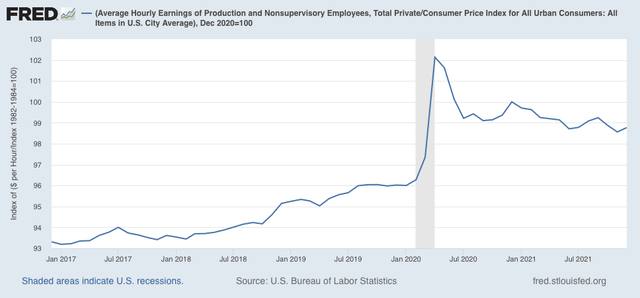

Now let’s talk about “real” wages. To cut to the chase, this month the news was positive.

Average real hourly wages increased in December by 0.2%, although they are still -1.2% below their interim peak last December:

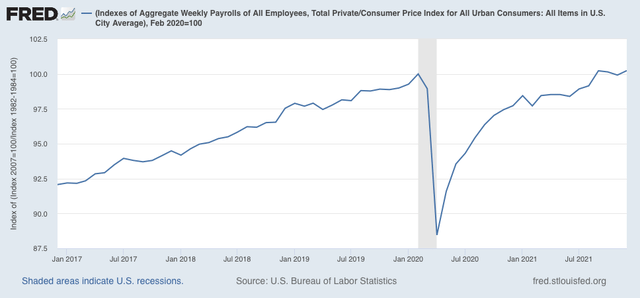

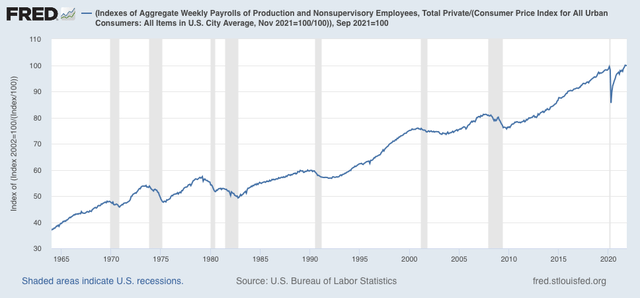

Additionally, real aggregate payrolls, an overall measure of consumer health, also increased 0.3% in December, and returned to equal their peak from September:

For the past 50+ years, when aggregate real wages have retreated from peak for 3 to 9 months, a recession has typically followed:

To sum up, while real wage growth has slowed down or halted, depending on which measure we use, they have not gone into reverse. This is consistent with taking a near term recession off the table for now. On the other hand, as I wrote last month, “we certainly are at a point where a sharp deceleration beginning with the consumer sector of the economy is more likely than not.” While perhaps I would modify that by dropping the descriptor “sharp,” a deceleration in the consumer sector remains supported by December’s inflation report.