Housing on track for an early 2023 recession, but with a major caveat – by New Deal democrat I don’t think anybody was expecting a good housing construction report this month. Those non-expectations were certainly fulfilled. Housing permits rose slightly, 1.4%, from last month’s 2 year low. Single family permits, which contain even more signal, declined -3.1% to the lowest level in 3 years excluding two pandemic lockdown months. The more volatile starts declined -8.1%, while their 3 month average declined -11.3% during the 3rd Quarter, also to a 2 year low: Measuring from their respective recent peaks, starts are down -20.3%, permits down -17.5%, and single family permits down -27.6%: These are well within the ranges of declines that

Topics:

NewDealdemocrat considers the following as important: Hot Topics, housing, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Housing on track for an early 2023 recession, but with a major caveat

– by New Deal democrat

I don’t think anybody was expecting a good housing construction report this month. Those non-expectations were certainly fulfilled.

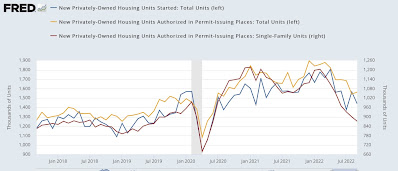

Housing permits rose slightly, 1.4%, from last month’s 2 year low. Single family permits, which contain even more signal, declined -3.1% to the lowest level in 3 years excluding two pandemic lockdown months. The more volatile starts declined -8.1%, while their 3 month average declined -11.3% during the 3rd Quarter, also to a 2 year low:

Measuring from their respective recent peaks, starts are down -20.3%, permits down -17.5%, and single family permits down -27.6%:

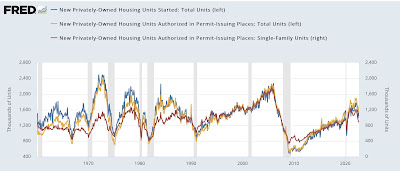

These are well within the ranges of declines that have previously been consistent with recessions, with the exception of 1966, although frequently the actual recession hasn’t started until there has been a -40% decline:

And it certainly looks like we are likely to get to that -40% milestone, and soon.

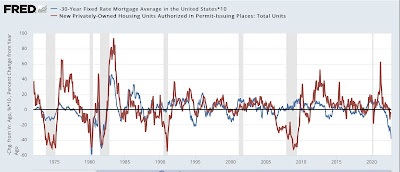

Here is a variation on a graph I have run many times over the past 10 years, comparing the YoY change in interest rates, in this case mortgage rates (inverted, *10 for scale) with the YoY% change in housing permits:

As I always point out, interest rates lead housing permits roughly by 3 to 6 months. YoY interest rates have climbed 4%. That was only exceeded by 5% and 6% increases in 1980 and 1982 respectively, which coincided with -50% declines in housing permits. In other words, we should expect housing permits to have declined by about -40% within the next 3 to 6 months – putting a likely recession start date in the 1st quarter of 2023.

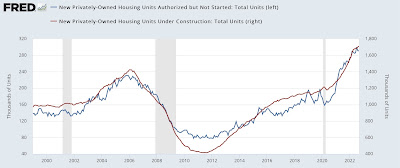

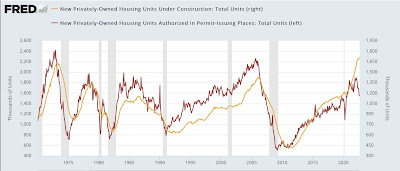

There is one silver lining, or at least an asterisk, in this forecast. Because of a shortage of building materials, there have been record numbers of housing units permitted, but have not yet been started (blue in the graph below). Consequently a big lag in housing under construction is existing as compared with housing permitted (red):

The former may have peaked in July, and has been essentially flat for the past 6 months. The latter has continued to increase, but only by 2.5% in the past 5 months.

Because housing under construction is the actual economic activity, this suggests that in the 3rd Quarter residential housing contributed ever so slightly to GDP growth.

With the sole exception of the 2020 pandemic lockdown recession, construction, which is an even smoother metric than single family permits, has always peaked at least 6 months before the onset of recession, with a median time of 18 months, and as much as 47 months; and has declined at least 6.5%, and as much as 34%, with a median decline of 20% from peak:

In other words, there is a significant element of “it’s different this time,” in that construction has in the past typically followed a decline in permits by 0 to 11 months, with a median of 5.5 months. Further, a recession has typically followed a decline in construction by between 6 and 47 months, with a median time of 18 months; and has declined at least 6.5%, and as much as 34%, with a median decline of 20% from peak.

We are now 9 months out from the peak in permits, and construction has not yet rolled over. Thus past history would suggest no recession begins until at least 6 months from now, and possibly much later – depending on how quickly construction rolls over and how abruptly it declines.

August existing home sales: confirmation of housing prices peaking (angrybearblog.com)

Housing: permits and average starts decline, while construction remains at peak – Angry Bear