As the economy slows, so has producer price growth – by New Deal democrat Consumer prices for September will be released tomorrow. This morning the upstream producer prices were released. Total PPI rose by 0.4%, after two straight months of decline; but excluding those and December 2021, the lowest monthly increase since November 2020. Here are the monthly changes compared with CPI: YoY producer prices increased at the lowest rate in a little over a year: Core PPI increased by 0.2% (blue in the graph below), which was the lowest reading since December 2020, and in line with historical pre-pandemic readings, in contrast to the continued elevation in core CPI (gold): PPI’s primary housing component is residential construction materials.

Topics:

NewDealdemocrat considers the following as important: New Deal Democrat, politics, Producer Price Index, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

As the economy slows, so has producer price growth

– by New Deal democrat

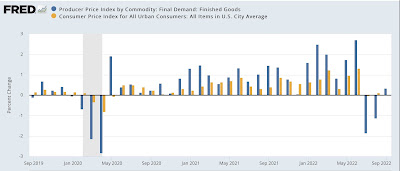

Consumer prices for September will be released tomorrow. This morning the upstream producer prices were released. Total PPI rose by 0.4%, after two straight months of decline; but excluding those and December 2021, the lowest monthly increase since November 2020. Here are the monthly changes compared with CPI:

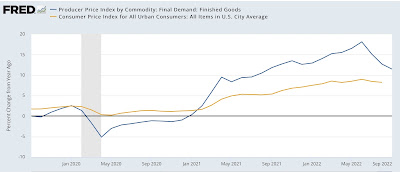

YoY producer prices increased at the lowest rate in a little over a year:

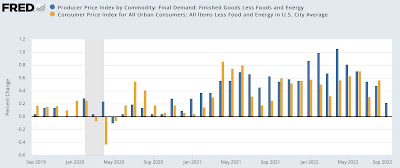

Core PPI increased by 0.2% (blue in the graph below), which was the lowest reading since December 2020, and in line with historical pre-pandemic readings, in contrast to the continued elevation in core CPI (gold):

PPI’s primary housing component is residential construction materials. Here are the absolute values in both flavors of that reading, normed to 100 as of January of this year:

Note that both have declined in the last few months, with construction materials down -2.6% since January, and goods inputs essentially flat since March. Both are still very elevated, up over 33% since the end of 2020. But at least they are o longer rising.

With a slower economy, as expected producer prices are easing. Tomorrow we will find out just how much Owners’ Equivalent Rent is distorting consumer prices to the upside.