Real income and – especially – spending increase in April, but households are getting much more overextended by NewDealdemocrat In April nominal personal income rose 0.4%, and spending rose 0.9%. March’s spending was revised up from 1.1% to 1.4%. In more good news, the personal consumption deflator, i.e., the relevant measure of inflation, rose only 0.2%, so real income rose 0.2%, and real personal spending rose 0.7%. So far, so good. While both real income and spending are well above their pre-pandemic levels, I have stopped comparing them with that, but instead with their level after last winter’s round of stimulus. Accordingly, the below graph is normed to 100 as of May 2021: Since then spending is up 3.3%, while income has declined

Topics:

NewDealdemocrat considers the following as important: housing, politics, real income, US EConomics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Real income and – especially – spending increase in April, but households are getting much more overextended

by NewDealdemocrat

In April nominal personal income rose 0.4%, and spending rose 0.9%. March’s spending was revised up from 1.1% to 1.4%. In more good news, the personal consumption deflator, i.e., the relevant measure of inflation, rose only 0.2%, so real income rose 0.2%, and real personal spending rose 0.7%. So far, so good.

While both real income and spending are well above their pre-pandemic levels, I have stopped comparing them with that, but instead with their level after last winter’s round of stimulus. Accordingly, the below graph is normed to 100 as of May 2021:

Since then spending is up 3.3%, while income has declined -1.0%.

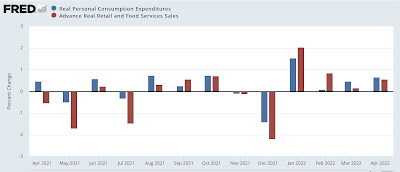

Comparing real personal consumption expenditures with real retail sales for March (essentially, both sides of the consumption coin) shows big increases in both:

The one fly in the ointment is that, as a result, the personal saving rate declined another -0.6% from a revised 5.0% in March to 4.4% in April. The graph below of the last 60+ years subtracts 4.4% from all months so the current reading is showing as 0:

Usually, the savings rate has tended to decrease as expansions grow longer, leaving consumers more vulnerable to shocks (e.g., gas prices). The current value is the lowest of any period except the two months after 9/11, and the 2004-2008 period when home equity refinancing from the last housing bubble was all the rage. In other words, so far consumers are making up shortfalls by digging into savings or tapping another source of credit, probably home equity.

This is very concerning late-cycle consumer behavior and leaves households very vulnerable to further price increases, e.g., gasoline. But it may continue until house prices inevitably break.