Industrial production heats up in July If the news in the housing sector this morning was bad, the news from the King of Coincident Indicators, industrial production, was quite good. Total production rose 0.6% to a new all-time high. Manufacturing production rose 0.7%, and is below its April peak by only -0.1%: Barring downward revisions, this, together with the latest blockbuster employment report, makes it *very* unlikely that the US was in recession as of July. This is further shown by the YoY% changes in each. Currently total production is up 3.9%, and manufacturing production up 3.2%. Typically recessions have started from much weaker comparisons, although 1973 (oil embargo) and 2008 (housing collapse) did start from similar YoY

Topics:

NewDealdemocrat considers the following as important: industrial production, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Industrial production heats up in July

If the news in the housing sector this morning was bad, the news from the King of Coincident Indicators, industrial production, was quite good.

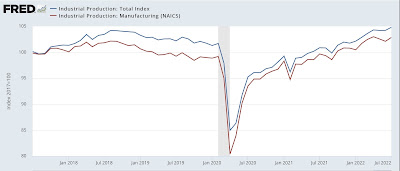

Total production rose 0.6% to a new all-time high. Manufacturing production rose 0.7%, and is below its April peak by only -0.1%:

Barring downward revisions, this, together with the latest blockbuster employment report, makes it *very* unlikely that the US was in recession as of July.

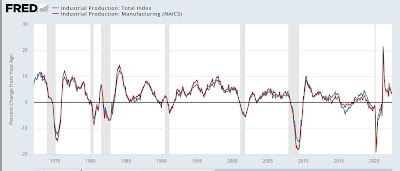

This is further shown by the YoY% changes in each. Currently total production is up 3.9%, and manufacturing production up 3.2%. Typically recessions have started from much weaker comparisons, although 1973 (oil embargo) and 2008 (housing collapse) did start from similar YoY comparisons:

With oil and gas prices having continued to decline in the past few weeks, I do not see any such sudden downdraft in the immediate present.