Manufacturing positive, but no longer red hot; inflation-adjusted construction spending is flat In addition to the jobs report, Friday gave us updates on manufacturing and construction. The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. While the index remained positive, its leading new orders component stumbled. In March the index declined from 58.6 to 57.1, and the new orders subindex declined from 61.7 to 53.8, the lowest since 2020. Since the breakeven point between expansion and contraction is 50, these remain positive, (note the graph below does not contain the latest numbers): This forecasts a continued expansion on the production side of the

Topics:

NewDealdemocrat considers the following as important: construction spending, manufacturing, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Manufacturing positive, but no longer red hot; inflation-adjusted construction spending is flat

In addition to the jobs report, Friday gave us updates on manufacturing and construction.

The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. While the index remained positive, its leading new orders component stumbled.

In March the index declined from 58.6 to 57.1, and the new orders subindex declined from 61.7 to 53.8, the lowest since 2020. Since the breakeven point between expansion and contraction is 50, these remain positive, (note the graph below does not contain the latest numbers):

This forecasts a continued expansion on the production side of the economy through summer.

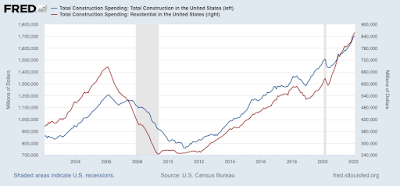

Meanwhile, construction spending for February rose 0.5% in nominal terms for overall spending including all types of construction, while the leading residential sector also rose 1.1%, both thus making new highs:

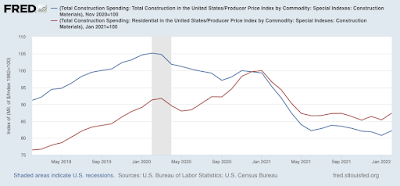

Adjusting for price changes in construction materials, which for the first time in six months actually declined, by -1.2%, “real” construction spending rose 1.7% m/m – also the first increase since last August. In absolute terms, “real” construction spending has declined sharply – by -17.8% – since its peak in November 2020, while “real” residential construction spending has declined -12.6% since its post-recession peak in January of last year:

Blah

While total construction spending has declined by more than the -10.4% it did before the Great Recession, the decline in residential construction spending, while increasingly substantial, remains nowhere near the -40.1% decline it suffered before the end of 2007.

There were some positive revisions to the past several months which helped out these comparisons this month, and reinforced that while down, they are not recessionary at this point. But with mortgage rates rising to nearly 5%, I would expect these metrics to deteriorate further later this year, after new home permits, starts, and sales.