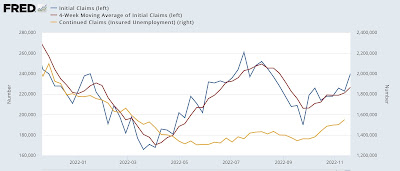

Jobless claims have a poor week, rising to multi-month highs – by New Deal democrat Initial claims for jobless benefits rose 17,000 this week to 240,000, a 3 month high. The 4 week average also rose by 5,500 to 226,750. Continuing claims one week ago rose 48,000 to 1,551,000, the highest number since March: While one week like this shouldn’t set off any alarm bells, initial claims has been one of the increasingly few positive short leading indicators. Recently it has been more neutral, but it would only take about another 25,000 increase in the 4 week average to over 250,000 for this to turn fully negative, consistent with the “recession warning” I have written about several times in the past week. At this point all 3 of my primary

Topics:

NewDealdemocrat considers the following as important: Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Jobless claims have a poor week, rising to multi-month highs

– by New Deal democrat

Initial claims for jobless benefits rose 17,000 this week to 240,000, a 3 month high. The 4 week average also rose by 5,500 to 226,750. Continuing claims one week ago rose 48,000 to 1,551,000, the highest number since March:

While one week like this shouldn’t set off any alarm bells, initial claims has been one of the increasingly few positive short leading indicators. Recently it has been more neutral, but it would only take about another 25,000 increase in the 4 week average to over 250,000 for this to turn fully negative, consistent with the “recession warning” I have written about several times in the past week.

At this point all 3 of my primary indicator systems – the long and short leading indicators tracked by the Conference Board and ECRI (pace Prof. Geoffrey Moore), the high frequency weekly indicators, and the “consumer nowcast” – are all signaling recession ahead.

On the bright side, manufacturers new orders rose 1.0% in October, and “core” capital goods rose 0.7%. This is one of the two components in the Conference Board’s Index of Leading Indicators that is still positive.

Also, new home sales will be released later this morning. I’ll update this post with a line or two later.

“Jobless claims: still holding steady,” Angry Bear, angry bear blog