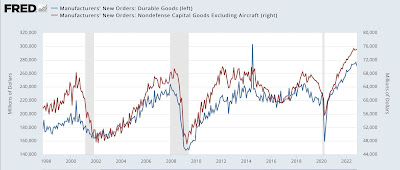

Durable goods orders appear to have peaked [Note: I’ll post about personal income and spending, as well as new home sales, later.] I normally don’t pay much attention to the monthly durable goods report, but this morning’s report for November appears significant. That’s because durable goods spending has been one of the few short leading indicators to have continued to improve – until now. Here’s the long term view: New factory orders for durable goods declined -2.1% in November, while “core” durable goods orders excluding aircraft and defense increased 0.2%. Here’s what the last 12 months look like: Durable goods orders have been essentially flat since June, and are now below that level. “Core” orders last made a high in August. They

Topics:

NewDealdemocrat considers the following as important: durable goods, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Durable goods orders appear to have peaked

[Note: I’ll post about personal income and spending, as well as new home sales, later.]

I normally don’t pay much attention to the monthly durable goods report, but this morning’s report for November appears significant.

That’s because durable goods spending has been one of the few short leading indicators to have continued to improve – until now. Here’s the long term view:

New factory orders for durable goods declined -2.1% in November, while “core” durable goods orders excluding aircraft and defense increased 0.2%. Here’s what the last 12 months look like:

Durable goods orders have been essentially flat since June, and are now below that level. “Core” orders last made a high in August. They appear to be in the process of rolling over.

That leaves consumer durable goods spending and initial jobless claims as the only remaining positive short leading indicators.

June durable goods orders continue rebound, Angry Bear, angry bear blog