Jump in January consumer prices seals the deal on Fed interest rate hikes, New Deal democrat Consumer prices increased 0.6% in January, the third time in four months that it has come in over 0.5%. Energy increased 0.9%, which isn’t a horrible monthly rate, but YoY energy prices for consumers are up 27%, just below their YoY peaks in 1974, 1979, 2005, and 2008 – not coincidentally 3 out of 4 of which coincided with deep recessions: YoY inflation is now 7.5%, the highest rate since 1982. My favorite measure, CPI ex energy, is also up 5.6% YoY, and tied for the worst since the 1981-82 recession as well: My rationale for tracking CPI ex-energy is that, unless energy costs filter through into the broader economy, there is no

Topics:

NewDealdemocrat considers the following as important: consumer prices, Featured Stories, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Jump in January consumer prices seals the deal on Fed interest rate hikes, New Deal democrat

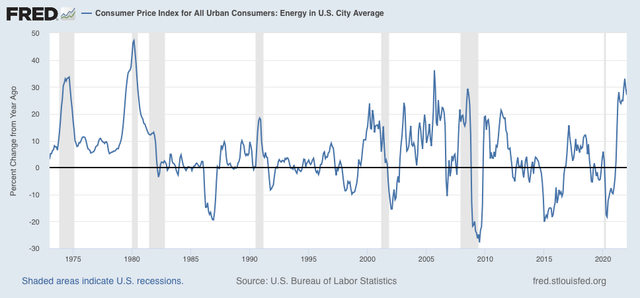

Consumer prices increased 0.6% in January, the third time in four months that it has come in over 0.5%. Energy increased 0.9%, which isn’t a horrible monthly rate, but YoY energy prices for consumers are up 27%, just below their YoY peaks in 1974, 1979, 2005, and 2008 – not coincidentally 3 out of 4 of which coincided with deep recessions:

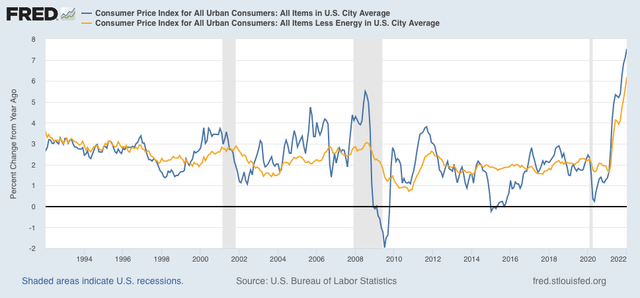

YoY inflation is now 7.5%, the highest rate since 1982. My favorite measure, CPI ex energy, is also up 5.6% YoY, and tied for the worst since the 1981-82 recession as well:

My rationale for tracking CPI ex-energy is that, unless energy costs filter through into the broader economy, there is no cause for alarm. But if the wider economy shows a sharp increase, then there is likely to be aggressive action by the Fed to bring the rate of inflation down, and that means slowing the economy, or even putting it into reverse.

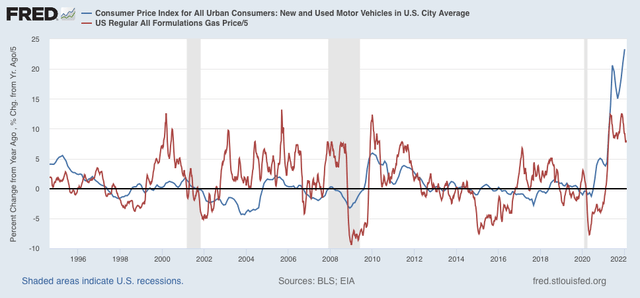

Inflation in new and used vehicle prices rose 0.9% in January, and 23.3% YoY, an all-time high (compared with gas prices, red):

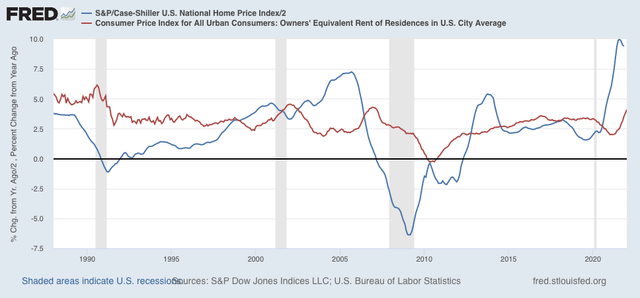

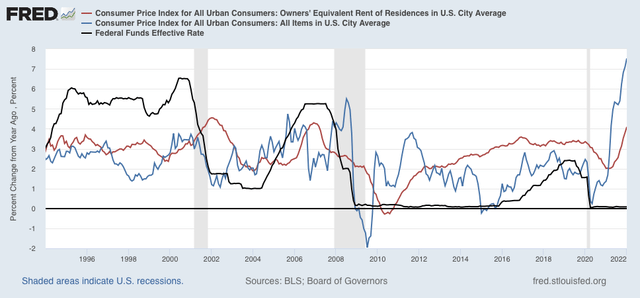

As I have forecast for months, house price increases (blue, /2 for scale) have continued to feed through into rents and “owners equivalent rent”(red), which constitutes 1/3rd of the entire inflation index, and in turn has also continued to increase, and is now up 4.1% YoY:

What happened in the case of both prior cases where owners’ equivalent rent surged after house prices did – 2000 and 2006 – the Fed stepped in and raised rates aggressively, in both cases resulting in recessions, which in turn caused the rate of overall inflation to decline:

This report all but seals the deal on the Fed raising interest rates in March. It increases the odds of a more aggressive .50% increase rather than a baby-steps .25% increase. I hasten to point out that, so long as the yield curve does not invert, the Fed can still achieve its desired result of a decline in inflation, without causing a recession – and the current spread between the 10 year and 2 year bond is consistent with an economy 2 or 3 years before a recession hits:

Unfortunately, in hindsight being 20/20, the Fed allowed itself to fall behind the curve. When house prices increased over 10% YoY consistently in early 2021, it should have realized that this was going to filter through into the broader measure this year, and begun laying the groundwork for tightening then and probably begun to tighten slowly by the end of last summer. Now it is probably too late. But the Fed, like me, probably assumed that the US population would be fully or nearly fully vaccinated by last autumn, bringing the pandemic to an effective end, thus bringing labor and supply shortages to an end as well. I’ll discuss the effect of this report on wages tomorrow.