February car sales decline, but truck sales continue rebound; plus a comment about the urgency of dealing with supply chain issues I used to follow vehicle sales more closely – until the vehicle manufacturers, one by one, stopped reporting monthly, and only updated quarterly for the previous quarter. That makes the data much less timely, so much less useful. Fortunately the BEA does keep track of sales, although for some reason FRED is only able to publish the figures with a one month delay. Here is the drill: light vehicle sales generally turn down *after* home sales, but before most other consumer durable goods and other consumer purchases. This makes them a useful short leading indicator, although as you can see below (blue line), they

Topics:

NewDealdemocrat considers the following as important: car and truck sales, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

February car sales decline, but truck sales continue rebound; plus a comment about the urgency of dealing with supply chain issues

I used to follow vehicle sales more closely – until the vehicle manufacturers, one by one, stopped reporting monthly, and only updated quarterly for the previous quarter. That makes the data much less timely, so much less useful.

Fortunately the BEA does keep track of sales, although for some reason FRED is only able to publish the figures with a one month delay.

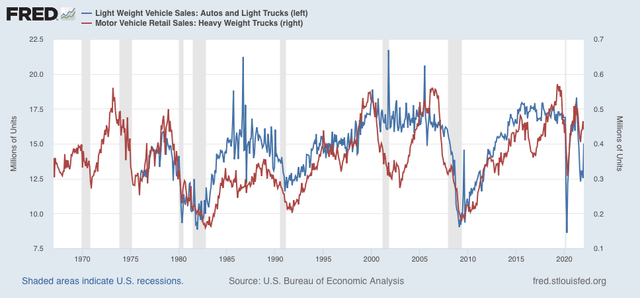

Here is the drill: light vehicle sales generally turn down *after* home sales, but before most other consumer durable goods and other consumer purchases. This makes them a useful short leading indicator, although as you can see below (blue line), they are quite noisy. Heavy truck sales, by contrast (red), turn down earlier, and much more sharply, with much less noise (and the also turn up later after a recession is over):

Heavy truck sales have turned down at least 15%, and usually much more, before a recession has hit.

Now let’s take a look at the last 12 months:

Both car and truck sales peaked early last spring, and bottomed last September. Car sales were down -33%, and truck sales were down -21%. Although not shown, in February according to the BEA, heavy truck sales increased to 0.471 million, only down -8% from their peak. Car and light truck sales decreased again to 14.1 million annualized, down -23% from peak.

Both light and heavy vehicle sales last autumn were consistent with – but did not necessarily mean – an oncoming recession. The rebound in heavy truck sales in the past few months suggests that was a false positive, and is consistent with basically all of the other production and manufacturing data we have received, such as yesterday’s ISM manufacturing report, and durable goods orders.

At the same time, it would behoove the Biden Administration to really lean on, and assist, vehicle manufacturers to solve their supply chain problems. This has gone on for over a year, it has done enough damage to the economy, and Russia’s invasion of Ukraine demonstrates the urgent national security considerations with this type of offshoring.