[unable to retrieve full-text content] – by New Deal democrat As usual, the month’s data begins with the ISM manufacturing index, and with a one month delay, construction spending. Because manufacturing is of diminishing importance to the economy, and was in deep contraction both in 2015-16 and again in 2022 without any recession occurring, I now use an economically weighted three […] The post ISM manufacturing remains weak, while construction spending continues...

Read More »Are manufacturing and construction in a synchronous downturn? If so, that’s Trouble

– by New Deal democrat I wanted to follow up on a point I made yesterday: although manufacturing is no longer a big enough slice of the US economy to bring about an economic downturn on its own – unless for some reason the manufacturing downturn were unusually severe – when it is paired with a downturn in construction, that historically has been a reliable (but of course not perfect!) harbinger of recession. And while yesterday’s construction...

Read More »Manufacturing and construction together suggest weak but still expanding leading sectors

– by New Deal democrat As usual we start the month with two important reports on the leading sectors of manufacturing and construction. First, the ISM manufacturing index showed contraction yet again, with the headline number “less negative” by way of increasing from 46.8 to 47.2, and the more leading new orders subindex declining sharply by -2.8 from 47.4 to 44.6: Including August, here are the last sis months of both the headline...

Read More »Manufacturing treads water in April, while real construction spending turned down in March (UPDATE: and heavy truck sales weren’t so great either)

by New Deal democrat The Bonddad Blog A preliminary programming note: In addition to the manufacturing and construction reports, today we also get the JOLTS report for March, and updated motor vehicle sales reports. Yesterday we also got the Employment Cost Index for Q1. I will comment on the JOLTS report later today. I’ll comment on the ECI along with jobless claims tomorrow. Additionally, Wolf Richter made an interesting point yesterday...

Read More »Monthly data starts out with slightly positive news in manufacturing, slightly negative in construction

– by New Deal democrat The Bonddad Blog As usual, the new month’s data starts out with information on manufacturing and construction. To repeat what I have said often recently, these are the two sectors I am paying particular attention to for forecasting purposes this year. The ISM manufacturing index has been a good leading indicator in that sector for 75 years. The difference over time, especially the last 20 years, is that manufacturing...

Read More »Manufacturing and construction show softness to start the month

Manufacturing and construction show softness to start the month – by New Deal democrat As usual, the new month’s data starts out with information on manufacturing and construction. The ISM manufacturing index has been a good leading indicator in that sector for 75 years. The difference over time, especially the last 20 years, is that manufacturing makes up a smaller share of the total US economy. As a result, even though it has almost...

Read More »Vehicle sales, residential, and manufacturing plant construction

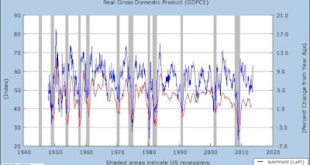

Vehicle sales and residential and manufacturing plant construction continue to outweigh general manufacturing downturn – by New Deal democrat No important economic news today, but on Friday in addition to the employment report we did get our typical 1st of the month snapshot of manufacturing, vehicle sales, and construction, so let’s look at each. The ISM manufacturing index has had an excellent record going all the way back to the 1940s,...

Read More »Manufacturing and construction sectors continue downward pull on economy

Manufacturing and construction sectors continue downward pull on economy – by New Deal democrat As usual, we start the month with new manufacturing and construction data. The ISM manufacturing index goes all the way back to the 1940s, and has been a very good short leading indicator of recession throughout that time (although nothing’s perfect!). However, since the “China shock” started 20 years ago, with so much offshoring of...

Read More »February Mfg. and January Const. Continue Negative, while Auto Sales Improve

February manufacturing and January construction continue negative, while auto sales improve – by New Deal democrat We started out yet another month of data with bad news in two leading sectors. The ISM manufacturing index has been showing contraction since November, and its more leading new orders subindex since September. And did so again in February, with the total index increasing slightly to 47.7, and the new orders index rebounding...

Read More »January manufacturing at recessionary levels; December construction spending declines

January manufacturing at recessionary levels; December construction spending also declines – by New Deal democrat The first data for the month of January is in, and with one exception, it is pretty bad. The ISM manufacturing index declined -1.0 to 47.4. According to the ISM, 48 is the cutoff below which is more consistent with a recession. Even worse, the new orders subindex cratered, falling 2.6 to 42.5: Going back 75 years, the *only*...

Read More » Heterodox

Heterodox