Initial jobless claims now in a clear uptrend, and other economic notes for the week First, a note on other economic news from earlier this week. The housing market is getting absolutely crushed by 10 year+ high mortgage rates. Mortgage applications fell to levels not seen since 2017 (except for a few weeks during the 2020 Covid lockdowns). Refinancing is at 20 year lows. The next questions are when prices will peak, and what will happen with the huge backlog in housing starts from properties already permitted? We’ll find out more in a week with the next report on housing starts and permits, but we won’t get more price information for a couple more weeks. I saw a couple of comments on consumer credit increasing. As I’ve noted, the consumer

Topics:

NewDealdemocrat considers the following as important: economic indicators, initial jobless claims, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Initial jobless claims now in a clear uptrend, and other economic notes for the week

First, a note on other economic news from earlier this week.

The housing market is getting absolutely crushed by 10 year+ high mortgage rates. Mortgage applications fell to levels not seen since 2017 (except for a few weeks during the 2020 Covid lockdowns). Refinancing is at 20 year lows. The next questions are when prices will peak, and what will happen with the huge backlog in housing starts from properties already permitted? We’ll find out more in a week with the next report on housing starts and permits, but we won’t get more price information for a couple more weeks.

I saw a couple of comments on consumer credit increasing. As I’ve noted, the consumer is in a typical late expansion mode, where real income growth if flagging, and consumers are extending themselves on more credit. I don’t see anything drastic happening here.

I also read a few reports that retailers are reporting marked dips in sales in the past month. I think we have reached the point where gas prices are high enough that consumers are cutting back on other purchases. I doubt we’re at an “oil shock” point, though, where consumers *over*compensate becoming extra cautious about other purchases.

Finally, there’s been some discussion about the future course of inflation. One highly compensated Wall Street pundit claimed that consumer spending had not caused any inflation, because – wait for it – in inflation-adjusted terms, it had kept up with inflation. In other words, consumer spending behaved exactly as you would expect it to if more money were chasing the same amount of goods. Although that’s clearly *not* the case with gasoline and cars, where demand has never completely returned to pre-pandemic levels, and yet prices are much higher.

Meanwhile, Paul Krugman among others is touting that inflation may be subsiding, so the Fed should be wary of over-reacting. Measured by wages for non-managerial workers, it has abated just slightly, so I’m not so sure. Beyond that, as I’ve pointed out in a few recent missives, this is how Booms turned into Busts in the immediate aftermath of World War 2. The Fed never raised rates, but price and mortgage rate increases overwhelmed the ability of consumers to keep pace. So they didn’t. Inflation abated because there were brief recessions which caused an abatement of interest rates and price increases. I.e., be careful what you wish for.

Turning to the news actually at hand . . .

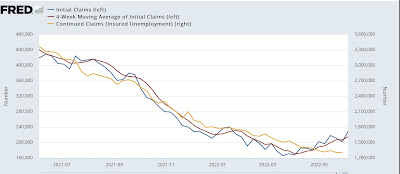

Initial jobless claims rose 27,000 to 229,000 last week, continuing above the recent 50+ year low of 166,000 set in March. The 4 week average also rose 8,000 to 215,000, compared with the all-time low of 170,500 nine weeks ago. Meanwhile continuing claims were unchanged at 1,306,000, tied for a 50 year low:

It’s now safe to say that initial claims have been in an uptrend over the past 2.5 months. If this continues a few more weeks, they will no longer qualify as a “positive” in my array of short leading indicators. I will be interested to see if this is confirmed by a significant decline in the “job openings” category of the next release of the JOLTS report, which would indicate that employers are affirmatively cutting back on their hiring plans.

In any event, yet more (slight) weakening in the economic indicators, and yet more reason for concern as we get to 2023. A few weeks ago I went on “Recession Watch” beginning with Q1 2023 and noted that, because I rely in large part on Prof. Geoffrey Moore’s long leading indicators, which also were the basis for ECRI’s forecasts (the last time they were public about their metrics), I expected ECRI to start talking about recession as well.

Well, within the past week, via a Lakshman Achuthan interview on CNN, they have.