First data releases of 2022 confirm manufacturing strength, construction slowdown The first December data, the forward-looking ISM manufacturing report, has been released. Yesterday construction spending for November was also released. Let’s take a look at both. The ISM index, especially its new orders subindex, is an important short leading indicator for the production sector. In December the index declined from 61.1 to 58.7, as did the more leading new orders subindex, which declined from 61.5 to 60.4 (note the breakeven point between expansion and contraction is 50): Both the total index and the new orders subindex ran extremely hot throughout 2021, and the moderate decrease in December remains consistent with a “hot” manufacturing

Topics:

NewDealdemocrat considers the following as important: manufacturing and construction, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

First data releases of 2022 confirm manufacturing strength, construction slowdown

The first December data, the forward-looking ISM manufacturing report, has been released. Yesterday construction spending for November was also released. Let’s take a look at both.

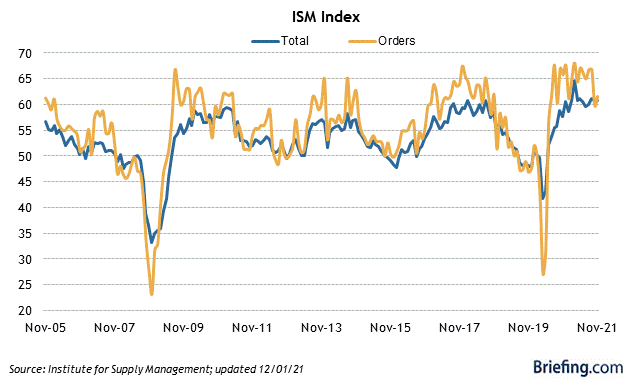

The ISM index, especially its new orders subindex, is an important short leading indicator for the production sector. In December the index declined from 61.1 to 58.7, as did the more leading new orders subindex, which declined from 61.5 to 60.4 (note the breakeven point between expansion and contraction is 50):

Both the total index and the new orders subindex ran extremely hot throughout 2021, and the moderate decrease in December remains consistent with a “hot” manufacturing sector. This continues to forecast a strong production side of the economy through mid-year 2022.

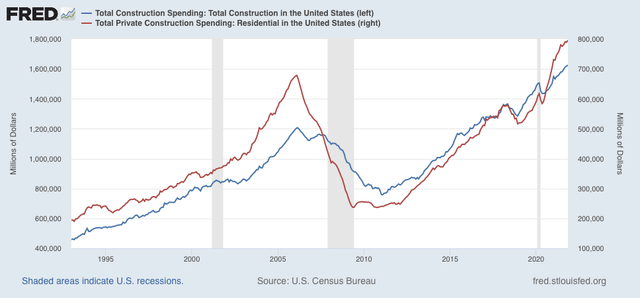

Turning to construction, during November in nominal terms overall spending including all types of construction rose 0.4%, from an upwardly revised 0.4% for October, while spending on the leading residential sector rose 0.9%. Both made new all-time highs:

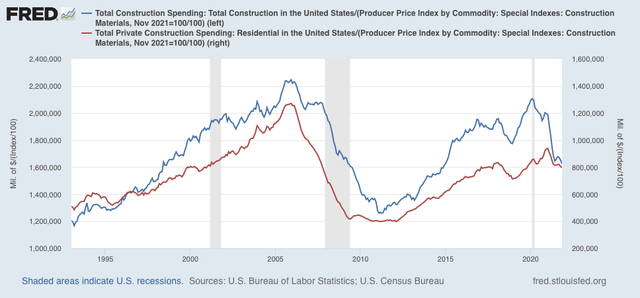

Adjusting for price changes in construction materials, which jumped 2.1% in November, “real” construction spending declined -1.6% m/m, and “real” residential construction spending declined -1.1%. In absolute terms, “real” construction spending has declined sharply – by -18.8%) – since its peak in November 2020, while “real” residential construction spending has declined -15.1% since its post-recession peak in January of this year

:

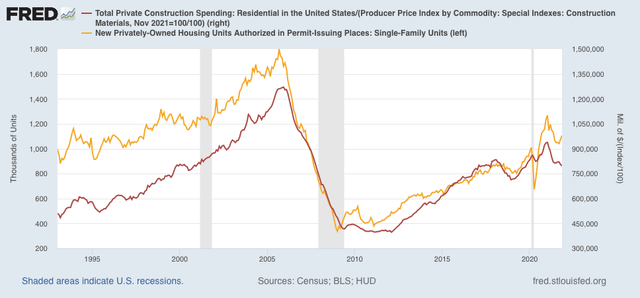

While total construction spending declined by more than it had before the Great Recession, the decline in residential construction spending, while increasingly substantial, remains nowhere near the big decline it suffered before the end of 2007, in this series that only dates from 1993. Comparing it with single-family permits (gold), below:

confirms the slowdown since one year ago, but not a recession level decline.