Manufacturing continues red hot, while construction gains completely consumed by inflation February monthly data started out this morning with the ISM manufacturing report. The index, especially its new orders subindex, is an important short leading indicator for the production sector. In February the index rose from 57.6 to 58.6, as did the more leading new orders subindex, which rose from 57.9 to 61.7. Since the breakeven point between expansion and contraction is 50, these are both very strong numbers – as they have been for most of the past 18 months: This forecasts a strong production side of the economy through summer. The second release that typically begins the month, construction spending for two months ago (January), rose

Topics:

NewDealdemocrat considers the following as important: manufacturing construction, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Manufacturing continues red hot, while construction gains completely consumed by inflation

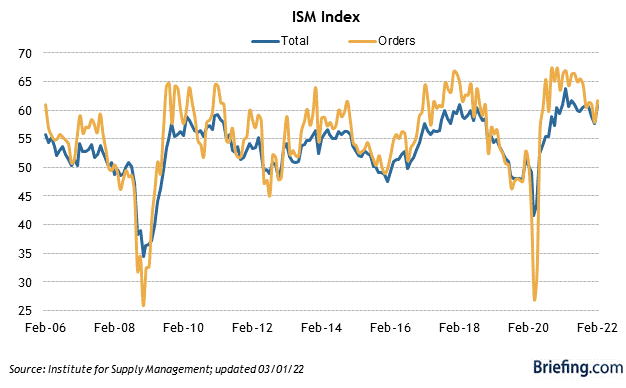

February monthly data started out this morning with the ISM manufacturing report. The index, especially its new orders subindex, is an important short leading indicator for the production sector.

In February the index rose from 57.6 to 58.6, as did the more leading new orders subindex, which rose from 57.9 to 61.7. Since the breakeven point between expansion and contraction is 50, these are both very strong numbers – as they have been for most of the past 18 months:

This forecasts a strong production side of the economy through summer.

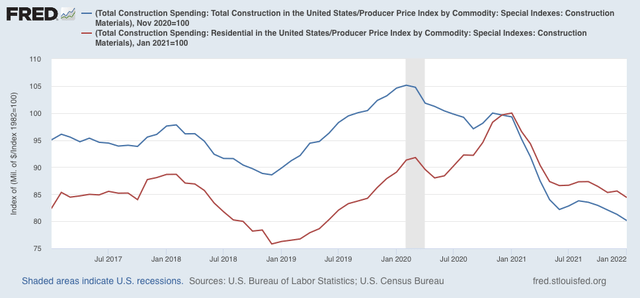

The second release that typically begins the month, construction spending for two months ago (January), rose 1.3% in nominal terms for overall spending including all types of construction, while the leading residential sector also rose 1.3%. Nominally, both made new all-time highs:

Adjusting for price changes in construction materials, which jumped another 2.7%, “real” construction spending declined another -1.4% m/m, continuing an almost relentless decline from one year ago. In absolute terms, “real” construction spending has declined sharply – by -19.9% – since its peak in November 2020, while “real” residential construction spending has declined -15.6% since its post-recession peak in January of this year:

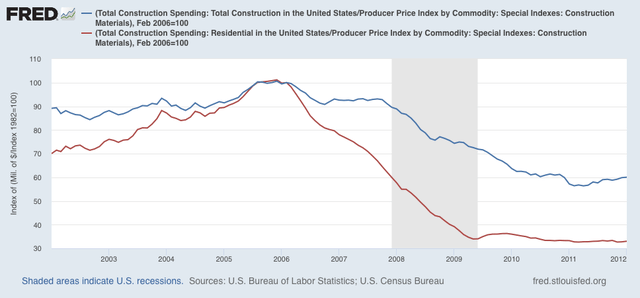

While total construction spending has declined by more than the -10.4% it did before the Great Recession, the decline in residential construction spending, while increasingly substantial, remains nowhere near the -40.1% decline it suffered before the end of 2007:

Real residential construction spending does not appear to be at a recession level decline at this point. If mortgage rates continue to be higher than 4%, this could well change in the next few months.