House price increases still strong, but clear deceleration from peak The Case Shiller and FHFA house price indexes were reporting this morning, covering the period through December. As you all know well, my mantra is that interest rates lead sales, and sales in turn lead prices. Here’s this month’s update. The monthly increase in the Case Shiller national index (violet) was 0.92%, and the YoY% increase was 18.3%. This is the 4th month of price deceleration from August’s high of 20.0%. Meanwhile, the FHFA purchase-only Index (red) increased 1.2% for the month, and was up 17.6% YoY, a decline from 19.3% in July: The below graph compares the FHFA index (red, *2 for scale) with several measures of home sales, including single-family and total

Topics:

NewDealdemocrat considers the following as important: Featured Stories, Housing Prices, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

House price increases still strong, but clear deceleration from peak

The Case Shiller and FHFA house price indexes were reporting this morning, covering the period through December.

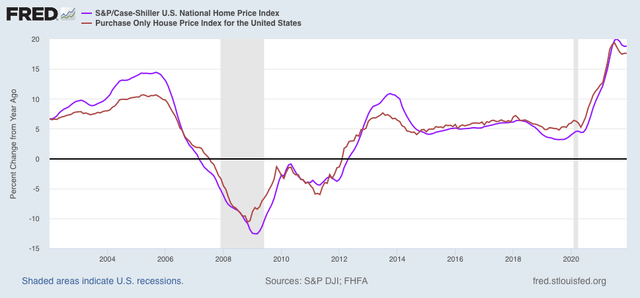

As you all know well, my mantra is that interest rates lead sales, and sales in turn lead prices. Here’s this month’s update.

The monthly increase in the Case Shiller national index (violet) was 0.92%, and the YoY% increase was 18.3%. This is the 4th month of price deceleration from August’s high of 20.0%. Meanwhile, the FHFA purchase-only Index (red) increased 1.2% for the month, and was up 17.6% YoY, a decline from 19.3% in July:

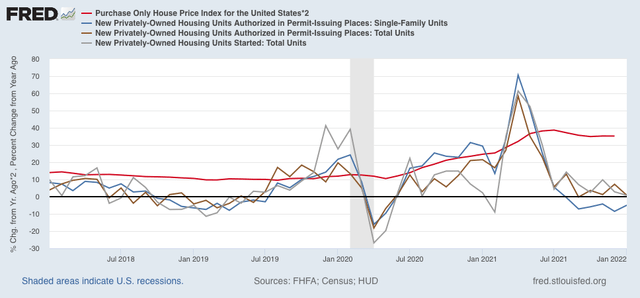

The below graph compares the FHFA index (red, *2 for scale) with several measures of home sales, including single-family and total permits, as well as housing starts, all YoY:

YoY housing sales have been decelerating since last April, and are barely positive at all. In fact, single-family permits are slightly negative.

We have almost certainly seen the peak in YoY price appreciation in housing. I expect prices to come very close to flatlining by later in this year sometime, and may even turn negative, i.e., we may see outright price declines as increased mortgage rates really take a bite.